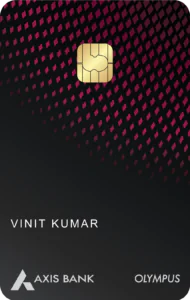

Axis Bank Olympus Credit Card is the latest addition to the list of super-premium credit cards in India, launched to transition Citi Prestige cardholders to Axis Bank. The card comes at an annual fee of Rs. 20,000 and offers benefits around travel and other lifestyle categories like golf and movies. While the reward-earning rate is quite basic, the card offers an excellent redemption ratio of 1:4 against travel partners. While most benefits on Axis Olympus are similar to Citi Prestige, some features vary. Read on to know where this card stands among other super-premium cards in the market and if this migration would be beneficial for Citi consumers.

Axis Bank Olympus Credit Card Overall Rating: ★★★★ (4/5) |

|

|

|

|

| Rewards Program | ★★★ |

| Travel Benefits | ★★★★ |

| Other Lifestyle Categories | ★★★★ |

Note: This card is not available on Paisabazaar.com. Content on this page is for information purpose only. To express interest in this card, please visit Axis Bank’s website.

Most features on Axis Olympus are identical to the Citi Prestige Credit Card, including a similar rewards structure, complimentary membership, and unlimited lounge access. However, Olympus offers 2500 bonus reward points every year and movie benefits on BookMyShow, concierge service, airport meet and greet, etc., making up for the previous devaluation on Axis Bank’s cards like Axis Magnus.

If looked upon individually, the card can fetch great value for travellers through unlimited lounge access, co-branded benefits with premium travel partners like Taj and ITC hotels, a complimentary stay program via Hotels.com, and a low forex markup fee of 1.8%. With travel benefits like these, Olympus competes head-to-head with other premium cards like HDFC Infinia and ICICI Emeralde Private.

Moreover, the reward structure particularly favours travellers. Despite a low earn rate of up to 2 points per Rs. 100, users can earn substantial returns on point-to-mile conversion as each reward point is worth 4 partner travel points (1:4). The reward redemption is even better than other travel-centric premium cards, like Magnus and Atlas, that offer the maximum redemption at 5:2 and 1:2, respectively. However, cardholders will have to ensure that they put maximum spends on the card to overcome the low earn rate and best utilize the high redemption potential.

Video: Quick Review of Axis Olympus Credit Card

Note: Details mentioned in the video have been sourced from the issuer’s website as of July 2024. For updated information, refer to this page.