NEFT services are available to all account holders of the Bank of India. This is a fund transfer option that is mostly used through the internet banking services provided. However, for those who are unable to access their net banking account or have any issue related to online NEFT transfers, you can also make the transfer offline at your nearest Bank of India Branch. Read on to learn more about details on Bank of India NEFT form for better understanding.

Check Free Credit Report with monthly updates. Check Now

Offline NEFT Transactions

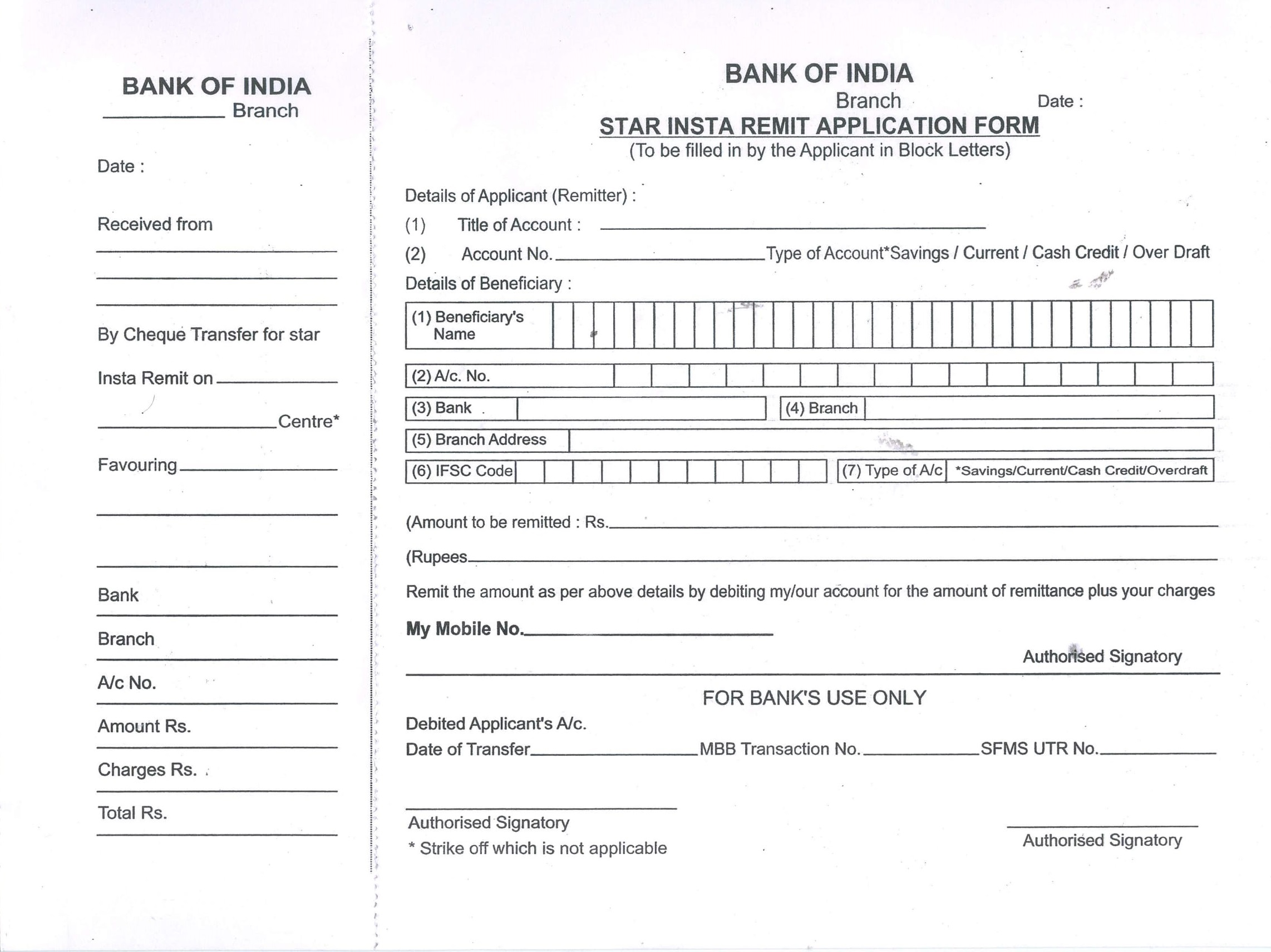

If you have to make a NEFT Transaction offline at a branch, you have to fill up a Bank of India NEFT Form and submit it to the branch. The details mentioned in the NEFT form are punched into the system physically by the official at the branch. Following this, the NEFT transaction takes place as it would online.

What are the details required in Bank of India NEFT Form?

You can download the Bank of India NEFT Form. Alternatively, you can check the details required to fill up Bank of India NEFT Form below:

1. Name of the branch

2. Date of transaction

3. Details of the remitter or the applicant:

- Title of the account

- Account number

- Type of account

4. Beneficiary details

- Name of the beneficiary

- The account number of the beneficiary

- Name of beneficiary bank and branch

- Branch address of beneficiary bank

- IFSC code of beneficiary bank & Type of Account

- Amount to be transferred in numerical and words

5. Mobile number of the applicant or the remitter

6. Signature of the remitter

The amount will be credited from your account and debited to the beneficiary account. Once you submit the form, the amount transferred will reflect in the beneficiary account after clearing.

Check Free Credit Report with monthly updates. Check Now

What are the Bank of India NEFT Charges?

In case of any inward settlements, your branch will not charge you any amount for the transaction. Moreover, the bank does not apply any charges on NEFT transactions initiated online via internet banking and/or mobile banking. The standard NEFT Charges on outward settlements are as follows:

| Transaction amount | Transaction fees |

| Up to Rs. 10000 | Rs. 2.50 + GST |

| Above Rs. 10,000 | Rs. 5.00 + GST |

When you fill the Bank of India NEFT form, you give the bank permission to debit the charges applied from your account automatically. These charges will be applied to each transaction that you carry out in one day.

Are there any Bank of India NEFT Timings?

You must make sure that you submit your Bank of India NEFT form within the NEFT timings of the branch. This is also subject to the working hours of the branch.

As per the Reserve Bank of India, settlement of fund transfer requests in NEFT is done on a half-hourly basis. There are 48 half-hourly settlement batches which run from 00:30 hours and the last batch will end at 00:00 hours. The system will be available on all days of the year, including holidays. You will be able to carry out NEFT transactions even on declared bank holidays. In addition to this, NEFT transfers are available on Sunday and Saturday as well.

A Good Credit Score can help in getting Loan Approvals Easily Check Now