Paisabazaar app Today!

Get instant access to loans, credit cards, and financial tools — all in one place

Our Advisors are available 7 days a week, 9:30 am - 6:30 pm to assist you with the best offers or help resolve any queries.

Get the App

Get the App

Get instant access to loans, credit cards, and financial tools — all in one place

Scan to download on

Find Credit Cards that Best Suits your Needs

Let’s Get Started

The entered number doesn't seem to be correct

Both private and nationalised banks provide interbank fund transfer facility in India; RTGS and NEFT are the main interbank fund transfer options in the country. Around 45000 bank branches facilitate RTGS in the country that takes place continuously through business hours. An applicant can fill Bank of India RTGS form to make transactions directly to other bank accounts.

As per Reserve Bank of India guidelines, the amount paid through RTGS should reach the beneficiary bank account within 30 minutes of initiation of the process. If for any reason, the balance cannot be credited in the bank account, the same must be returned to the sender account within 2 hours. Filling the Bank of India RTGS form makes the processing simple and time-saving for the applicant. This ensures that all the required information is available to both parties in one place.

Check Free Credit Report with monthly updates. Check Now

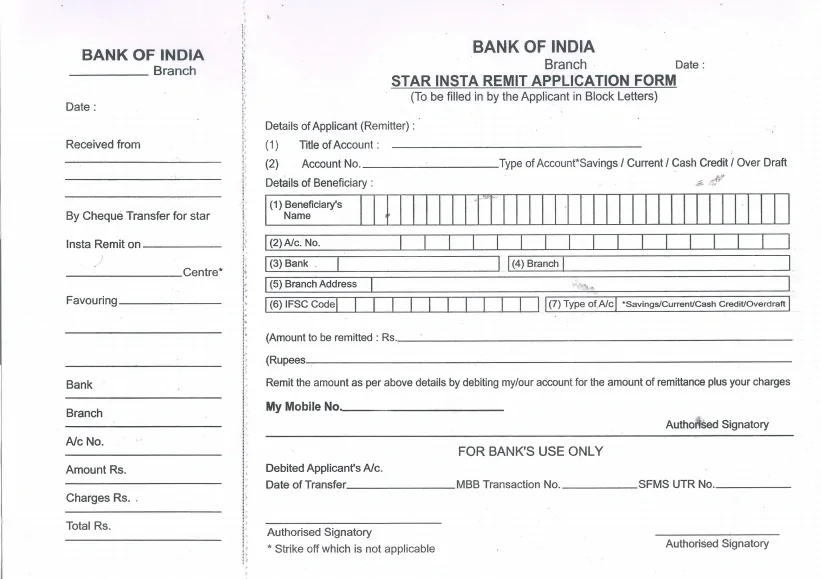

The below-mentioned details need to be filled up in the Bank of India RTGS form:

(Image Source: Bank of India)

Bank of India RTGS form is editable and fillable online. Applicants can download, take a print and submit the hard copy at the bank branch to initiate the RTGS transaction. The form can be uploaded online to initiate the RTGS transaction via net banking and mobile banking.

Bank of India permits RTGS on minimum Rs 2 lakhs and maximum Rs 25 lakhs in a day if the transaction is carried out at the branch. If the RTGS is done through mobile banking or net banking, the upper ceiling is Rs 5 lakhs.

Check Free Credit Report with monthly updates. Check Now

Bank of India RTGS form has some terms and conditions which the applicant need to check and adhere in order to initiate the transition. These include: