Unified Payments Interface (UPI) is a fund transfer platform that lets users transfer money from their bank accounts to another account instantly just by using any UPI application. It is a convenient fund transfer option that allows everyone to transact online without sharing any bank account details making it a safe and secure option. ESAF Small Finance Bank provides this facility through the BHIM ESAF UPI app.

ESAF Small Finance Bank UPI

ESAF Small Finance Bank customers can avail UPI services through the BHIM ESAF UPI app by linking their accounts. The application provides an immediate money transfer facility and is available round the clock 24×7 and 365 days. Read on to know more about UPI services of ESAF Small Finance Bank.

Also Read: Unified Payments Interface

Features of ESAF Small Finance Bank UPI

- Access different bank accounts from single mobile application

- Avail facilities of UPI 24×7

- Transaction limit in a day is Rs. 40,000

- Safe and secure way of making payments

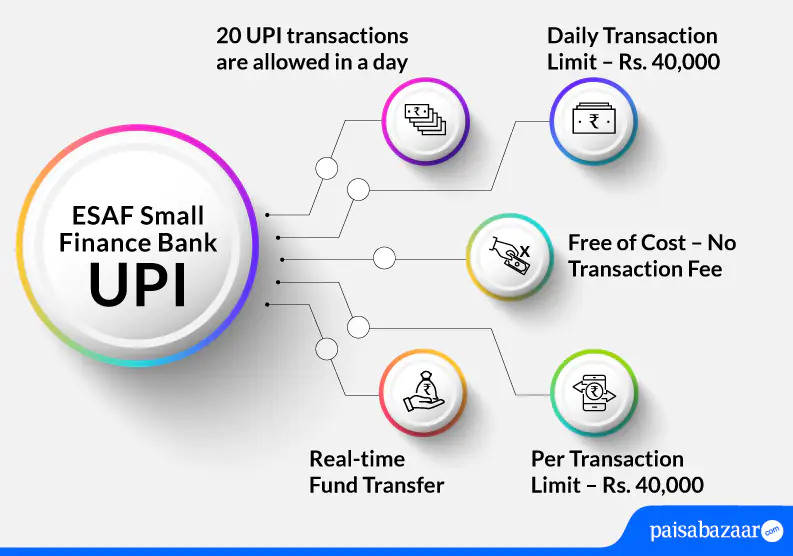

ESAF Small Finance Bank UPI Limit

| Type of Transaction | Transaction Limit |

| Per transaction limit | Rs. 40,000 |

| Daily transaction limit | Rs. 40,000 |

| Number of transactions allowed in a day | 20 |

| IPO limit | Rs. 5,00,000 |

| For categories like Capital Markets, Collections, Insurance, Foreign Inward Remittances | Rs. 2,00,000 |

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Register and Link your ESAF Small Finance Bank Account on BHIM UPI

ESAF Small Finance Bank provides its customers with BHIM ESAF UPI app for Android users. However, iOS users can link their ESAF account to BHIM UPI to access UPI services. The registration and linking process for both applications is the same as mentioned below:

Step 1: Download and install BHIM UPI app from Google Play Store or Apple Store.

Step 2: Select your preferred language.

Step 3: Provide BHIM application the permission to send and view SMS messages and verify your mobile number. Add your registered mobile number with the bank.

Step 4: You need to set the passcode to access the application.

Step 5: From the bank option, choose your ESAF Small Finance Bank.

Step 6: Now, set your UPI PIN. You will require the last 6-digits of your debit card and its expiry date.

Step 7: You will receive an OTP on your registered mobile number. Enter the OTP and then enter your new PIN. Confirm your PIN and tap on ‘Submit’.

Step 8: On the home screen of the application, tap on ‘Profile’ section and on the next page, create your UPI ID.

Step 9: When you do so, your UPI ID will be created and you can successfully avail UPI services on the BHIM application.

How to Send Money using BHIM UPI App

BHIM UPI offers multiple ways to send money namely – through VPA, through mobile number, and through account number & IFSC. However, the below-mentioned steps explain how can one send money using a mobile number:

Step 1: Open the BHIM UPI app and login with the set passcode.

Step 2: On the home screen of the application, tap on ‘Send’ option.

Step 3: As you add the number of the receiver, the name of the receiver will appear on your screen.

Step 4: Select the receiver and enter the amount that needs to be sent.

Step 5: Enter the UPI PIN to complete the transaction.

Step 6: Your transaction will be successful.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Receive/Collect Money using BHIM UPI

BHIM UPI offers multiple ways to receive/collect money. However, the below-mentioned steps explain how one can receive/collect money through mobile number:

Step 1: Open the BHIM UPI app and login with the passcode.

Step 2: On the home screen of the app, tap on ‘Receive Money’ option.

Step 3: Add the mobile number of the payer and tap on verify to check the name of the payer.

Step 4: Once you do so, the details of the payer will reflect on the screen. Check the details and add the amount that needs to be received.

Step 5: Confirmation of the request will be sent to you.

Step 6: The initiated request will be sent to the payer. Once the payer accepts your request, the amount will be transferred to your bank account.

ESAF Small Finance Bank UPI Customer Care

If the customer faces any issues regarding UPI, he/she can call the bank on the bank’s toll-free number 1-800-103-3723.

Alternatively, you can also write to the bank at customercare@esafbank.com.

Know More about UPI

Get FREE Credit Report from Multiple Credit Bureaus Check Now

ESAF Small Finance Bank UPI FAQs

Q. How many bank account can be linked to BHIM account?

Ans. BHIM allows you to link up to 5 accounts.

Q. On what all platforms is BHIM available currently?

Ans. Currently, BHIM is available on all handsets with iOS (version 9.0 and above) & Android OS (version 5.0 and above).

Q. What is the process to generate QR code on BHIM application?

Ans. Upon successful verification on BHIM, a QR code and default VPA will be created for you. These details can be checked in the ‘My Profile’ section of the BHIM UPI app.

Q. Who can I contact if I have any issues with BHIM application?

Ans. You can contact BHIM’s toll free number 18001201740 for any complaints.

Q. If I have any concerns regarding bill pay transaction, who can I contact?

Ans. In such a case, you can contact your bank through Call Bank option on BHIM. You can find the same in the ‘Failed Transaction’ section.