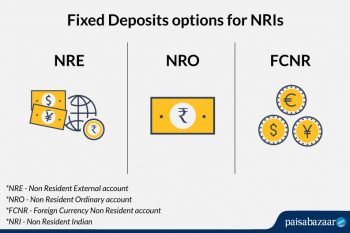

NRE, NRO & FCNR Fixed Deposits: Know the difference

Fixed deposit is considered a safe and fruitful investment option in India. People living in India enjoy decent returns on FD thus making FD a preferred choice for risk-averse investors. But the fixed deposit is not limited to residents of India only. NRIs or the Non-Resident Indians also have this option in the form of…

Exchange Traded Funds (ETF)- Meaning, Benefits, Limitations & Best ETFs

Mutual Funds which are listed and traded on stock exchanges like shares are known as Exchange Traded Funds (ETFs). Read more for a better understanding of what are ETFs, how do they work, advantages of ETFs and more- Table of Contents : Meaning: Exchange Traded Funds Benefits Limitations Best Equity ETFs Best Gold ETFs List…

What is SEBI: Meaning, Structure, Regulations, Categorisation

Best Investment Options for Senior Citizens

There are numerous curated Investment options for senior citizens such as bank FDs and RDs, post office FDs and RDs, Senior Citizens’ Savings Scheme (SCSS), National Pension System (NPS), Life Insurance Premiums and mutual funds. Some of these are low-risk fixed return options like bank and post office FDs, SCSS, etc. Others are relatively high risk but…

How to Use Your Credit Card for Maximum Benefits

What are Global Mutual Funds?

As the name states, investment tools that allow you to invest in international markets are referred to as Global Mutual Funds. Mutual Funds or Exchange Traded funds that primarily invest in companies across the globe are called Global Mutual Funds. It is important to note that there is a huge difference between Global Mutual Funds…

Union Budget: Key Highlights for Investors

Multi Asset Allocation: Definition and Features

Systematic Withdrawal Plan (SWP)

Table of Contents : What is Systematic Withdrawal Plan? How does a Systematic Withdrawal Plan work? Benefits of SWP List of Top Performing Mutual Funds for FY 2020 A systematic withdrawal plan (SWP) is a facility which allows you to withdraw a fixed amount from your mutual fund at regular periodic intervals. The periodic intervals…