Netbanking is provided by the HDFC Bank to both retail and corporate customers. This service enables the bank’s customers to conduct financial and non- financial transaction comfortably, easily, and securely. HDFC covers more than 175 transactions under its netbanking service. The HDFC customers can check their account balance, download account statement up to a period of 5 years, pay bills online, book transport, recharge DTH connections and lots of other services. However, a user has to fill the HDFC netbanking form to avail this facility.

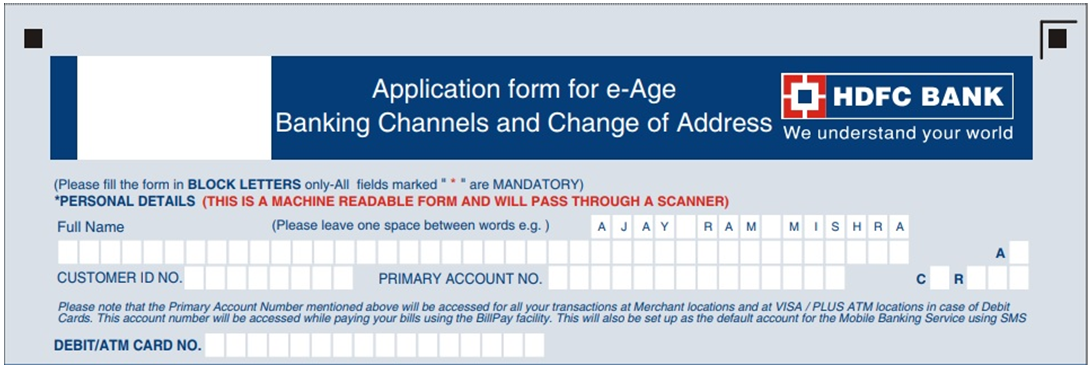

HDFC Netbanking Form

The customer can also download the form from the bank’s website, fill it in, and submit the registration form to the bank branch.

The Process for filling in the NetBanking Form is given below:

- Enter full name of the account holder, customer ID provided by the bank, and Primary Account Number.

- Enter Debit Card/ATM Card Number.

- The customer should fill the form in capital letters.

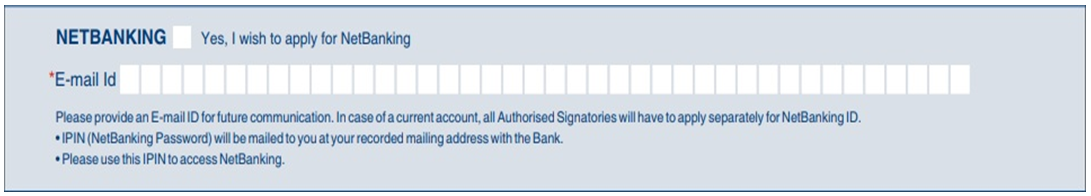

- Enter personal email ID in the required field.

- Once the form is duly filled in, the bank would send the IPIN to the customer’s registered e-mail ID with the bank,

The customer is required to fill in only those fields related to NetBanking (No need to fill in Change Address field).

Registering for HDFC Netbanking through Other Methods

HDFC provides all HDFC customers with its netbanking service by default. If a customer doesn’t have netbanking activated, the bank has made it easy. The customer can fill in the HDFC netbanking form, submit it, and the rest will be done within a week.

The bank provides various ways through which a customer can register a request for netbanking:

- Online Registration – The customer can fill the request form online.

- Phone Banking – The customer can call the phone banking agent to register a request for netbanking. Once the agent has registered the request, the IPIN would be sent to the customer’s e-mail ID. It will take a period of 5 working days.

ATM

- The customer can visit any HDFC Bank ATM.

- He should enter the Debit Card number along with ATM PIN.

- Select ‘Other Option’.

- Then the customer should select ‘NetBanking Registration’ and confirm.

- The bank would courier the IPIN to the registered e-mail ID of the customer.

Features and Benefits of Netbanking

- The customer can check account balances anytime and anywhere.

- Getting account statement of the five-year period in five formats is better than earlier.

- The customer can book Fixed Deposit / Recurring Deposit.

- Paying Utility Bills and Credit Card Bills has become a one-minute effort.

- It is easy to recharge Prepaid Mobile and DTH Connections using NetBanking.

- The customer can invest in mutual funds through online payment.

- Booking Railway Tickets and Air Tickets are easier.

- Purchasing products online save valuable time.

- The customer can pay taxes online.

- The customer can place a request for a Demand Draft/ Cheque-book.

- Requesting to Stop Payment of a Cheque doesn’t require physical presence in the bank.

- The customer can pay Loan Instalments like hdfc home loan or personal loan etc.

- The customer can register for a Third Party Transfer.

- Transferring funds between accounts within HDFC Bank and the accounts with other banks can be done instantly.

The benefits listed above are some of the 175+ transactions a customer can conduct through NetBanking. HDFC uses high-end technologies to keep the transactions secure and safer.

HDFC Netbanking Form FAQs

Q: Who is eligible for netbanking with HDFC Bank?

A. All Account holders with Savings and Current Accounts with HDFC Bank are eligible to access netbanking.

Q: Does the HDFC Bank charge for the NetBanking services?

A: No, the HDFC Bank doesn’t charge for NetBanking currently. The service is offered free of charge. However, the customer should meet the required minimum balance/deposit amount.