The Government of India has made it mandatory for all the individuals to link their Aadhaar Card with PAN Card for filing the Income Tax Return. As per the Aadhaar Act, 2016, section 139AA of the Income Tax Act, it will not be applicable for individuals who do not reside in India.

Exemption from Linking of PAN and Aadhaar

Linking Aadhaar with PAN is mandatory only for those individuals who are eligible for obtaining Aadhaar. Certain individuals who are exempt from this rule include:

- NRIs, OCIs, POIs, etc. who do not reside in India but conduct businesses here do not have to get their PAN linked with Aadhaar

- Foreign nationals residing in India also do not have to mandatorily get their Aadhaar linked with PAN

- Taxpayers of Assam, Meghalaya, and J&K are also exempted from linking their PAN with Aadhaar

- Those senior citizens who are above 80 years of age do not have to mandatorily link both their documents

Get <strong>Free Credit Report</strong> with monthly updates. Check Now

Process of Linking Aadhaar to Income Tax Returns

The Government has made it very easy to link PAN with Aadhaar for Income Tax Returns by either getting the documents linked online or by simply sending the SMS.

Linking PAN and Aadhaar Online

Follow the steps mentioned below to link PAN and Aadhaar online:

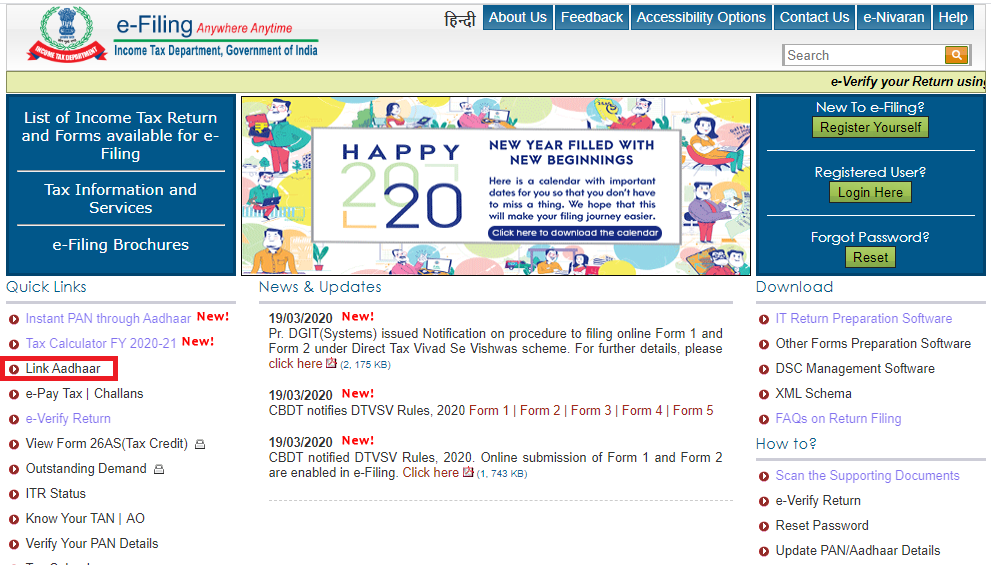

Step 1: Visit the ITR e-filing website i.e. https://www.incometax.gov.in/iec/foportal/

Step 2: Click on the ‘Link Aadhaar’ option in the ‘Quick Links’ section

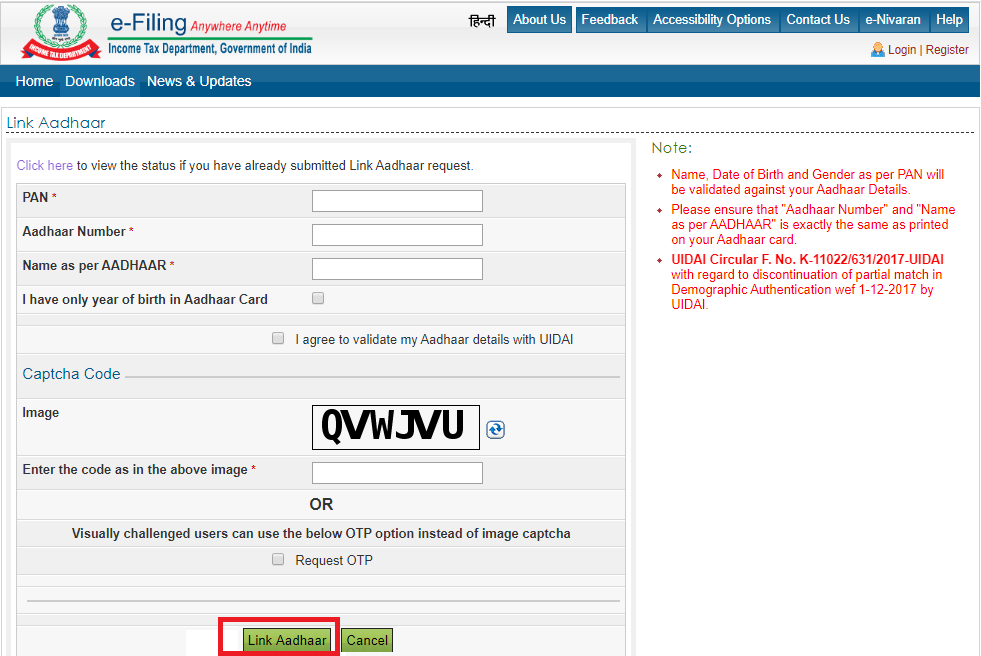

Step 3: Enter your PAN number

Step 4: Input your Aadhaar number

Step 5: Enter your name as mentioned in the Aadhaar card

Step 6: Tick the square if only your birth year is mentioned in your Aadhaar card as the date of birth

Step 7: The visually challenged users can avail this facility by requesting got an OTP instead of image captcha

Step 8: Enter the verification code and click on the Link Aadhaar button

Note: Your Aadhaar will be linked instantly with your PAN. However, your PAN will not be linked with Aadhaar if details like name, gender, and date of birth do not match in both documents. In that case, you will first have to get your details corrected and then link both documents again.

Linking PAN and Aadhaar by SMS

To link PAN and Aadahaar by SMS, you need to send the SMS in the format mentioned below:

UIDPAN<space><12 Digit Aadhaar> <space><10 Digit PAN> and the message has to be sent either to 567678 or 56161

For example, if your Aadhaar number is 987654321098 and the PAN number is ABCDE9876F, you have to type the message UIDPAN 987654321098 ABCDE9876F and send it to 567678 or 56161.

How to Rectify Issues in Linking PAN and Aadhaar

The only issue that occurs in linking PAN and Aadhaar cards is because there are errors in the spelling of your name, gender, or date of birth. These errors might be due to several reasons such as an error in updating the details in your document or due to other human errors. This could lead to a serious issue in case you want to link your PAN and Aadhaar. In order to get your documents linked, you will first have to get those details corrected. There are separate methods for updating your details for both PAN and Aadhaar.

In case there are errors in your PAN details, you will have to get it rectified through the NSDL website. If your Aadhaar has errors, you can get it updated at UIDAI’s website.

Correcting Errors in PAN Card

In order to get your PAN card details corrected, you have to follow the steps mentioned below:

Step 1: Visit the official website of NSDL E-Governance at www.tin-nsdl.com

Step 2: Click on ‘PAN’ under the services section

Step 3: Now, click the ‘Apply’ option under the ‘Change/Correction in PAN Data’ category

Step 4: From the ‘Application Type’ dropdown menu, you need to select ‘Changes or Correction in existing PAN data/Reprint of PAN Card (No changes in Existing PAN Data)’ option

Step 5- From the dropdown menu of ‘Category’, select the correct category of the assessee, for example, if the PAN is registered in your name, select ‘Individual’ from the list

Step 6- Now, enter your name, date of birth, email address, and mobile number

Step 7- You have to fill the ‘Captcha’ and click on the ‘Submit’ button

Step 8- Once submitted, your request will be registered and a Token Number will be sent to the registered email ID. You can also continue the process by clicking the button given below it

Step 9- You will now be redirected to the form and there will be three options to submit your documents, click on the ‘Submit scanned images through e-Sign on NSDL e-gov’

Step 10- Fill in all the mandatory details such as your father’s name, mother’s name (which is optional), your Aadhaar number and click on the ‘Next’ button

Step 11- You will now be redirected to a new page where you can update your address

Step 12- Upload all the necessary documents such as proof of address, proof of age, proof of identity and PAN

Step 13- You need to sign the declaration and click on the ‘Submit’ button

Step 14- A new page for the payment process will appear on your screen. Payment can be made through demand draft, net banking, and Credit card/Debit card

Step 15- On successful payment, an acknowledgement slip will be generated. The applicant should take a print of it and send it to the NSDL e-gov office along with the physical proof of documents. Also, affix a photograph in the space provided and sign across it. You must write ‘Application for PAN Change’ on top of the envelope along with the acknowledgement number. This should be mailed to –

NSDL e-Gov at Income Tax PAN Services Unit,

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling, Plot No. 341,

Survey No. 997/8, Model Colony,

Near Deep Bungalow Chowk, Pune – 411 016′

Note: You have to pay the fee towards the correction or update of your PAN details which is Rs 110 if the communication address is located within the country and Rs 1020 if the communication address is located in a different country.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

FAQs on Linking Aadhaar to Income Tax Returns

Q. I don’t fall in the taxable income bracket. Should I have to get Aadhaar or link it to PAN?

A. Even if you do not fall under the income tax slab, you should enrol for Aadhaar and link your PAN with Aadhaar to avoid deactivation.

Q. I don’t have Aadhaar. Can I still e-file?

A. You can still e-file your income tax returns even if your PAN is not linked with Aadhaar. However, you should link both documents soon as it may be mandatory for the next fiscal.

Q. What information should I provide to register Aadhaar in the ITD e-Filing website?

A. You have to only mention your Aadhaar number while filing your income tax returns. No other details related to your Aadhaar have to be mentioned here.

Q. How to reset my password through Aadhaar at the Income Tax e-Filing website for an individual user?

A. You can enter your PAN and select the Forgot Password option. Then you have to provide the mobile number registered with Aadhaar. An OTP will be sent to your mobile number. Enter this OTP to reset your password.

Q. Is it mandatory to link Aadhaar number in e-Filing profile at the Income Tax website?

A. Aadhaar and PAN have been made mandatory for e-filing taxes. If you do not link Aadhaar and PAN, your tax returns may not be processed.

Q. Do NRIs have to provide their Aadhaar card to file tax returns in India?

A. NRIs are exempted from providing Aadhaar number while filing Income Tax Returns as they are not eligible to possess one.