ICICI Bank issues bank statement to its account holders that shows the detailed activity in their accounts. It allows the account holder to see all the transactions processed on their savings account and current account for any specific tenure in the ICICI Bank statement.

ICICI Bank Statement Format

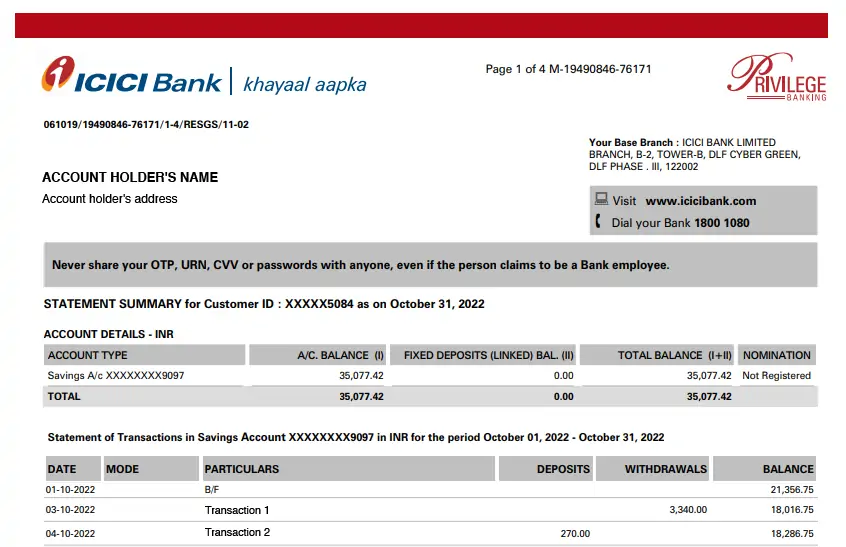

ICICI Bank allows its customers to view and download savings account statement by authenticating their debit card details. The account holder needs to login with their User ID and password to view and download their account statement or they can also register to receive their statements on their email-id. Click here to view or download your savings bank statement. The below-mentioned image shows how ICICI Bank’s savings account statement looks like.

Note: The account holders can now download the statement using the iMobile Pay app and Internet Banking.

ICICI Bank statement usually contains:

- Account holder details

- Account details

- Transaction history

- Transaction detail part shows all the transactions recorded (both debit and credit card) with date, amount, and the description of the payee or the payer.

- A customer has the option to choose the statement period for which he/she wants the ICICI Bank statement.

Account holder details are mentioned at the top of the bank statement. These include Name, registered mobile number, and residential address. After account holder details, the account summary is presented that holds the account number, account type, ICICI Bank FD (if any linked with the bank account), total balance, etc.

Check Free Credit Report with monthly updates. Check Now

How to get ICICI Bank Statement?

There are two ways to get the ICICI Bank statement:

How to get ICICI Bank Statement online?

Customers can avail ICICI Bank statement by email once they get their mail IDs registered with the bank. ICICI bank offers a subscription for one month wherein customers will receive the account statement in the first week of every month.

These ICICI Bank e-statements are free of cost and can be accessed easily without visiting the branch.

Here are the steps to subscribe for monthly ICICI Bank e-statements via mail –

Step 1: Log in to the ICICI net banking portal by providing User ID and Password.

Step 2: Go to the “Banking” section and then click on the “Account Statement by Email” option and carry out the subscription process.

Alternatively, one can contact the ICICI Bank Customer Care Number to enquire about the ICICI Bank statement.

How to view the bank statement of ICICI Bank online?

Account-holders can view and download their ICICI Bank statement online via iMobile – ICICI Bank mobile banking app or ICICI net banking portal. Here are the steps to view and generate ICICI Bank statement via net banking portal:

Step 1: Log in to ICICI Bank Corporate Internet Banking and click on “Continue to login”.

Step 2: Enter the Corporate ID, User ID & Password and click on “Login”.

Step 3: On the next page, click on “E-statement”.

Step 4: Select account number, time period and click on “PDF” to generate the statement.

Also Read: ICICI Net banking

How to get e-statement from ICICI Bank offline?

ICICI Bank provides an account statement in the physical form on a quarterly as well as on a monthly basis free of cost. One can subscribe to monthly or quarterly account statements in the physical form to avail of this facility. The account holder can subscribe for ICICI Bank statements by following the steps mentioned below:

- Fill up the subscription form take a printout and drop it at an ICICI Bank Branch/ATM

- Alternatively, one can contact the ICICI Bank Customer Care Number and enquire about the facility

Check Free Credit Score with monthly updates. Check Now

What are the ICICI Account Statement charges?

| Frequency of Bank Statement | Mode of Receipt | Charges |

| Monthly | Free | |

| Monthly | Physical | Rs. 200 |

| Quarterly | Physical | Free |

| Issue of Duplicate Statement | At the branch | Rs. 100 |

| Issue of Duplicate Statement | Customer Care, ATM, Net Banking | Rs. 50 |

What are the benefits of ICICI Account Statement?

- ICICI Bank statement is a great tool to help account holders to keep a track of their funds.

- These help account holders to track their finances, identify errors, and recognize spending habits.

- With ICICI Bank statement, one can verify bill payments and debit card charges which were debited from the bank account.

- Banks might add interest payments, fees or penalties on the account. Monthly bank statements help account holder to keep track on these.

Don’t know your Credit Score? Check it here for FREE. Check Now

FAQs

Q. How to open ICICI Bank Statement PDF password?

A. ICICI Bank sends statements via email to the customers that can be downloaded as a PDF. ICICI Bank automatically sends monthly statements by mail which are password protected and can only be accessed by using the right password only.

ICICI Bank Statement PDF Password is usually the combination of the first 4 letters of the name and date of birth.

For example, if the account holder’s name is Sumit Kumar and his date of birth is 01 February 1982. The ICICI Account Statement password will be “SUMI0102”.

Q. How is ICICI Bank Mini Statement different from the ICICI Account Statement?

A. Mini statement of ICICI Bank is different from the ICICI Account statement by the following ways:

| Bank Statement | Mini Statement |

| ICICI Account statement is a list of all transactions for a bank account over a set period, usually monthly/quarterly. | ICICI mini statement is a list of recent 3 transactions carried out by a customer. |

| Accountholders can avail ICICI Account Statement using mobile banking, net banking and by visiting the branch. | Account holders can avail ICICI Bank Mini Statement using missed call service, SMS Banking, mobile banking, and net banking |

Q. How to download ICICI Account Statement online?

A. ICICI Bank sends a monthly bank statement if the customer has registered their email address with them. All bank statements sent through emails are password protected hence make sure to read the password instructions in the email to download ICICI Account Statement PDF.

Q. How many years bank statement can I avail in ICICI Bank?

Ans. You can avail ICICI Bank statement up to the last 4 years.

Q. What is the process to check transaction time in ICICI Bank?

Ans. To check your transaction history in ICICI Bank follow the below-mentioned steps:

- Open iMobile app in your phone.

- Log in to app using your credentials and click on BHIM UPI

- Click on ‘Manage’ and then click on ‘Transaction History’.

- You will now see your recent UPI transactions listed along will all the transaction details.

About ICICI Bank

ICICI Bank is India’s largest private sector bank with total consolidated assets of Rs.11,242.81 billion as of March 31, 2018. ICICI Bank was established in 1955 at the initiative of the World Bank with the objective of creating a developed financial institution for providing medium-term and long-term project financing to Indian businesses.