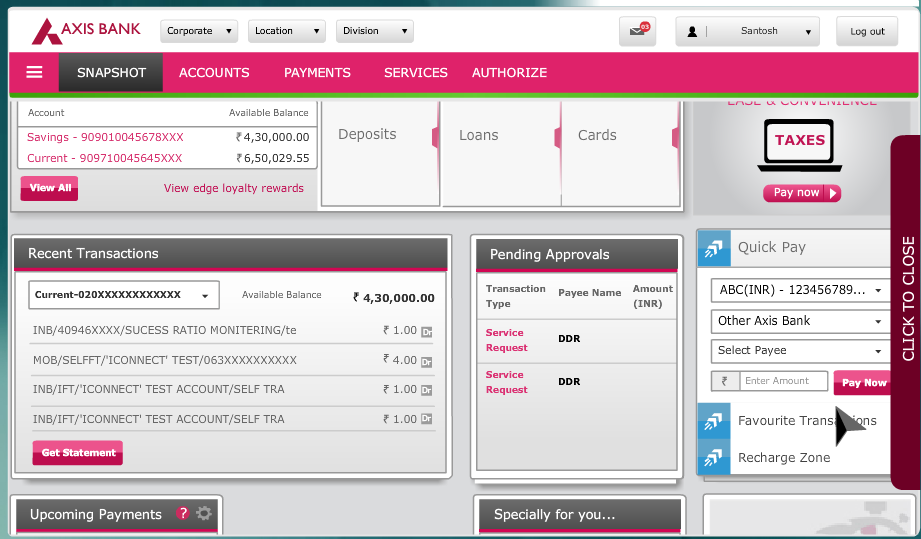

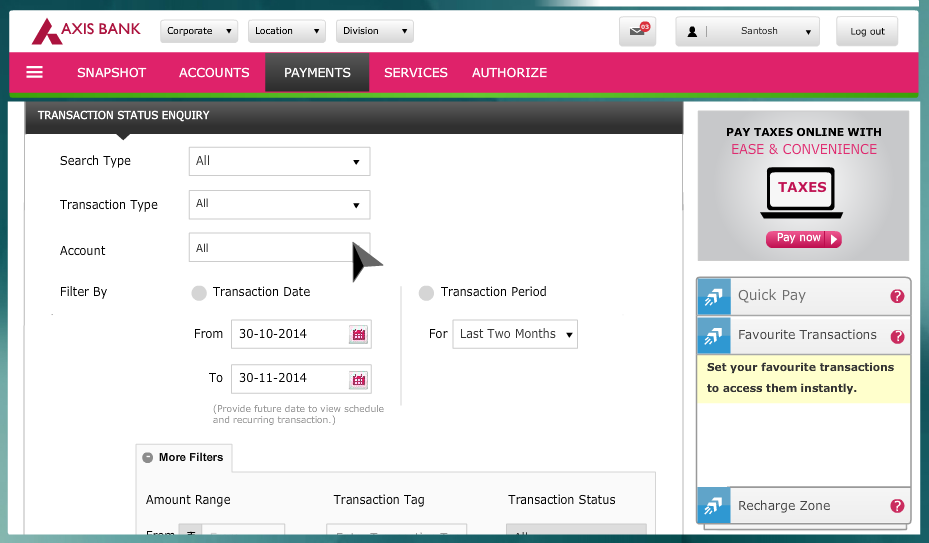

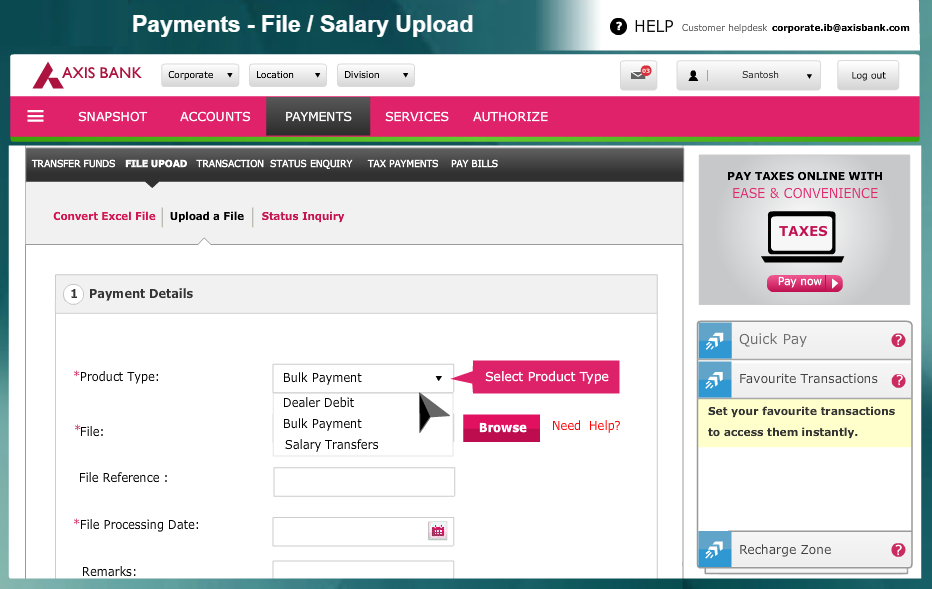

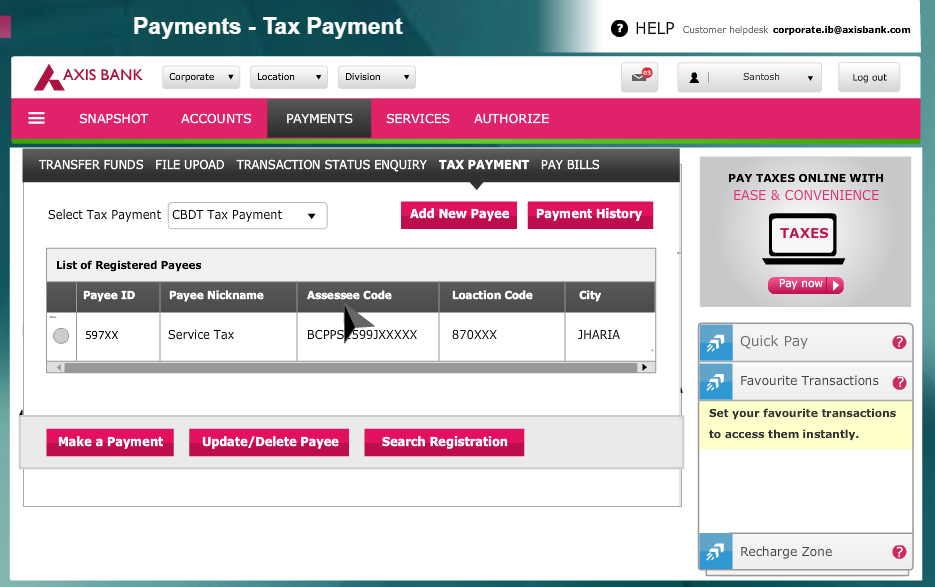

Internet banking has emerged as the most powerful tool for businesses to cut down delays and efforts. It allows entities to carry out business transactions without the constraint of any location or time. Corporates will have more time and resources to key business areas instead of spending countless hours in banking processes. Axis Bank corporate net banking allows companies to conduct their banking activities online anytime and from anywhere.