Banking operations have now become faster and more secure with the help of internet and sophisticated technologies. While personal internet banking saves an individual’s time and effort, ICICI corporate net banking increases the efficiency of organizations associated with the bank. The corporates can focus more on their growth strategies than spending more time on banking matters.

ICICI Corporate Net Banking

ICICI Banks corporate net banking, also known as Corporate Internet Banking (CIB) is the three-time award winner feature of the bank. You can perform a number of financial transactions right from your office. It reduces your paperwork drastically and gives you an efficient, economical and easy option to perform corporate banking transactions.

Key Highlights of ICICI Corporate Net Banking

| Account Balance information on Real Time Bases | Open Fixed Deposit online | Fund Transfer from Channel Partners | E-Payment Gateways |

| Six Formats of Account statements (for download) | Trade MIS | NEFT, RTGS transfers | Cash Management Services |

| Subscribe Account statement by Email | Fund Transfer to self-accounts | Utility Bill Payments ( More than 302 billers registered) | Global Trade Services |

| Request Cheque book and stop payment of cheque online | Fund Transfer to Channel Partners | Online Tax Payment | Current Account Management |

Benefits of ICICI Corporate Net Banking

ICICI corporate net banking comes with the sophistication of user-friendly interface, efficient execution of transactions and advanced security features. It understands the business needs of corporates and strikes the right balance between ease of doing transactions and security. Below are notable features of ICICI corporate net banking.

| Real-Time Information | · The information is the key in business.

· You can access your account information and track in a single view. |

| Easy Reconciliation | · Download account information into several convenient formats.

· Simplified reconciliation of your accounts. |

| Supply Chain Management | · Pay your all vendors with single file upload.

· Electronic Bill Payment/Presentment and e-payment gateway services. · Real-time and customized MIS · Manage your collections effectively |

| Transaction by Employees | · Multi-Level Approval Process

· Authorization rights and limits for your employees · Information Access solutions · User id monitoring to prevent the misuse of access |

| Safe and Secure Banking | · Firewalls and Filtering

· Secured Socket Layer with 128-bit encryption · Audit trails · Access with authorization only · Separate login and transaction password for two-level security |

How to avail ICICI Corporate Net Banking (CIB) facility?

- In case you do not have a current account with ICICI Bank, apply for opening a current account with your nearest branch of the bank.

- You can fill up registration form meant for corporate internet banking with ICICI Bank branch.

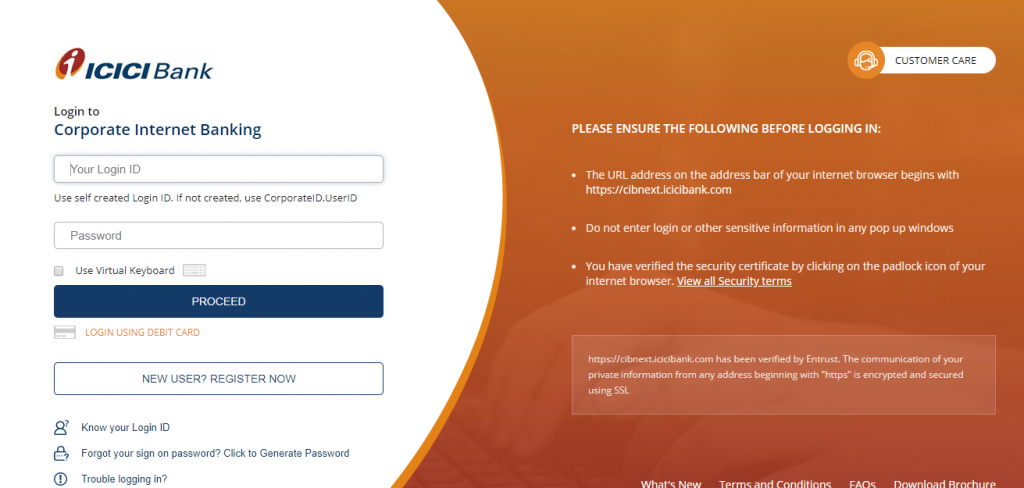

- Upon due process and authentication, the bank will issue your corporate ID, User ID, and Sign-On password.

- With the above credentials, you can log in to corporate banking of ICICI Bank through its website icicibank.com.

- For security purposes, it is recommended to change your password after the first

ICICI Bank Corporate Net Banking

For any net banking, fund transfer is a basic and essential feature. However, when it comes to corporate net banking, situations demand far more sophistication than mere fund transfer. Below mentioned are unique ways of fund transfer through ICICI net banking:

Modes of Fund Transfer

- You can perform one-to-one fund transfer to ICICI Bank accounts and other bank accounts.

- When you want to transfer funds to multiple beneficiaries, you can do so effortlessly by “Bulk File Upload” feature through Corporate Internet Banking of ICICI Bank.

- Tax payment and bill payment is also simplified through ICICI corporate net banking.

Bulk File Upload Facility

- You can create a simple text file as per format on ICICI Bank website.

- This facility minimizes your efforts for bulk payments like salary, dealer payment, and vendor payment.

Authorization and Limits

- Similar to cheque signing powers to authorized signatories, you can assign the limits to each user of the corporate net banking of ICICI Bank.

- The limits can be amount wise, transactions wise and a combination of both.

- If you have not assigned the limits to your users, the bank will apply default limits as per standards mentioned for each category of account.

Multilevel Approvals

- ICICI corporate net banking supports multilevel approvals.

- You can create layers of approvals as per your organization’s need.

- The transaction will be processed by the bank after the final approver gives his consent for the same.

- Hence, it gives you the right balance between authority and security of your internal financial system.

Channel Partner Solution

- You can avail mandate from your channel partners to debit their account in favour of your company.

- With the above mandate, you can pool money in your ICICI Bank current account with debiting channel partners’ account.

- It eliminates several processes and paperwork for your company and your vendor, both.

Timings of Fund Transfer

- For 24×7 fund transfer, you can utilize IMPS facility under ICICI corporate net banking.

- For higher amount, you can use NEFT and RTGS; both are available from Monday to Saturday (Except 2nd and 4th Saturday).

- Timings for NEFT are 8 am to 6.30 pm, and for RTGS it is 8.15 am to 4.15 pm.

- NEFT and RTGS are not available on Sundays and other bank holidays.

Track Your Fund Transfer

- The fund transfer made through ICICI corporate net banking can be traced online or offline.

- You can directly call corporate care phone banking officers to know the status of your transaction.

- You can also send email to corporatecare@icicibank.com with details of transactions like account number, amount of transactions, beneficiary details, and date of transactions.

- You can also know the status in ICICI corporate net banking website under “Payment Mode” link.

Safety Tips for ICICI Corporate Net Banking

- For security reasons, each authorized user of ICICI corporate net banking must keep his password unique and secret.

- Consider changing the password at regular intervals.

- You can visit ICICI Bank corporate banking website for protocols to generate safe passwords. The password must be easy to remember for you but difficult to guess for anyone else. Never write your password anywhere nor share it with anyone. The only way to secure the password is to memorize

- Avoid using shared computers for accessing your ICICI corporate net banking as far as possible. If it is necessary to access it in an emergency, always use “Virtual Keyboard” facility provided by the bank. It will ensure that your keystrokes will not be recorded or transmitted by the hidden malware in cyber café.

- After you finish your work in ICICI corporate net banking, do not forget to “Logout.” Never leave your place unattended if your login session is live in ICICI Corporate Netbanking. Even after logout, keep practice to close the browser and clear the cache immediately.

- Keep your computer equipped with the latest anti-virus software.

- Never respond to emails, phone calls or SMS that asks your login or transaction password or OTP (One Time Password). Bank has not authorized anyone, including its employees to ask the password from you.

- If you receive multiple OTPs (One Time Password) on your mobile number without any action on your part, consider changing your login and transaction passwords immediately. Moreover, inform ICICI Bank corporate banking helpline to take protective steps.

- Always initiate your ICICI corporate banking session through typing the website name in the address bar of the browser. Never click on the link received through email, as the website might be fraudulent and your data may be stolen by unidentified networks.

ICICI Corporate Net Banking FAQs

Q. I have done an erroneous transaction by mistake using ICICI corporate net banking. How can I reverse the same?

Ans. You can apply on company letterhead with complete transactions details at your branch. ICICI bank will do needful to reverse transactions subject to prevailing laws and factors within the control of the bank.

Q. How to handle “404 error” message while accessing ICICI corporate net banking?

Ans. Usually “404 error” is due to technical issues and it is temporary. You can try using ICICI corporate net banking after some time. If you get the same error repeatedly, you can take a screenshot of the error and send to corporatecare@icicibank.com from your registered email id.

Q. If we have not mentioned the fund transfer limit, what is the limit for fund transfer?

Ans. For your security, it is recommended to mention user wise limit for fund transfer transactions. However, if it is not mentioned, the bank sets a limit of Rs. 5 Lakhs per transaction for each user if you are a non-company user of ICICI corporate net banking. If you are a company user, the limit is Rs. 1 Crore per transaction.

Q. If I click on “Tax Payment,” I do not get a response on the webpage. What to do?

Ans. “Tax Payment” and other third-party services requires to open in the new browser called “Pop-Ups.” If your internet browser setting does not allow pop-ups, you may not be able to see a new window. You can click on the address bar and disable popup blocker (hence allowing popups) for ICICI Bank websites.