IDBI Bank Statement is a document provided by the bank which acts as a record of all the transactions happening in the customer’s account. IDBI Bank statement summarizes the fees charged, money owed, money withdrawn, interest earned, etc.

What is the IDBI Bank Statement Format?

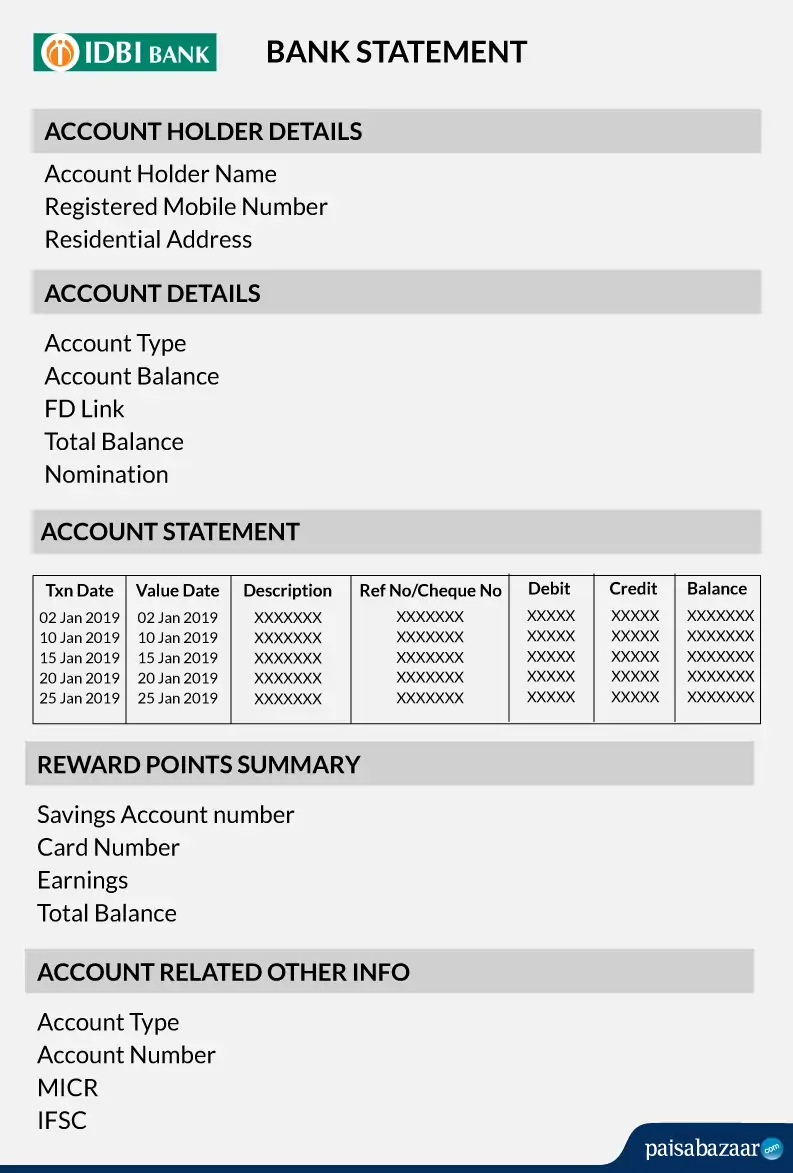

IDBI Bank Statement is usually divided into two parts:

- Header containing account holder details and account details

- The body containing the transaction history

How to get IDBI Bank Statement?

A customer can get his/her IDBI Bank Statement for any desired time period via the following ways:

| Online | Offline | ||

| IDBI Net Banking | IDBI Mobile Banking | E-statements | Visiting the branch |

IDBI Net Banking

IDBI Bank offers online banking facility, which can be accessed anytime and anywhere with the help of an active internet connection.

One needs to login to the net banking account and get the account statement for any required statement period.

IDBI Mobile Banking

IDBI Mobile Banking allows users to access a wide array of banking facilities from the convenience of their home.

IDBI mPassbook is one such app that can be used by the account holders to access their account statement on their mobile phones. Here are the steps to use mPassbook:

Step 1: Download mPassbook from the Google Play Store or Apple App Store.

Step 2: Enter the Customer ID and the registered mobile number.

Step 3: Enter the 6-digit OTP received on the registered mobile number and click on “Proceed”.

Step 4: As soon as the OTP is validated, set the 4-digit numeric PIN to access the app.

Step 5: Now use the app to get the IDBI Account Statement.

E-statement

As an eco-friendly measure and to promote digital banking, IDBI Bank offers the facility of

E-statements. E-statements are the electronic account statements that are sent via mail to a customer having an account with IDBI Bank.

Hence, accessing IDBI eStatements is convenient, easily accessible and free of cost.

Visiting IDBI Branch

Unlike other banks, IDBI Bank doesn’t offer the facility of sending the bank statements via post to its customers. To promote digital banking, IDBI Bank prefers paperless mode for sending account statements.

In case a customer still wants to avail the IDBI Bank statement via offline mode he/she can contact IDBI customer care.

What are the benefits IDBI Bank Account Statement?

IDBI Bank Statement helps the account holders to keep a track of all the debit and credit transactions happening in the account. With this, account holders can keep a track of his/her account. This can help the account holder to beware of any theft or fraudulent activity. Also, account holders can use a certified IDBI account statement for tax purposes.

FAQs

Q: Who can access IDBI Bank Statement via mPassbook app?

A: Currently, account holders can download IDBI mPassbook app from Google Play Store or Apple App Store. Hence, android users can access IDBI Bank Statement via mPassbook app.

Q: How to register for mPassbook service?

A: “mPassbook” service is pre-activated for all SB/CA/Overdraft/Cash-credit account holders of IDBI Bank. Simply download the mPassbook app and start using it.

Q: How to avail IDBI Mini Statement?

A: One can get the IDBI Mini Statement via an SMS for the last 5 transactions in an account by giving a Missed Call to 18008431133.

About IDBI Bank

Industrial Development Bank of India (IDBI), established in 1964 and headquartered in Mumbai provides various financial and banking services to its customers such as deposit accounts, debit cards, credit cards, loans, investments, etc.