Real Time Gross Settlement or RTGS is a mode of money transfer in India. Most of the private and nationalized banks of the country offer this option of electronic money transfer to their customers. IDBI account holders can also transfer money via RTGS by filling up the IDBI RTGS form.

Get Free Credit Report with monthly updates. Check Now

How to Fill IDBI Bank RTGS Form

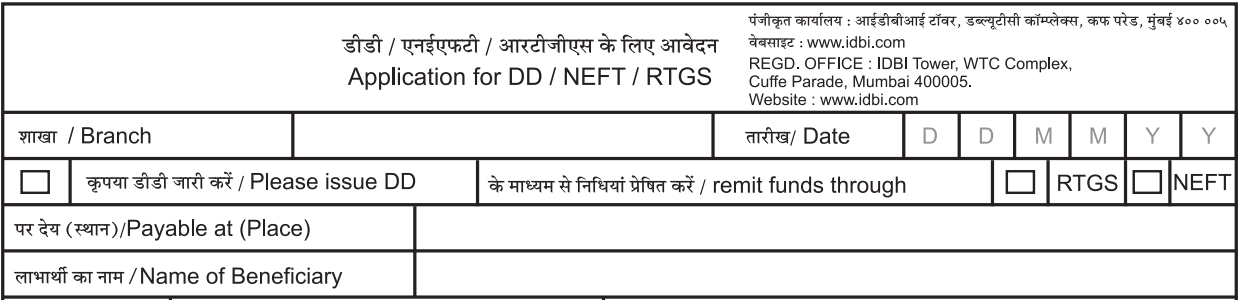

(Image Source: IDBI)

IDBI has a single application form for NEFT, RTGS and Demand Draft. For this reason, it is essential that the sender selects the right option while filling up the form. The following details should be kept handy while filling up the RTGS form.

- Beneficiary details- Here users need to enter the details of the receipt and his/ her bank account.

- Name

- Address

- Account name

- Contact details

- Branch address

- Account number

- Branch IFSC code

- Account type (savings/ current)

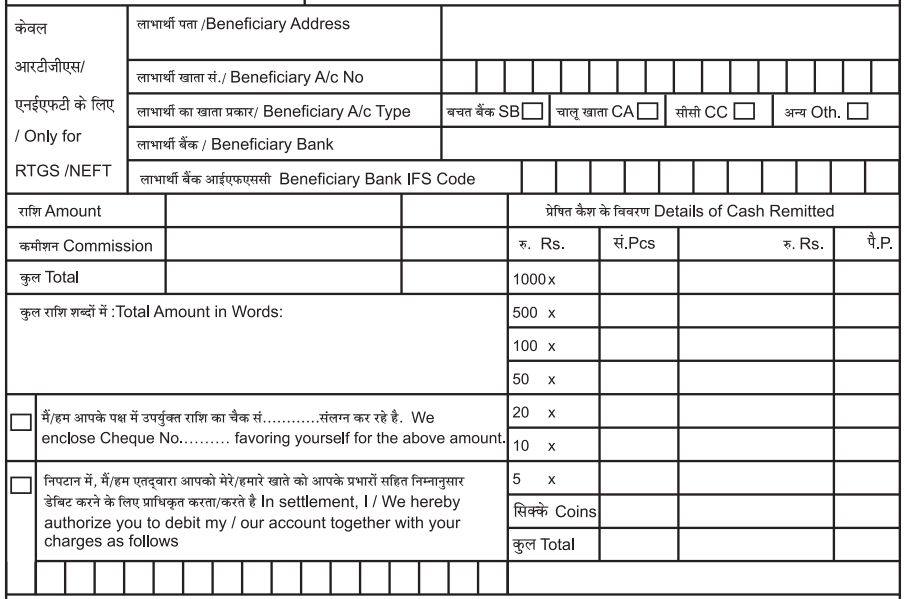

(Image Source: IDBI)

- Applicant details- Refers to the sender who is making the payment.

- PAN number

- Sender name

- Sender contact details

- Purpose of remittance

- Payment details- Refers to the amount which will be transferred

- Details of cash remitted

- If paying through cheque then the cheque number

- Account number if the money is to be directly debited from the savings/ current account

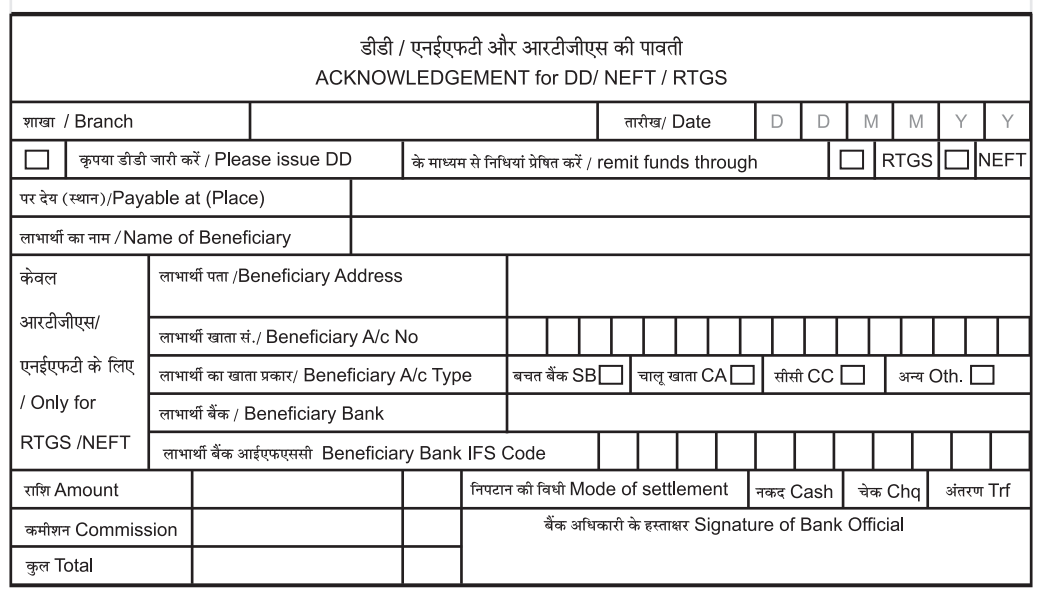

(Image Source: IDBI)

(Image Source: IDBI)

The sender gets an acknowledgement slip after submitting the IDBI RTGS form. In case the payment is not done or delayed, the sender can raise a concern or escalate the matter by showing the acknowledgement slip.

Important Points related to IDBI Bank RTGS

There are some specific terms and conditions for RTGS money transfer through IDBI. These include

- The amount paid to the beneficiary account cannot be reversed. This is because the settlement takes place directly in the Reserve Bank of India books of records

- If the details are not filled in properly or the information is incorrect, then the bank will not be liable if there are consequences for the same

RTGS transactions at IDBI ensures that

- There are fewer interest costs

- The transaction is fast and secure

- There is less paperwork; just filling the IDBI RTGS form is enough to initiate the RTGS transaction

The minimum amount which can be transferred is Rs 2 lakh. The maximum amount which can be transferred depends on the transaction mode; if RTGS is done at the bank branch then more amount can be transferred. Moreover, there is no fee for the inward transaction.

The RTGS transaction at IDBI is available from Monday to Sunday 24×7. This change in timings has been made to boost the adoption of the digital payments system. Earlier, the same service was available from 9 am to 4 pm. Likewise, the users can initiate the RTGS transaction online using the IDBI RTGS form at any time of the day but it will be processed by the bank only within business hours.

According to RBI guidelines, the amount transferred through RTGS must be deposited in the beneficiary account within 30 minutes. If the time is crossed, the sender can raise a complaint by calling the customer care number. If the issue is still not resolved, the sender can escalate the case to the RBI grievance cell.