HDFC Bank offers a comprehensive range of netbanking services to its customers that include both financial as well as non-financial transactions. But, not all are familiar to carry out netbanking transactions with ease. In this article, we will discuss how to transfer money from HDFC netbanking to other bank accounts.

Get Your Free Credit Report with Monthly Updates Check Now

In this transformational technological shift towards modern payment and fund transfer systems online, there are various possibilities that have emerged. All merchant sites, utility bill payment services, and various product or service providers have their savings or current bank accounts linked with HDFC payment platforms to make the transfers convenient and transparent.

There are numerous wallets, payment gateways etc. that are also integrated with HDFC Bank online platform providing options to transfer money instantaneously to other bank accounts. However, based on the nature of the fund transfer, one must use the relevant solution offered by HDFC Bank. Generally, there could be many scenarios in which one individual would wish to transfer funds but we will consider the major segments and payment channels only.

A. Payments done to other bank account using payment channels like:

- PayZapp

- SmartHub

- Samsung Pay

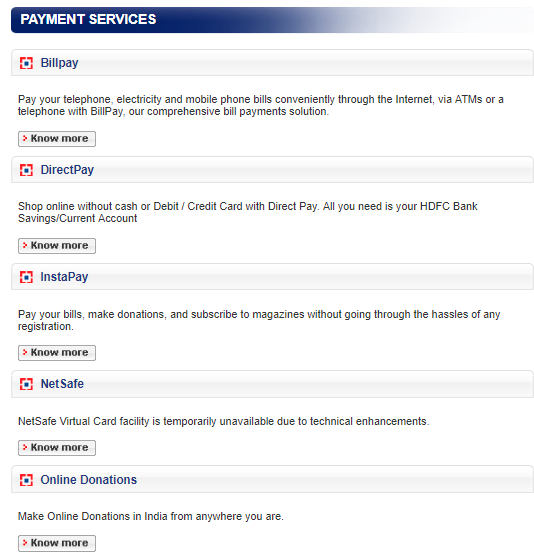

B. Payments done against any shopping bills, utility bills, or any consumer products or services are interfaced in the account holder HDFC Bank panel and can choose the relevant option and instantly make payments. DirectPay, BillPay, InstaPay, Net Safe etc. are very helpful for all such benefits to the account holders.

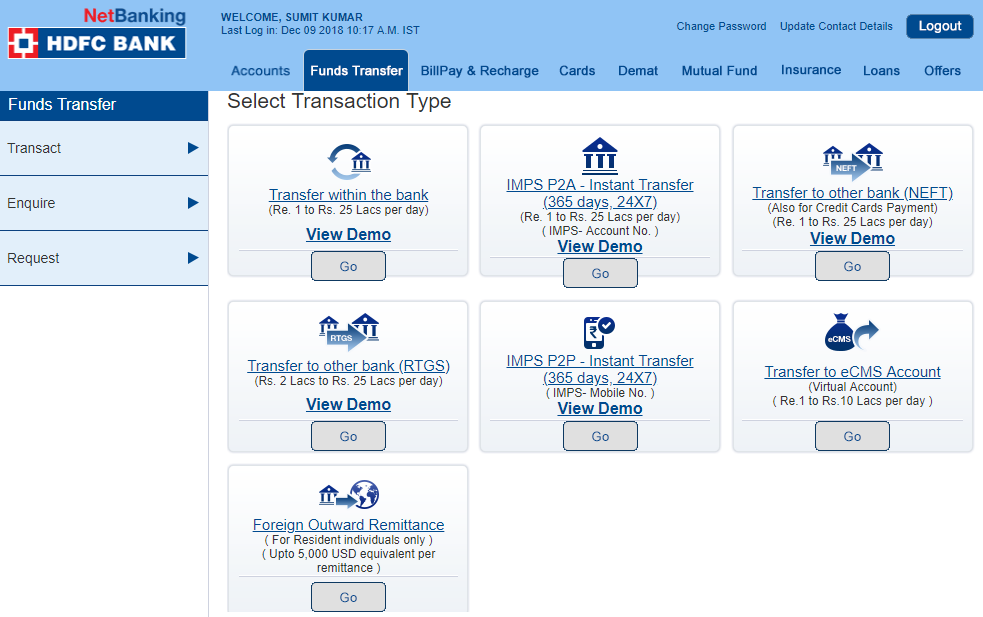

C. Third Party Transfers – Now, let’s quickly consider the Fund Transfer options provided by HDFC Bank. One can login to his/her HDFC Bank Account online dashboard and consider the type of fund transfer he/she wants to choose. The options provided by the bank are IMPS, RTGS, NEFT, IMPS P2P (Mobile Banking), and transfer to eCMS Virtual Accounts. This is generally applicable for transfer of funds within India. The attached screenshot in this section will help visualize the convenience one may get on his/her individual HDFC Bank account. Let’s quickly understand in brief about each of this important fund transfer services:

- NEFT– National Electronic Funds Transfer is a nation-wide payment system currently in India. In this mode of payment service, anyone, who has a HDFC Bank Account, can transfer funds from his/her account to an individual anywhere in India who has an authorized bank account with any bank at a branch that is participating in this Scheme. The bank collects some charges on such transactions for providing benefits to the customer.

- RTGS – Real Time Gross Settlement is probably one of the fastest ways to transfer funds through the banking channels in India. The minimum limit for a RTGS Transaction is INR 2 lakhs whereas there is no maximum limit if done through the bank branch. But, if someone is using net banking to transfer funds through RTGS, there is a maximum limit per Customer ID is restricted to INR 25 lakhs. One must check the RTGS Transaction Timings and charges levied by the bank on such transactions along with tax.

- IMPS – Immediate Payment Service or IMPS offered by HDFC Bank is an instant inter-bank fund transfer service using electronic mode. This service is available to the bank customers 24 hours a day, 7 days a week including Sundays and bank holidays. Customers have the ability to transfer money using the registered mobile number with the bank and MMID. Alternatively, they can use Account Details of the beneficiary and IFSC Code. The customer has to pay some charges and tax against such transactions that can be checked on the bank’s website or calling up the toll-free number.

D. BHIM/UPI– The HDFC Bank customers also have the facility of transferring funds using the BHIM APP or UPI through their registered mobile number with the bank. The key steps for a successful transfer of funds are:

- Select a BHIM or UPI ID (generally registered mobile number).

- Select Pay option to enter the details of the beneficiary, amount and description and initiate transfer of funds.

- The beneficiary receives alert on his/her mobile or account for successful transfer of funds.

FAQs

Q-1 What are the different channels a HDFC Bank customer can use to transfer funds through NEFT?

Answer. Below are the various options available for HDFC Bank customers to transfer funds through NEFT:

- Internet Banking

- Mobile Banking

- Branch

- Enet

Q-2 Are RTGS transactions subject to any waiting periods for funds transfer?

Answer. No, transactions through RTGS are not subject to any waiting periods. However, one must check the transaction timings as per the HDFC Bank transfer window either through the bank branch or transferring through net banking.

Q-3 What are the IMPS charges excluding taxes for a transaction amount less than INR 1 lakh?

Answer. Rs. 5 would be IMPS charges excluding GST for a transaction amount less than INR 1 lakh.