With the advent of internet banking, financial providers have successfully handed banking services to their customers. Banking performed with the help of internet is termed as internet banking. You can now bank using your smartphone, tab, or laptop. However, the procedure of internet banking may vary from one bank to the other. The internet banking facility from Allahabad Bank allows its users to use banking services in a hassle-free manner. Allahabad corporate net banking allows companies and corporate customers to avail net banking services directly from their offices.

What is Corporate Banking? How is it Different from Retail Banking?

Retail banking directly deals with retail customers. Retail banking is also termed as personal banking or consumer banking. This banking facility is available to the general public, and the branches for personal banking are in abundance available in almost all major cities. Corporate banking, on the other hand, is also termed as business banking. This type of banking is for the corporate customers to manage the large-scale fund influx and efflux efficiently. Corporate banking is the major source of profit for almost all banks. Allahabad Bank is one such financial provider that offers the facility of both retail internet banking and corporate internet banking to its customers.

How to Activate Allahabad Corporate Net Banking?

You can activate the corporate internet banking facility by Allahabad Bank by following the steps mentioned below:

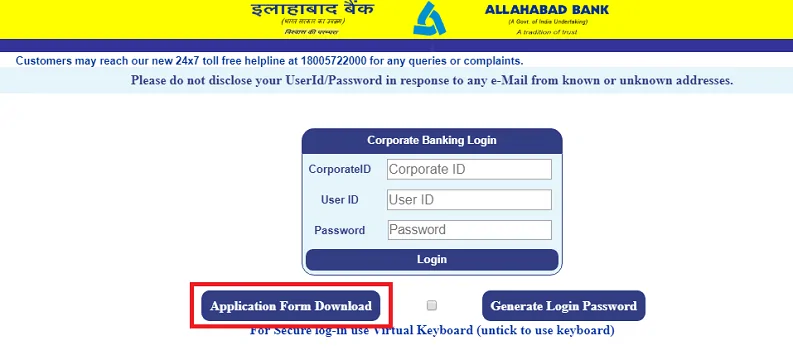

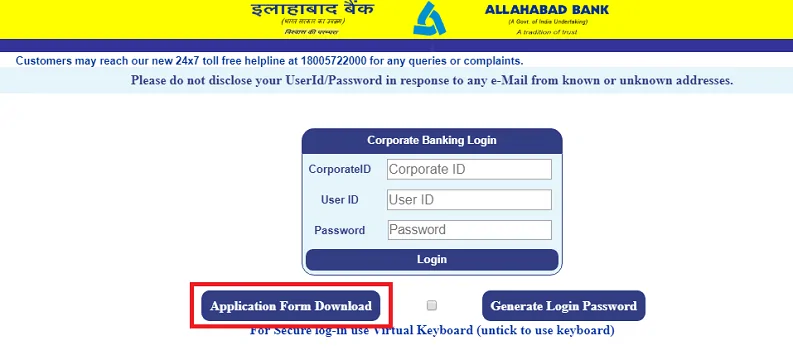

- Download Allahabad bank corporate internet banking application form.

- Visit your Allahabad Bank branch and submit the duly filled application form. The bank will give you your user ID and password.

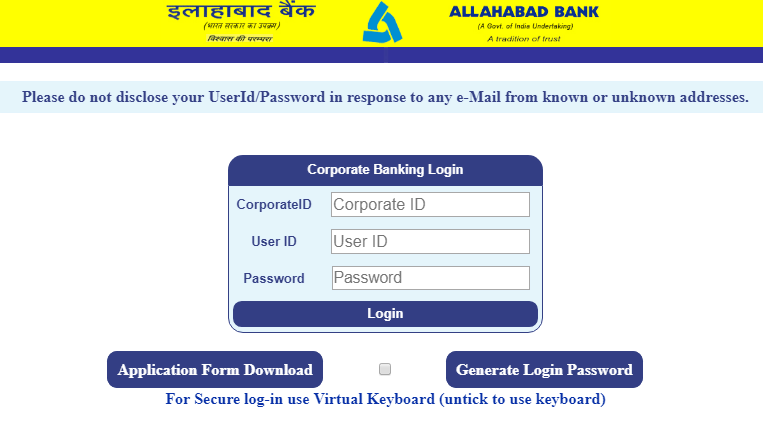

- Click on “Corporate Banking” in Allahabad Bank internet banking section

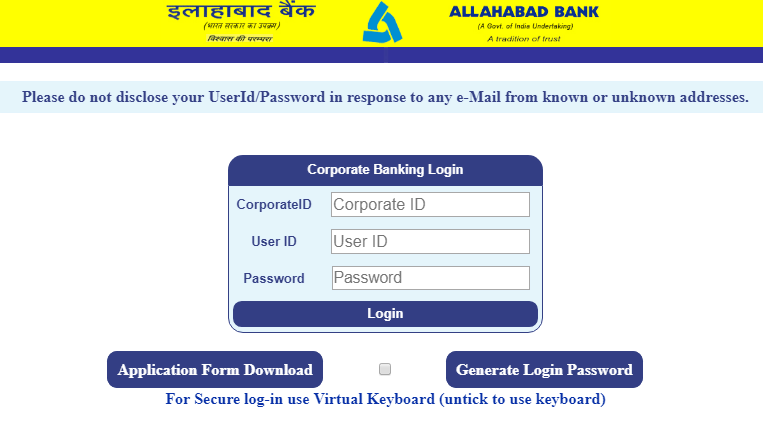

- You need to enter the corporate ID, user ID, and the password. Click on the login button.

- After the first login, you will need to change the login password and the transaction password mandatorily. However, you need to make sure that both the passwords should be different from each other.

- After the successful login, the main menu will be displayed. You can enjoy the internet banking facility from Allahabad Bank without any hindrance.

You need to enter your corporate ID, user ID, and password every time you wish to login to your internet banking portal from Allahabad Bank. Also, it is advised to change your login password and transaction password every 90 days to maintain security and prevent any misuse of your bank account.

How to Regenerate Login Password in Allahabad Corporate Net Banking?

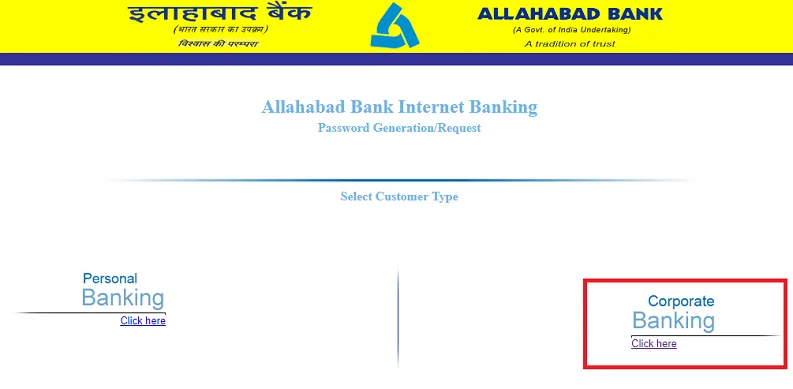

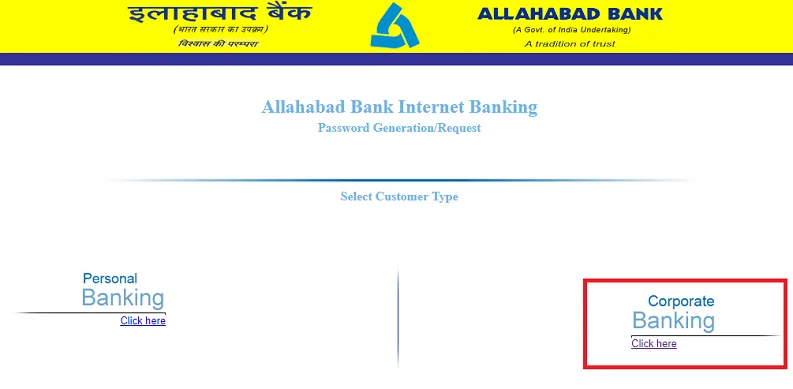

To avail the net banking facility from Allahabad Bank, you need to remember your login password. However, in case you forget your login password for logging in to the Allahabad Bank net banking account, you can regenerate your login password by following the steps mentioned below:

- For offline request, you need to submit a written request to the nearest branch of Allahabad Bank.

- For online request, on the net banking portal of Allahabad Bank, you need to click on the ‘Forgot Password’ link on the login screen. You need to submit a few security details, and a reference number will be generated on its basis. You need to note this number for future references.

After you finish any of the steps mentioned above, you will receive your login password from your branch of Allahabad Bank. Also, your transaction password will be sent to your address registered with your Allahabad bank branch.

Important Points for Using Allahabad Corporate Net Banking

Every bank and the financial provider have fixed specific terms and conditions to use the net banking facility. The Allahabad Bank has set the following terms and conditions to use its net banking facility:

- The Allahabad Bank holds the right to disable the net banking user account and cease its operation without any prior notice at any time.

- Two passwords viz. net banking login password and net banking transaction password will be provided to the customer.

- The user needs to change the passwords as soon as the first login is accomplished. The customer can also change the passwords periodically to maintain the security of the bank account.

- The passwords need to be kept in secrecy with only the user of the bank account. The user should not write down or save the password at any place that enables any third person of knowing the same.

- The user of the net banking is solely responsible for all the transactions made, and the bank will not be responsible for any transactions. Also, the user will be answerable for any loses incurred due to unauthorized use of user ID or passwords.

- The account information recorded in the bank will only be considered unless the bank verifies it and makes necessary changes if required.

- The account will be debited with the charges applied for using the net banking facility (if any).

- The transactions permitted from the bank will be as per the instructions are given on the internet banking module.

- The user needs to intimate the bank immediately in case of mishandling of user ID and passwords or in case of forgetting the password.

- The bank wouldn’t be liable for any failure in providing the services due to faulty internet connectivity or other uncontrollable circumstances.

- The user shall not use or permit the use of any banking service for illegal activities.

- The user should not attempt or permit to access the account information stored on the bank computers expect from net banking website.

- The net banking user needs to read all the terms and conditions, privacy policy, and disclaimer set by the Allahabad bank and agree only if the user agrees to it for using the net banking facility.

Features of Net Banking from Allahabad Bank

Allahabad Bank allows its customer to enjoy internet banking conveniently and easily. Below mentioned are the category and the features available with the internet banking facility from Allahabad bank:

| Sr. No. | Category | Features |

| 1. | Account Services | i. Summary of all accounts in the bank |

| ii. Account statements | ||

| iii. Aadhar linking | ||

| iv. Cheque book request | ||

| 2. | Payments / Fund Transfer | i. Fund transfer within the bank |

| ii. Fund transfer to other banks | ||

| iii. Beneficiary management | ||

| iv. IMPS enables transfer | ||

| v. NEFT/RTGS transfer and inquiry | ||

| vi. Scheduled payment inquiry | ||

| vii. Mobile banking registration | ||

| 3. | Deposit Accounts | i. Account opening for FD, RD, etc. |

| ii. Account closing | ||

| iii. Open PPF | ||

| 4. | Payment Instruction | i. Standing instructions for transferring a fixed sum for a specific time on a fixed date |

| ii. Stop payment on a cheque number. You can also revoke the stop instruction. | ||

| iii. Pay tax option available for Maharashtra state tax payment. For other states, you need to visit the state government tax portal. | ||

| iv. Download duplicate tax payment receipts for a successful attempt of tax payment. | ||

| v. View tax credit from form no. 26AS. | ||

| vi. Direct login to e-filing portal. | ||

| 5. | ATM Services | i. Generate ATM PIN |

| ii. Block ATM card in case of misplacing or theft. | ||

| 6. | Password Management | i. Change login password |

| ii. Change transaction password | ||

| iii. Generate new transaction password | ||

| iv. Get new login password by clicking on forgot password | ||

| 7. | Payment History | i. Check online payment status |

| 8. | Mails | i. Directly contact internet banking administrator |

| 9. | Security | i. Register GRID cards for second-factor authentication |

| ii. Avail additional security via digital certificate | ||

| 10. | Miscellaneous facility | i. Write your feedback for better services |

| ii. Provide contact details registered with the bank. Update the personal details when needed. | ||

| iii. Change the appearance and color of the internet banking portal as per your preference. | ||

| iv. View and verify login history |

Allahabad Corporate Net Banking FAQs

What are the banking services provided by Allahabad corporate net banking?

You can perform the following tasks using the net banking of Allahabad bank:

- Schedule fund transfer and manage beneficiaries.

- Send direct emails to customer care for quick assistance.

- Request for issuing a new cheque book.

- Stop payment for a specific cheque number.

- Enquire status of the cheque.

- Give standing instructions for timely fund transfer to accounts like RD, loans, etc.

- Cancel the standing instructions as per your requirements.

- View real-time balance status.

- View the transaction history at any time from anywhere.

- Make offline as well as online requests.

- Open FD account, RD account, or other accounts within few clicks.

- Make quick online payments.

What are the available types of fund transfer with Allahabad corporate net banking facility?

You can avail the following types of fund transfer using the Allahabad bank net banking services:

- Transfer fund to the accounts linked to your bank account.

- Transfer funds to other accounts in any of the branches of Allahabad Bank.

- Transfer funds to other accounts from a different bank through IMPS or NEFT / RTGS.

- Schedule transactions on fixed dates by giving standing instructions.

What is Corporate Banking? How is it Different from Retail Banking?

Retail banking directly deals with retail customers. Retail banking is also termed as personal banking or consumer banking. This banking facility is available to the general public, and the branches for personal banking are in abundance available in almost all major cities. Corporate banking, on the other hand, is also termed as business banking. This type of banking is for the corporate customers to manage the large-scale fund influx and efflux efficiently. Corporate banking is the major source of profit for almost all banks. Allahabad Bank is one such financial provider that offers the facility of both retail internet banking and corporate internet banking to its customers.

How to Activate Allahabad Corporate Net Banking?

You can activate the corporate internet banking facility by Allahabad Bank by following the steps mentioned below:

- Download Allahabad bank corporate internet banking application form.

- Visit your Allahabad Bank branch and submit the duly filled application form. The bank will give you your user ID and password.

- Click on “Corporate Banking” in Allahabad Bank internet banking section

- You need to enter the corporate ID, user ID, and the password. Click on the login button.

- After the first login, you will need to change the login password and the transaction password mandatorily. However, you need to make sure that both the passwords should be different from each other.

- After the successful login, the main menu will be displayed. You can enjoy the internet banking facility from Allahabad Bank without any hindrance.

You need to enter your corporate ID, user ID, and password every time you wish to login to your internet banking portal from Allahabad Bank. Also, it is advised to change your login password and transaction password every 90 days to maintain security and prevent any misuse of your bank account.

How to Regenerate Login Password in Allahabad Corporate Net Banking?

To avail the net banking facility from Allahabad Bank, you need to remember your login password. However, in case you forget your login password for logging in to the Allahabad Bank net banking account, you can regenerate your login password by following the steps mentioned below:

- For offline request, you need to submit a written request to the nearest branch of Allahabad Bank.

- For online request, on the net banking portal of Allahabad Bank, you need to click on the ‘Forgot Password’ link on the login screen. You need to submit a few security details, and a reference number will be generated on its basis. You need to note this number for future references.

After you finish any of the steps mentioned above, you will receive your login password from your branch of Allahabad Bank. Also, your transaction password will be sent to your address registered with your Allahabad bank branch.

Important Points for Using Allahabad Corporate Net Banking

Every bank and the financial provider have fixed specific terms and conditions to use the net banking facility. The Allahabad Bank has set the following terms and conditions to use its net banking facility:

- The Allahabad Bank holds the right to disable the net banking user account and cease its operation without any prior notice at any time.

- Two passwords viz. net banking login password and net banking transaction password will be provided to the customer.

- The user needs to change the passwords as soon as the first login is accomplished. The customer can also change the passwords periodically to maintain the security of the bank account.

- The passwords need to be kept in secrecy with only the user of the bank account. The user should not write down or save the password at any place that enables any third person of knowing the same.

- The user of the net banking is solely responsible for all the transactions made, and the bank will not be responsible for any transactions. Also, the user will be answerable for any loses incurred due to unauthorized use of user ID or passwords.

- The account information recorded in the bank will only be considered unless the bank verifies it and makes necessary changes if required.

- The account will be debited with the charges applied for using the net banking facility (if any).

- The transactions permitted from the bank will be as per the instructions are given on the internet banking module.

- The user needs to intimate the bank immediately in case of mishandling of user ID and passwords or in case of forgetting the password.

- The bank wouldn’t be liable for any failure in providing the services due to faulty internet connectivity or other uncontrollable circumstances.

- The user shall not use or permit the use of any banking service for illegal activities.

- The user should not attempt or permit to access the account information stored on the bank computers expect from net banking website.

- The net banking user needs to read all the terms and conditions, privacy policy, and disclaimer set by the Allahabad bank and agree only if the user agrees to it for using the net banking facility.

Features of Net Banking from Allahabad Bank

Allahabad Bank allows its customer to enjoy internet banking conveniently and easily. Below mentioned are the category and the features available with the internet banking facility from Allahabad bank:

| Sr. No. | Category | Features |

| 1. | Account Services | i. Summary of all accounts in the bank |

| ii. Account statements | ||

| iii. Aadhar linking | ||

| iv. Cheque book request | ||

| 2. | Payments / Fund Transfer | i. Fund transfer within the bank |

| ii. Fund transfer to other banks | ||

| iii. Beneficiary management | ||

| iv. IMPS enables transfer | ||

| v. NEFT/RTGS transfer and inquiry | ||

| vi. Scheduled payment inquiry | ||

| vii. Mobile banking registration | ||

| 3. | Deposit Accounts | i. Account opening for FD, RD, etc. |

| ii. Account closing | ||

| iii. Open PPF | ||

| 4. | Payment Instruction | i. Standing instructions for transferring a fixed sum for a specific time on a fixed date |

| ii. Stop payment on a cheque number. You can also revoke the stop instruction. | ||

| iii. Pay tax option available for Maharashtra state tax payment. For other states, you need to visit the state government tax portal. | ||

| iv. Download duplicate tax payment receipts for a successful attempt of tax payment. | ||

| v. View tax credit from form no. 26AS. | ||

| vi. Direct login to e-filing portal. | ||

| 5. | ATM Services | i. Generate ATM PIN |

| ii. Block ATM card in case of misplacing or theft. | ||

| 6. | Password Management | i. Change login password |

| ii. Change transaction password | ||

| iii. Generate new transaction password | ||

| iv. Get new login password by clicking on forgot password | ||

| 7. | Payment History | i. Check online payment status |

| 8. | Mails | i. Directly contact internet banking administrator |

| 9. | Security | i. Register GRID cards for second-factor authentication |

| ii. Avail additional security via digital certificate | ||

| 10. | Miscellaneous facility | i. Write your feedback for better services |

| ii. Provide contact details registered with the bank. Update the personal details when needed. | ||

| iii. Change the appearance and color of the internet banking portal as per your preference. | ||

| iv. View and verify login history |

Allahabad Corporate Net Banking FAQs

What are the banking services provided by Allahabad corporate net banking?

You can perform the following tasks using the net banking of Allahabad bank:

- Schedule fund transfer and manage beneficiaries.

- Send direct emails to customer care for quick assistance.

- Request for issuing a new cheque book.

- Stop payment for a specific cheque number.

- Enquire status of the cheque.

- Give standing instructions for timely fund transfer to accounts like RD, loans, etc.

- Cancel the standing instructions as per your requirements.

- View real-time balance status.

- View the transaction history at any time from anywhere.

- Make offline as well as online requests.

- Open FD account, RD account, or other accounts within few clicks.

- Make quick online payments.

What are the available types of fund transfer with Allahabad corporate net banking facility?

You can avail the following types of fund transfer using the Allahabad bank net banking services:

- Transfer fund to the accounts linked to your bank account.

- Transfer funds to other accounts in any of the branches of Allahabad Bank.

- Transfer funds to other accounts from a different bank through IMPS or NEFT / RTGS.

- Schedule transactions on fixed dates by giving standing instructions.