Pros and Cons of Add-on Credit Cards

Add-on credit cards, also known as supplementary credit cards, are issued against a primary credit card and comes with similar credit limit and benefits as that of the primary card. The add-on card is offered to the family members of primary cardholders like his/her parents, spouse, or children above the age of 18. Most of…

What happens when you default on credit cards?

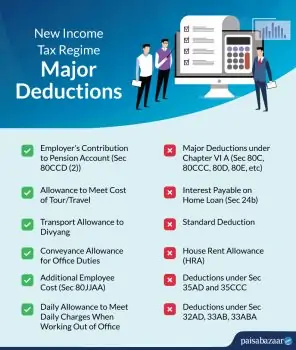

Deductions Allowed Under the New Income Tax Regime

A new and optional income tax regime was announced in Union Budget 2020. Under this new regime, the income tax slab rates have been significantly reduced. However, the concessional slab rates come at the cost of traditional income tax deductions that can be claimed under the old (existing) tax regime. As things stand right now,…

When is the Right Time to Request a Limit Increase on Your Credit Card

How Banks Grant Loans Based on Your Credit Score

Many people are unaware that getting approved for a loan and the applicable interest rate at which they get the loan are dependent on many factors other than the regular income or repayment capacity. One of the key factors banks look at before they sanction a loan is the credit score. Your credit score, which […]

The Way Forward for Credit Bureaus in India

Credit rating is still a developing concept in India with the first Indian credit rating bureau, CIBIL being just a decade old. The CIBIL credit report and score was introduced to banks in November 2007 and in April 2011 this facility was made available to the individuals. CIBIL also known as CIBIL TransUnion is among […]

Lesser Known Reasons Why Your Credit Score is Dropping

Your credit score is one of the biggest indictors of your financial health. Unfortunately, awareness around the concept of credit score and the critical importance it holds in one’s life is low in India. Even those who know about Credit Score often ignore or undermine it. Your Credit Score represents your financial trustworthiness and it […]

5 Habits of People with High Credit Score that Every One Must Follow