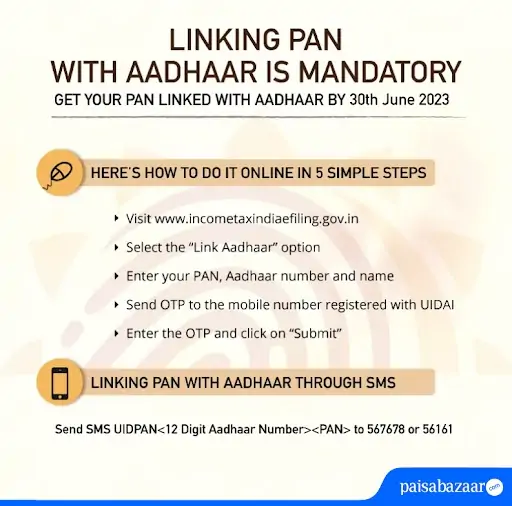

The Supreme Court, in its judgement on the constitutional validity of Aadhaar, has upheld the Government’s decision to linking PAN with Aadhaar. It has also made it mandatory to furnish Aadhaar for filing Income Tax Returns (ITR). The 5-judges constitution bench has also clarified that Aadhaar will continue to be mandatory for availing welfare schemes provided by the Government.