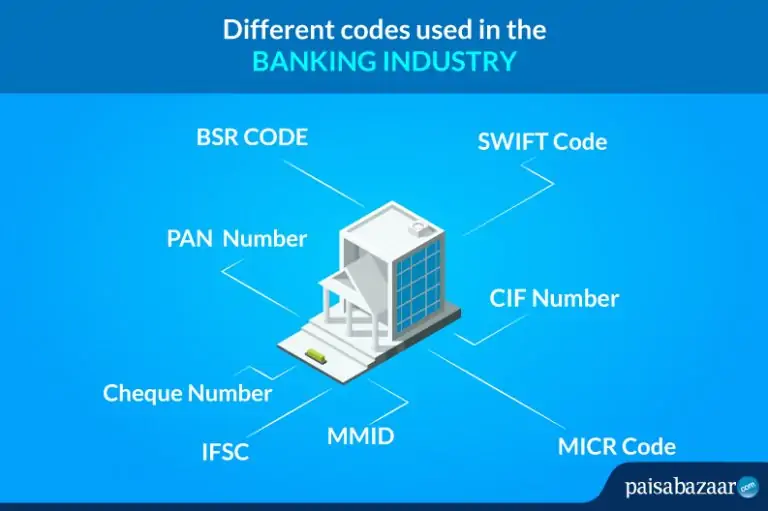

Indian Banking system is one of the sources that facilities the economy of the country. With time, banking in India has undergone significant transformations and hence there have been several inventions from time to time to support the same. In this article, we will learn about some of the codes introduced for the banking sector of the country to accelerate various banking operations.

IFSC (Indian Financial System Code)

- IFSC can be defined as an 11-character alphanumeric code developed for carrying out fund transactions between the banks

- IFSC is considered to the base of banking as it is an essential part of money management in India

- IFSC works in a manner that it identifies the payer’s and payee’s bank branch and ensures that the funds are directed to the correct bank branch

- Because of the IFSC, RBI can track the transactions made between the banks making the fund transfer process secure and error-free

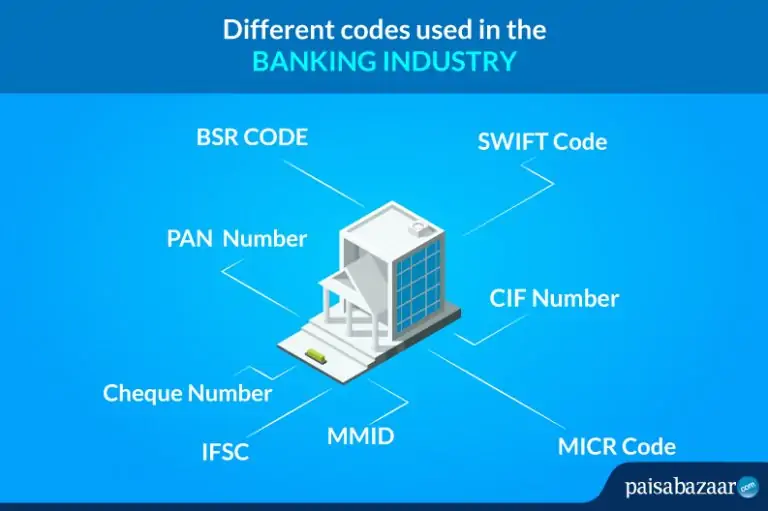

- IFSC is printed on the front page of the passbook as well as on the cheque leaf

IFSC Format

IFSC is formed by a combination of 11 numbers and alphabets. The initial four alphabets correspond to the bank whereas the last six determine the bank branch. The fifth digit is a zero that is kept for future use.

| Bank Name | Zero | Bank Branch | ||||||||

| C | N | R | B | 0 | 0 | 0 | 8 | 6 | 6 | 1 |

Example of IFSC

As seen from the cheque image above, “CNRB0008661” is the IFSC of Bhagalpur Collectorate Branch of the Canara Bank printed at the top of the cheque leaf.

MICR Code (Magnetic Ink Character Recognition)

- MICR is a 9-figure code used to recognize the location of the bank branch participating in ECS (Electronic Clearing Service). MICR refers to Magnetic Ink Character Recognition, a technology used for printing MICR codes on cheques

- The code aids in fund transfer by accelerating the cheque clearance process. MICR was introduced to abolish the manual processing of cheques that further prevent human-made errors and fasten the cheque clearing process

- MICR is usually mentioned on a cheque leaf and on the front page of the bank’s savings account passbook

MICR Format

MICR is made up of 9-digits in such a way that each bank branch is allocated a unique MICR code. Out of the 9-digit, the first 3-digits determine the city the next three the bank, and the last three the bank branch.

| City | Bank | Bank Branch | ||||||

| 8 | 1 | 2 | 0 | 1 | 5 | 0 | 0 | 3 |

Example

If we look at the bottom of the cheque leaf provided above, it can be seen that “812015003” is the MICR Code Bhagalpur Collectorate Branch of the Canara Bank.

Here “812” corresponds to the City, “015” denotes the branch and “003” denotes the bank branch.

Cheque Number

- A cheque number is a 6-digit number used to identify a cheque. Printed between inverted commas at the bottom of a cheque leaf, cheque number tells us the status of the cheque

- One is required to fill certain cheque details while depositing a received cheque into his/her account

- These details include the date, account number, cheque amount, cheque number, etc. Hence a cheque number acts as a cheque identifier for banking operations.

Cheque Number Format

A cheque number is formed uniquely by the combination of 6-digit numbers.

Example

Cheque number is printed at the bottom of a cheque leaf right next to the MICR Code. If we look at the cheque image above we can see “432371” placed at the bottom of the cheque.

SWIFT Code (Society of Worldwide Interbank Financial Telecommunication)

- SWIFT Code also known as BIC can be defined as a network that enables financial transactions across the world in a standardized and secure manner

- SWIFT Code identifies the country, city, and the branch of the beneficiary and ends up the money at the right destination

- SWIFT code can be seen on the front page of the passbook if the bank is supporting international fund transfers else you can contact the bank’s customer care department

SWIFT Code Format

SWIFT Code is constructed using a bank code, country code, city code, and branch code. The code is formed by the combination of 8 to 11 alphanumeric characters.

| City | Country | Location | Bank Branch | |||||||

| S | B | I | N | I | N | B | B | X | X | X |

Example

SBININBBXXX is the SWIFT Code of Colaba Branch Mumbai, India.

- The first four alphabets “SBIN” represent the City

- The next two digits “IN” represent the Country

- “BB” represents the Location

- The last three digits “XXX” are indicative of Bank Branch

CIF Number (Customer Information Number)

- A CIF Number is a virtual file of an account holder issued by the bank at the time of account opening. CIF Number contains all the banking details of an account holder like the details related to loans and Demat accounts, KYC details, etc.

- Banks have the sole right to access the CIF Number of an account holder and retrieve his/her details if required. An account holder can have a number of bank accounts under on unique CIF Number

- Thus CIF Number maintains the transparency between the bank and its customers thus further avoids any sort of fraudulent activities

- CIF was initiated to abolish manual tracking of account holders and to hold all the details of account holders at a single place

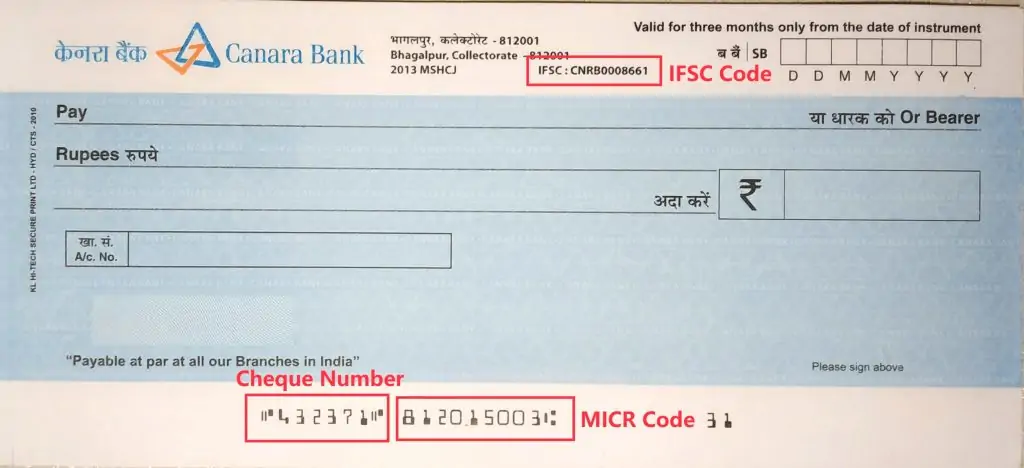

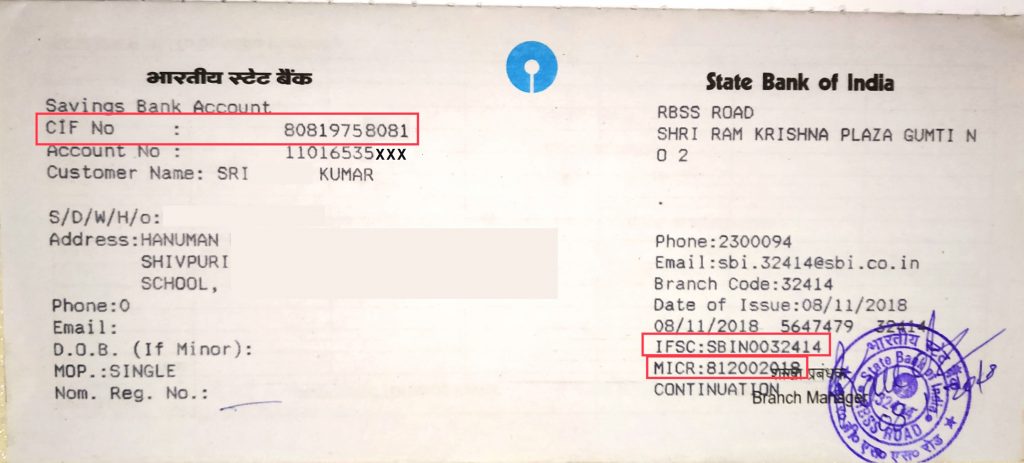

- A CIF number is usually printed on the front page of the passbook along with other account details of an account holder

CIF Number Format

Different banks have different CIF Number Formats like SBI CIF Number is formed of 11-digits while HDFC CIF Number is formed of 8-digits.

Example

As seen from the passbook image above,”80819758081’ is the CIF Number of the SBI Bank. We can see IFSC, MICR Code along with the CIF Number mentioned on the front page of the SBI Passbook.

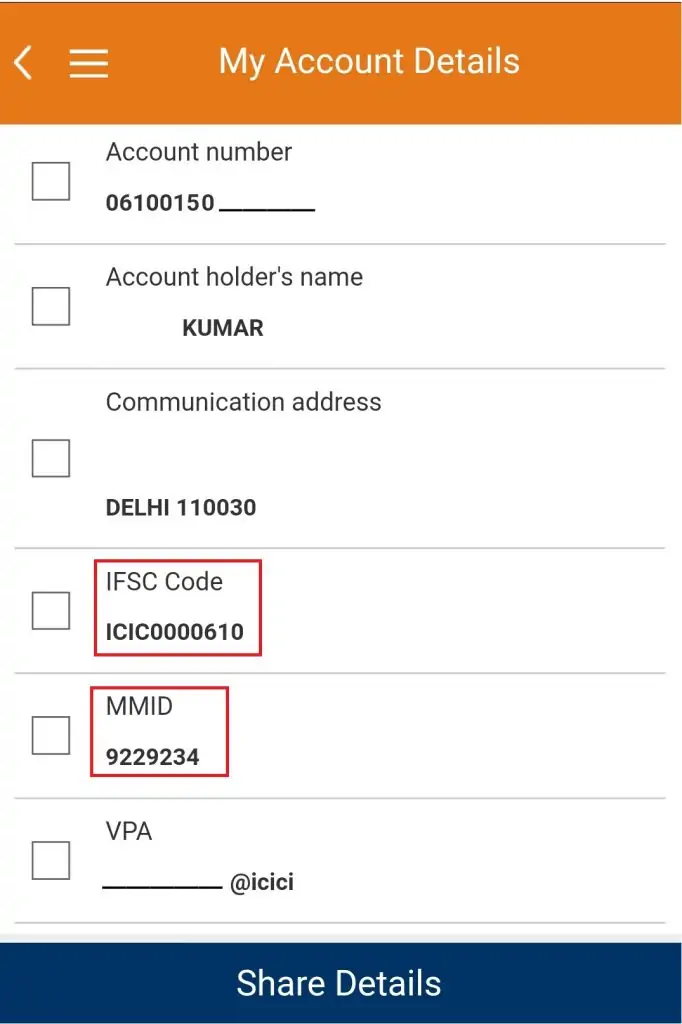

MMID (Mobile Money Identifier)

Before understanding MMID you must know what IMPS is. IMPS or Immediate Payment system can be defined as an interbank fund transfer system that works in real-time. With IMPS money gets credited to the receiver’s account as soon as payment is made and is available 365 days a year, unlike NEFT and RTGS.

IMPS can be initiated by a number of ways after getting registered to the mobile banking facility of the bank. The various ways are as under

- IMPS transfer via IFSC

- IMPS transfer via Mobile Number and MMID

- IMPS transfer via SMS

- IMPS transfer via ATM

So MMID can be defined as a unique code that is used to facilitate immediate fund transfer via IMPS. Simply log in to the mobile baking app of the bank and enter the receiver’s mobile number, the amount, and the MMID and carry out the fund transaction.

Also Read: MMID

MMID Format

MMID is formed by the combination of 7-digits.

Example

You can easily look for the MMID by logging to the mobile banking app of the bank. From the image given above it can be seen that “9229234” is the MMID of an ICICI Bank account holder.

PAN Number (Permanent Account Number)

- PAN is a unique 10-figure code allotted by the Income Tax department. PAN number acts as an electronic system wherein all the tax-related information of a taxpayer is stored at a single place

- PAN number is essential for major financial transactions like opening a bank account, sale or purchase of a property, investing in Mutual Funds, getting a gas connection, etc

- Further PAN number is a must while paying income tax and it acts as an identity proof of a person

Read More: PAN Card

PAN Number Format

PAN Number is assigned to the customers in the form of a plastic card called the PAN Card. Looking at the structure of a PAN number it can be seen that the code is made of 10-digits wherein

The first three digits are alphabets starting from AAA TO ZZZ

The fourth digit is also an alphabet that determines the category of the taxpayer.

Following are the alphabets that can be used as the fourth digit-

A – Association of Persons

B – Body of Individuals

C – Company

F – Firms

G – Government

H – Hindu Undivided Family

L – Local Authority

J – Artificial Judicial Person

P – Individual

T – Association of Persons for a Trust

The fifth digit represents the first alphabet of the individual’s surname

The next four digits are numbers starting from 0001 to 9999

The tenth digit of the code is an alphabet check number

Example

From the image given above, we can see the PAN Number printed at the bottom of the PAN Card.”BOIPK3123X” is the PAN Number mentioned on the PAN Card along with other details of the cardholder.

BSR Code (Basic Statistical Return)

- BSR Code is a unique code assigned by the RBI to all the registered banks in India

- The code is used to track all the online payments made toward the tax by various banks and alerts the income Tax Department regarding the same

- BSR is further used to upload the details of the challan after recording all the taxes paid by the banks

BSR Format

The code is structured by seven numeric digits wherein the first three numbers in the code correspond to the bank and the last four digits correspond to the branch.

| Bank | Branch | |||||

| 0 | 2 | 1 | 0 | 6 | 0 | 9 |

Example

“0210609” is the BSR code of Allahabad Bank for the Imphal City, Manipur. Here “021” represents the Allahabad Bank and “0609” represents the Imphal Branch.

Conclusion

Banking operations on the front look very smooth and simple but there are many codes involved to make a banking operation successful. One must be aware of the functioning of all such code in order to prevent fraudulent activities and to ensure successful fund transactions. Apart from this, one must make a habit to verify all such codes before using them.