Unified Payments Interface (UPI) allows people to make fund transfers through UPI from their savings account and current account in real-time. Individuals can directly transfer funds from their bank account. UPI facility has eliminated the need to carry hard cash. Customers of AU Small Finance Bank can use BHIM AU to avail UPI services. It also allows individuals to make UPI payments from their RuPay credit card.

AU Small Finance Bank UPI

BHIM AU UPI and AU 0101 applications allow customers of AU Small Finance Bank to make UPI payments in real-time from any bank account just by using a VPA (Virtual Payments Address). There is no need to remember details of the beneficiary anymore to transfer funds. These applications allow customers to make a direct payment by scanning the UPI QR code of the merchant.

Suggested Read: Unified Payments Interface

Features of AU Small Finance Bank UPI App

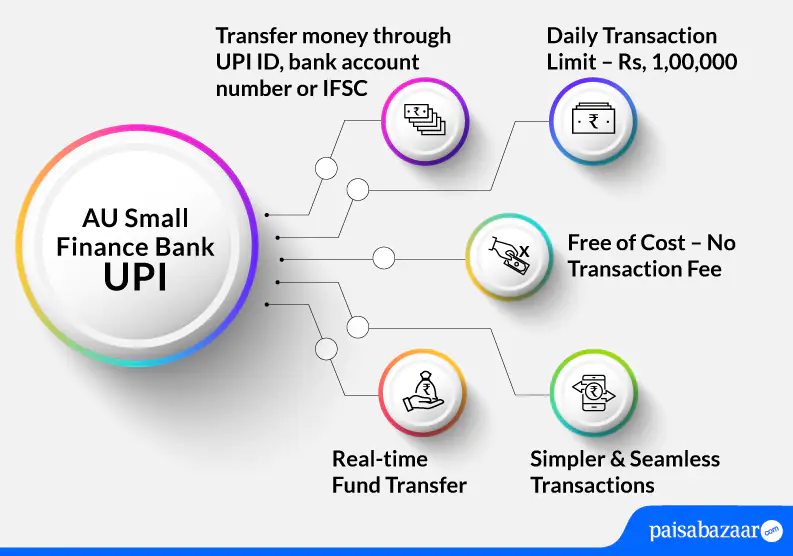

BHIM AU UPI offers below-mentioned features to customers:

- The bank account number is not needed to send/receive money

- The application is available 24×7

- Provides financial freedom because it eliminates the need to carry physical money in the wallet

- Provides different ways to transfer money such as: through UPI ID, bank account number or IFSC

- Daily transfer limit is Rs. 1,00,000

Get FREE Credit Report from Multiple Credit Bureaus Check Now

AU Small Finance Bank UPI Limit

| Type of Transaction | Transaction Limit |

| Per transaction limit | Rs. 1,00,000 |

| Per day total transaction limit | Rs. 1,00,000 |

| Limit for Android users post registration for the first 24 hours | Rs. 5,000 |

| Limit for iOS users post registration for the first 72 hours | Rs. 15,000 |

| IPO limit | Rs. 5,00,000 |

| For categories like Capital Markets, Collections, Insurance, Foreign Inward Remittances | Rs. 2,00,000 |

How to Register and Link your Account on AU Small Finance Bank UPI

Customers can either use the AU 0101 App or the BHIM AU App to avail UPI services at AU Small Finance Bank. Both apps can be downloaded from the Google Play Store or Apple Store. However, the individual must ensure that they have a smartphone with an active internet connection. The below-mentioned steps explain how one can use these apps to make UPI payments:

Step 1: Once you download the app on your smartphone, refer to the instructions on the app to sign in.

Step 2: You will receive an SMS from the bank to validate your mobile number registered with the bank.

Step 3: Select your bank account and verify your debit card details.

Step 4: In this step, select your UPI ID and set your MPIN to start availing UPI services.

Create your UPI ID

Step 1: Open the AU 0101 app on your smartphone by using your login credentials.

Step 2: On the dashboard, select the ‘BHIM UPI’ option.

Step 3: Tap on the ‘UPI Registration’ option. Create your desired VPA and confirm the availability of the created VPA.

Step 4: Confirm the details added and tap on ‘Submit’.

Step 5: Your VPA will be successfully created.

How to Send Money using AU Small Finance Bank UPI

Step 1: Open your AU 0101 app and on the home screen, tap on the ‘Scan to Pay’ option.

Step 2: Scan and Pay option will allow you to send money by scanning the QR code of the merchant.

Step 3: You can choose from other payment options available on the app and make payments as required.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Receive/Collect Money using AU Small Finance Bank UPI

AU Small Finance Bank savings account holders can follow the below-mentioned process to receive/collect money using the AU 0101 app:

Step 1: Login to the AU 0101 app.

Step 2: Tap on the ‘BHIM UPI’ option on the home screen.

Step 3: On the next screen, tap on ‘Request Money’.

Step 4: Enter the details of the payer as asked by the bank.

Step 5: Set the expiry date of the transaction if asked by the bank and initiate the request.

Upon doing so, a message will be sent to the payer regarding the collect money request. Once the payer accepts the request, the amount will be transferred to your account.

AU Small Finance Bank UPI Customer Care

- If the customer faces any issues regarding UPI, the customer can call the bank on the bank’s toll-free number 1800 1200 1200 or 1800 26 66677

- The customer can also drop an email at customercare@aubank.in

- For any technical support on UPI-QR, the customer can drop an email at support@aubank.in

Also Read: AU Small Finance Bank Customer Care

Get FREE Credit Report from Multiple Credit Bureaus Check Now

AU Small Finance Bank FAQs

Q. I do not have an account in AU Small Finance Bank, can I access AU 0101 for availing UPU services?

Ans. Both AU Small Finance Bank customers and non-AU Small Finance Bank customers can access AU 0101.

Q. I have forgotten my AU Small Finance Bank’s MPIN. How can I reset it?

Ans. On the AU 0101 app, click on Forgot MPIN. There are three ways by which you can reset your MPIN. Below-mentioned are the ways:

- AU 0101 username and password

- Debit card details

- Credit card details

Q. What if I delete AU 0101 app? Will I have to register again?

Ans. Yes. If you delete the app, you will have to register again on the app. However, you may not be required to create your MPIN again.

Q. What is the format of AU Small Finance Bank UPI ID?

Ans. The format of AU Small Finance Bank UPI ID is xxxxxxxx@aubank.

Q. Can I add multiple UPI IDs to AU 0101 app?

Ans. Yes. You can add multiple UPI IDs to AU 0101 app.