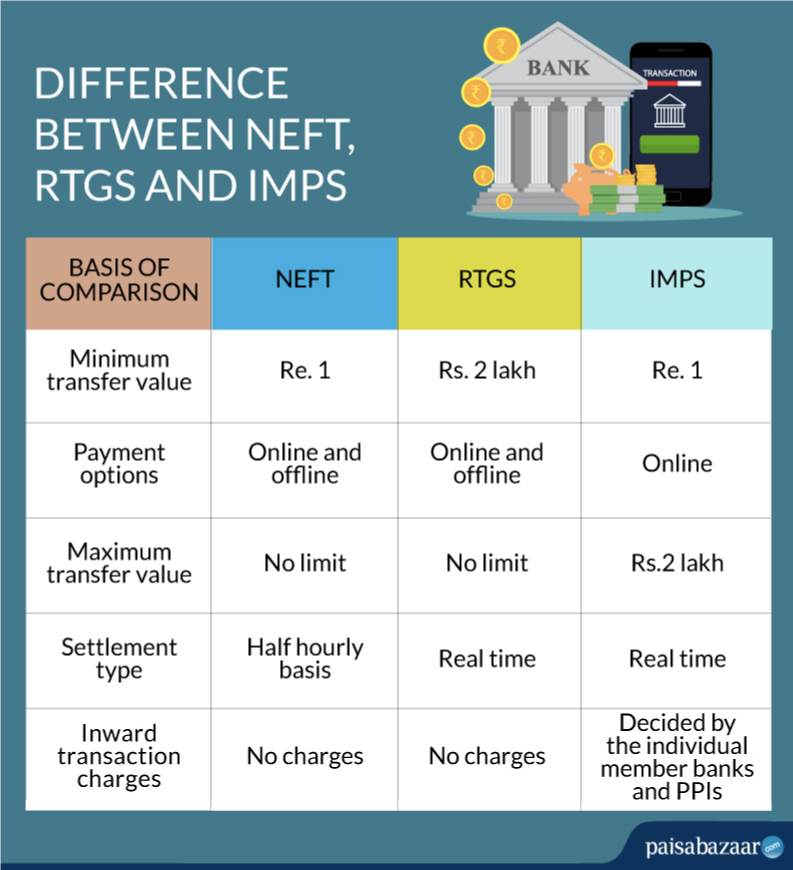

Different payment and settlement systems in India have made the task of transferring money from one bank account to another easier and faster. A large number of banks, private companies and government bodies along with others are adopting different payment and settlement methods such as NEFT, RTGS and IMPS. This has helped in reducing the gap between the entities and their customers and other concerned people. These methods are fast, convenient and useful for documentation purposes. Read on to know more.