The Central Government has suggested people to link mutual funds with Aadhaar. As per the Prevention of Money Laundering (Maintenance of Records) Second Amendment Rules, 2017, Asset Management and Mutual Fund Companies have to collect Aadhaar number of people, verify the details with UIDAI and link all mutual funds with Aadhaar.

There are four methods to link Aadhaar with mutual funds – online, offline, SMS and through e-mail.

You can send an e-mail to your AMC mentioning your Aadhaar and PAN details and the authority will link the account with Aadhaar. However, your email should be linked with the mutual fund to avail this facility.

Get Free Credit Report with monthly updates. Check Now

Steps to Link Aadhaar with Mutual Funds Online through CAMS

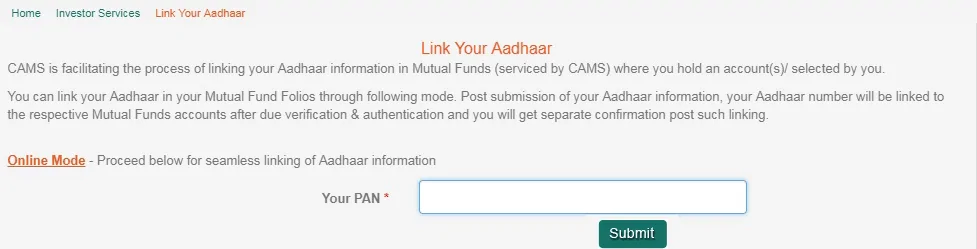

Aadhaar can be linked online by visiting the CAMS website. There are separate links for individuals, HUFs and non-individuals other than HUFs. You can follow these simple steps to link mutual funds with Aadhaar:

Step 1: Visit Aadhaar-linking portal of CAMS

Step 2: Select the option as per the type of investor – individual, HUF or non-individuals

Step 3: Enter your PAN in the space provided and click on “Submit”

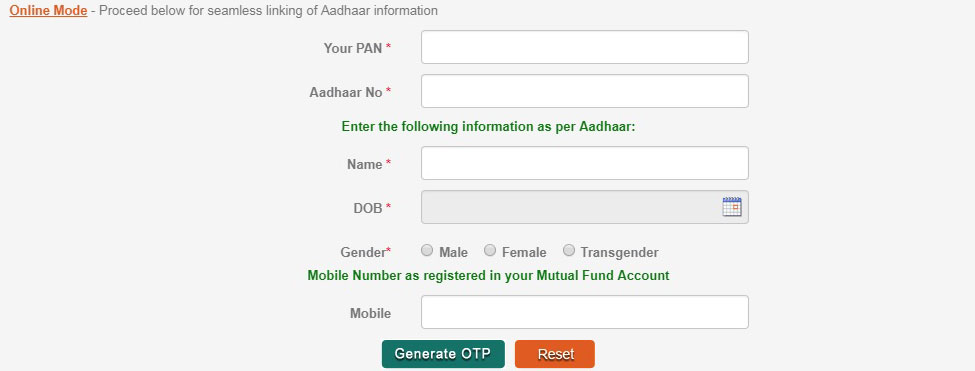

Step 4: Enter your Aadhaar number, name, DOB, gender and mobile number. Click on “Generate OTP” to send the OTP to Step 5: your mobile number registered with the mutual fund

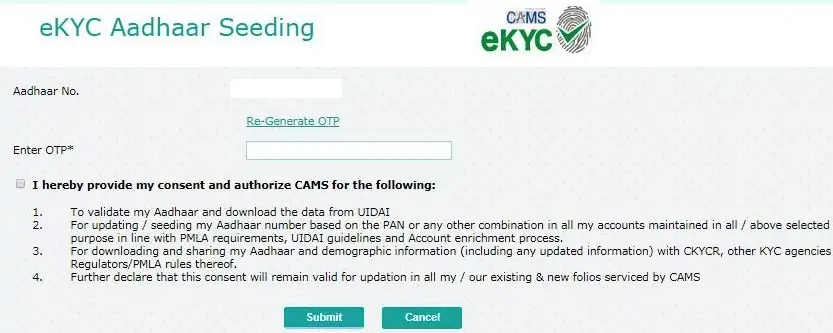

Step 6: Enter the OTP, tick the disclaimer and click on the “Submit” button

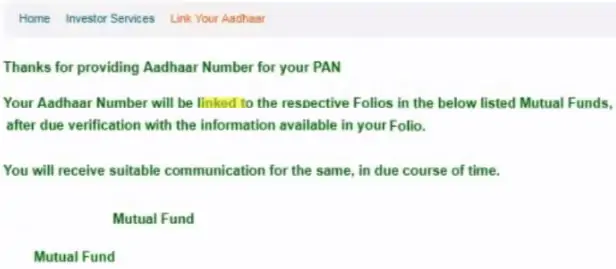

Step 7: Your request will be submitted and your mutual funds associated with PAN will automatically be linked with Aadhaar after proper verification

Link Aadhaar with Mutual Fund through SMS

Investors can link their mutual funds with Aadhaar by sending an SMS as well. The have to follow the steps mentioned below:

Step 1: Type a message in the format ADRLNK<space>Your PAN<space>Your Aadhaar<space>Y

Step 2: Send the SMS to +91 9212993399

Step 3: Y in the message is for providing consent to Karvy to authenticate and seed Aadhaar with your mutual fund

Step 4: You will get a confirmation message on successful Aadhaar seeding

Step 5: It is worth mentioning that you will have to link Aadhaar with mutual funds managed through CAMS, Sundaram BNP and Franklin Templeton

Step 6: Your mobile number should be linked with your mutual fund to avail this facility

Steps to Link Aadhaar with Mutual Fund through Offline

There are cases where your mobile number or email id is not linked with the mutual fund account. In such cases, you can opt for linking your mutual fund with Aadhaar offline:

Step 1: Fill the Aadhaar linking form mentioning your mutual fund details and Aadhaar

Step 2: Attach a self-attested copy of your Aadhaar card with the form

Step 3: Submit the form at the nearest service centre of your fund manager

Step 4: You will get a confirmation message on successful Aadhaar seeding

Karvy

CAMS

Sundaram BNP

Franklin Templeton

Points to Remember

- Your mobile number should be linked with Aadhaar for OTP-based authentication

- NRIs are not eligible for Aadhaar-linking

- Your mobile number should also be linked with the mutual fund account

- Details in the Aadhaar seeding form should match with that of the Aadhaar card, else the fund will not be linked with Aadhaar

- All mutual funds can be linked with Aadhaar through your PAN itself.

Get Free Credit Report with monthly updates. Check Now

Who should Link Aadhaar with Mutual Funds?

- All holders of mutual funds, be it first holder, joint holders, guardian (for minors), Power of Attorney (POA) holders or donors (Children’s schemes), have to furnish their Aadhaar.

- NRIs do not have to link their mutual funds with Aadhaar as they are not eligible for Aadhaar.

- Residents of Jammu & Kashmir, Assam and Meghalaya are also exempted from Aadhaar seeding.

- In case of non-individuals such as firms, companies, etc., all authorised signatories have to submit their Aadhaar details.

- In case of investments done by HUFs, karta of the family has to provide the Aadhaar card.