Andhra Bank Pension Loan is designed to fulfil the personal needs pensioners facing a financial emergency or other fund requirement. From wedding in the family to medical condition and vacation to home renovation and much more, Andhra Bank Pension Loan caters to various personal needs by offering a loan amount of up to Rs. 5 lakh.

Table of Contents :

- Features of Andhra Bank Pension Loan

- Interest Rates

- Eligibility Criteria

- Documents Required For Loan Application

- How to Apply for Andhra Bank Pension Loan with Paisabazaar?

- Pension Loan Verification Process

- Check Andhra Bank Pension Loan Application Status

- Fees and Other Charges

- How to Login on Andhra Bank Portal?

- EMI Calculation

- Comparison of Andhra Bank Pension Loan VS Other Lenders

- Customer care

- Benefits of Applying for Personal Loan at Paisabazaar

- Important Aspects

- FAQs

Features of Andhra Bank Pension Loan

- Loan amount: The loan amount offered by Andhra Bank Pension Loan can go up to 8 times of monthly pension with maximum cap of Rs. 5 lakh. Let’s say, if your monthly pension is Rs. 40,000, you may be eligible for pension loan amount of up to Rs. 3.2 lakh

- Online application: Like other types of personal loans, Andhra Bank Pension Loan can also be applied online that can save you from the hassle of personally visiting the bank’s branch

- Flexible tenure: The tenure to repay Andhra Bank Pension Loan is up to 60 months and offers flexibility for the convenience of pensioners

- Minimum documentation: To make the application process easy for pensioners, the bank ask only for minimum documents

Andhra Bank Pension Loan Interest Rate

| Pension Loan Tenure | Rate of Interest |

| Up to 36 months | 11.10% onwards |

| More than 36 months to 60 months | 11.35% onwards |

Eligibility Criteria of Andhra Bank Pension Loan

- You should be a pensioner

- You should be drawing your pension from Andhra Bank

- Your maximum age should be 75 years

Documents Required for Andhra Bank Pension Loan Application

- Duly filled Andhra Bank pension loan application form

- Address Proof: Aadhaar Card, Driving License, Passport, Utility Bills, etc.

- ID proof: Aadhaar Card, Passport, PAN Card, Driving License, etc.

- Bank account statement of last 6 months

Please note that the bank may ask you for additional documents apart from the ones mentioned above.

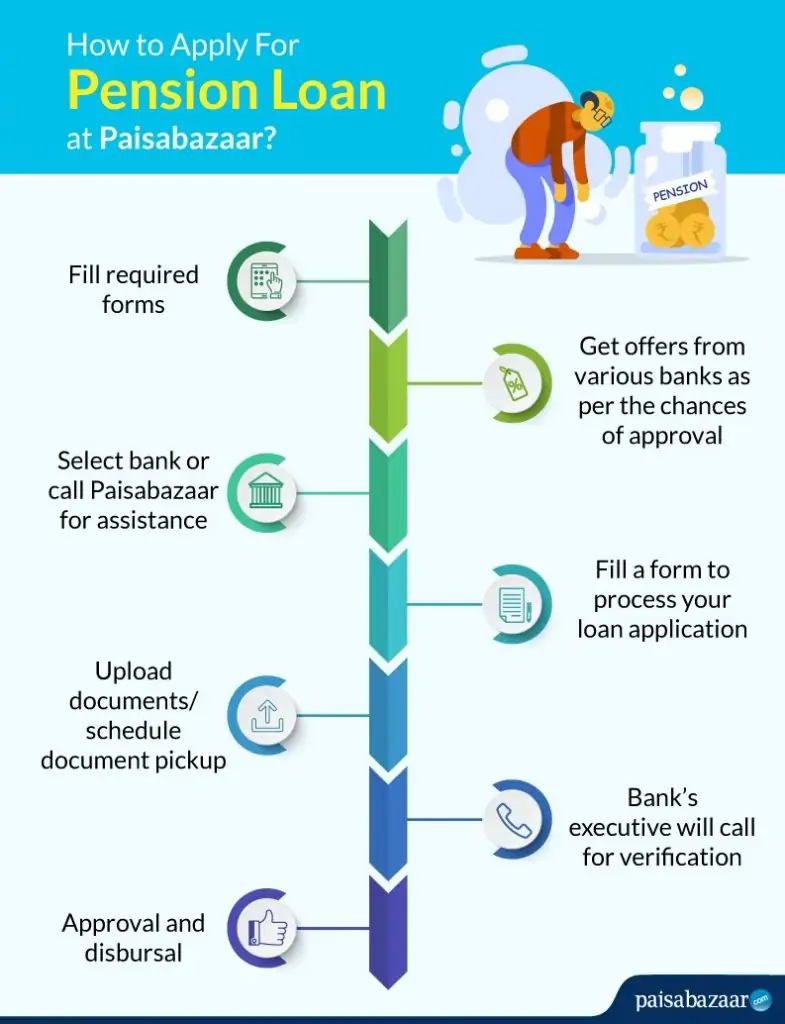

How to Apply for Andhra Bank Pension Loan with Paisabazaar?

- To apply for Andhra Bank Pension Loan at Paisabazaar, click here and fill a form

- When you click on ‘proceed’ you will be redirected to a page displaying various pension loan offers by different lenders as per the chances of approval

- You have the option of either selecting a lender or calling Paisabazaar for assistance

- After selecting the loan offer, fill a few more forms to process your loan application

Pension Loan Application Verification Process

- When you submit your pension loan at Paisabazaar, it gets forwarded to the prospective lender

- The lender’s representative gives you a verification call and schedules document pickup as per your convenience

- When the documents are verified, you get another call from the representative regarding the final loan offer

- When you agree with the terms and conditions, the loan get disbursed to your account within 3 to 5 working days

Check Andhra Bank Pension Loan Application Status

- Go to the Andhra Bank Official Website

- Enter application reference number and security code

- Click on ‘check status’

Fees and Other Charges

| Processing Fee | Nominal as per the guidelines in force |

| Administrative Charges | Collected at the end of every quarter as per the bank’s guidelines |

| Part Prepayment Charges | Nil |

| Foreclosure Charges | Nil |

How to Login on Andhra Bank Portal?

If you already have registered to internet banking, follow the steps to login:

- Go to the Andhra Bank online banking portal

- Enter your User ID

- Enter your password

- Click on ‘login’

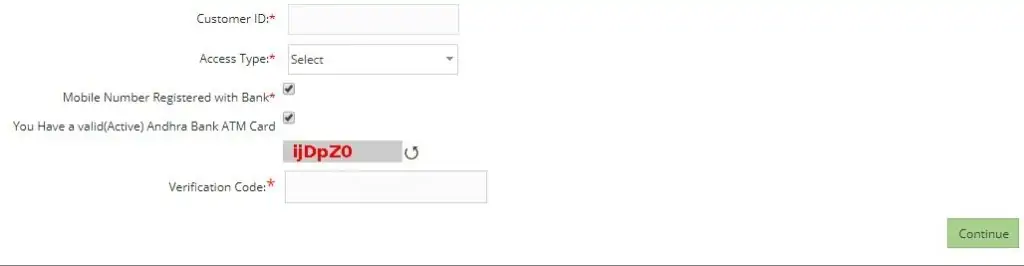

If you are a new user, register yourself first by following the steps mentioned below:

- Go to the online banking portal of Andhra Bank

- Enter customer ID

- Select ‘access type’

- Select if you have a mobile number registered with the bank and a valid (active) Andhra Bank ATM Card

- Enter verification code

- Click on ‘continue’

EMI Calculation

The following table gives you an estimate how much EMI you will have to pay for your Andhra Bank pension loan for various loan amount, loan interest rates and tenures:

| Loan Amount (Rs.) and Interest Rate (p.a.) |

Monthly EMI Payout (Rs.) |

||||

| 1 year | 2 years | 3 years | 4 years | 5 years | |

| 3 lakh @ 11.20% | Rs. 26,542 | Rs. 14,010 | Rs. 9,850 | Rs. 7,782 | Rs. 6,552 |

| 4 lakh @ 12% | Rs. 35,539 | Rs. 18,829 | Rs. 13,285 | Rs. 10,533 | Rs. 8,897 |

| 5 lakh @ 12.5% | Rs. 44,541 | Rs. 23,653 | Rs. 16,726 | Rs. 13,289 | Rs. 11,248 |

Comparison of Andhra Bank Pension Loan VS Other Lenders

The following table compares Andhra Bank pension loan to similar products by other leading lenders:

| Particulars | Andhra Bank | Bank of India | SBI | Indian Bank |

| Interest Rate | Starting from 11.20% | Starting from 9.75% | Starting from 11.30% | Starting from 11.15% |

| Tenure | Up to 60 months | Up to 60 months | Up to 84 months | Up to 60 months |

| Loan amount | Up to Rs. 5 lakh | Up to Rs. 5 lakh | Up to Rs. 14 lakh | Up to 6 lakh |

| Processing Fee | Nominal as per the guidelines in force | 2% of loan amount (Min. Rs. 500, Max. Rs. 2,000) | 0.50% of loan amount (Min. Rs. 500, Max. Rs. 2,500) | Nil for loans up to Rs. 25,000/Rs. 255 for loans > Rs. 25,000 |

Andhra Bank Customer Care

- You can call on 1800-425-1515 (toll free) or on telephone numbers, 040-23234313 and 23252000; Extensions: 2422, 2577 (between 10:00 AM to 5:00 PM on all working days, except 2nd and 4th Saturdays)

- You can send a fax on 23232419

- You can send an email on customerser@andhrabank.co.in

- You can send an SMS “UPSET” to 9666606060

- You can visit the head office at 5-9-11, Dr Pattabhi Bhavan, Secretariat Road, Saifabad, Hyderabad 500 004. Telangana

- You can visit the nearest branch of the bank

Benefits of Applying for Pension Loan at Paisabazaar

- Various lenders, single platform: Paisabazaar is one single platform that shows you pension loan offers from various lenders altogether. This helps you to compare the offers at one place and choose the best one without separately visiting the official websites of all the lenders

- End- to- end assistance: Not only the customer care team of Paisabazaar offers you end- to end assistance throughout the loan journey but also the website itself holds all the information about pension loan by various banks. You will come across many bank pages, blogs and FAQs to solve your query instantly

- Anytime, anywhere access: Unlike the banks that are open for a fixed number of hours and have strict rules, Paisabazaar is an online platform that can be accessed anytime, anywhere and allows you to apply for a loan whenever you wish to

- Instant EMI calculation: It is important to know your EMIs when you wish to avail a loan. Paisabazaar’s EMI Calculator lets you calculate the EMIs instantly even before you apply for a pension loan

Important Aspects (Things to Remember While Applying)

- Check credit score: One of the most important factors that is considered while evaluating an individual’s application is his credit score as it is a reflection of his past repayments. A poor credit score can refrain you from availing funds and a good credit score can help in getting a loan at a lower interest rate

- Avoid making multiple loan applications simultaneously: Applying with multiple lenders together for a pension loan may result in increase in hard enquiries in your credit report and this may bring your credit score down

- Compare before you finalise any offer: As mentioned above, you can compare various pension loan offers at Paisabazaar and can finalise the lender offering the lowest interest rate

FAQs

Q1. How do I repay Andhra Bank Pension Loan?

You can conveniently repay Andhra Bank Pension loan in EMIs at any of the bank branches. Also, you can give standing instructions to deduct the same form your savings account.

Q2. Can I foreclose my Andhra Bank Pension Loan?

Yes, you can foreclose your pension loan without any foreclosure charges.

Q3. Who can be my co-applicant for Andhra Bank pension loan?

Your co-applicant for a pension loan from Andhra Bank can either be your family pensioner or a nominee.

Q4. Are there any foreclosure charges for pension loan from Andhra Bank?

No. Andhra Bank pension loan is currently offered with zero foreclosure charges.

Q5. How long does disbursal of pension loan take?

Typically Andhra Bank disburses pension loan within 5 business days of receiving all applicable documents. This time period can however be longer depending on key factors such as loan amount and applicant profile.