Real Time Gross Settlement (RTGS) is a super fast and hassle-free online money transfer method. While Real Time refers to money transfer taking place to live, “Gross Settlement” refers to the processing of funds on an individual basis and not in hourly slots like that in NEFT. The bank has made RTGS payments simple by enabling a single IOB RTGS form for initiating the payment. An applicant can download the IOB RTGS form from the banking portal as well.

A Good Credit Score can help in getting Loan Approvals Easily

Check Now

How to Fill IOB RTGS Form

The minimum amount which can be transferred through RTGS is Rs 2 lakhs per day; the maximum depends on whether the transaction is made online or through the bank branch.

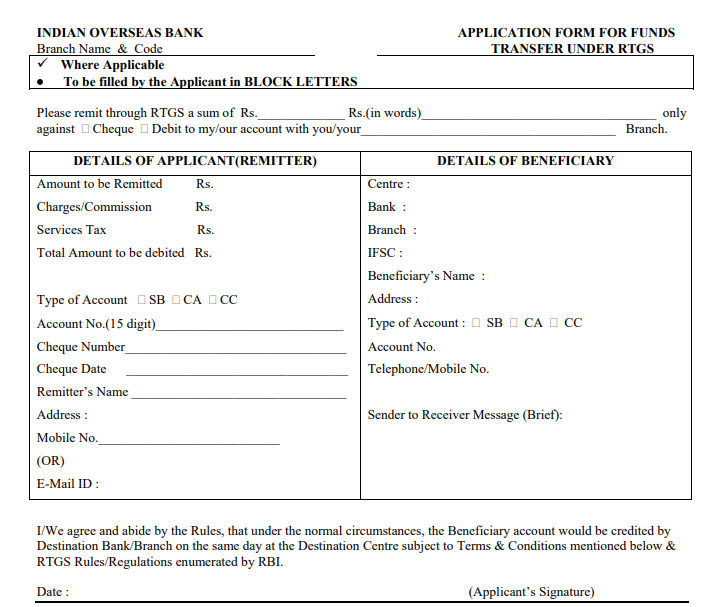

(Image Source: Indian Overseas Bank)

The details which must be filled up in the IOB RTGS form are-

- Amount to be remitted

- The IOB branch name and code

- Additional charges or commission

- The name and contact details (address, mobile number and email id) of the sender

- The beneficiary name, bank and branch address

- The beneficiary account type (savings, current or credit card)

- The beneficiary account number, IFSC code and mobile number

- Whether the remitted amount is to be paid as cash, through cheque or will be debited directly from the bank account

- The cheque number if the amount is paid through cheque/ the account type and account number if the amount is debited from the bank account

- The sender can also send a message in brief to the beneficiary through the IOB RTGS form

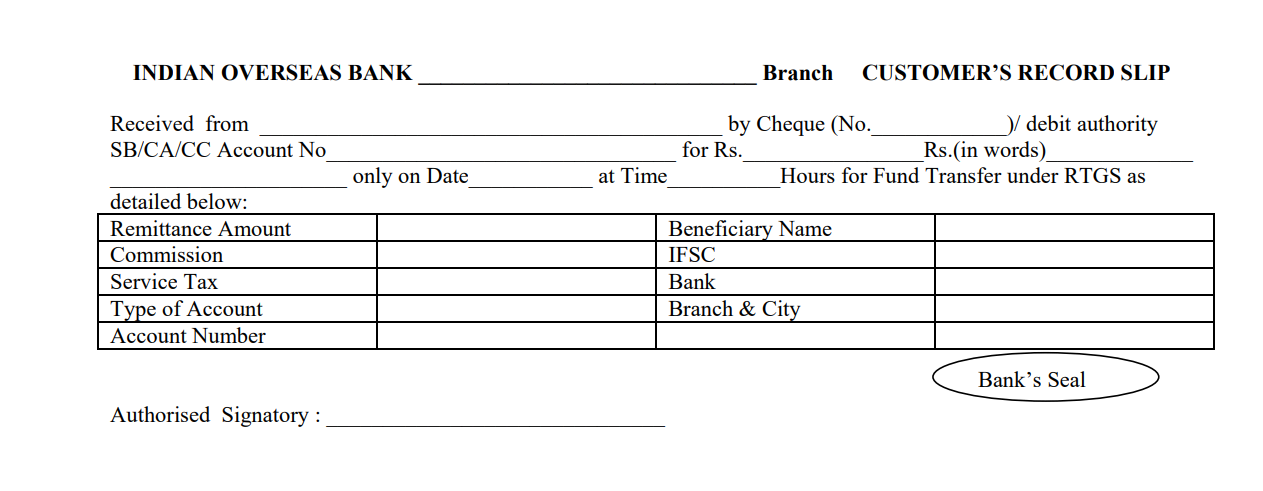

The sender will get an acknowledgement slip after submitting the form and depositing the money. In case there is a delay in the transaction, the sender can complain at the customer service of IOB or even escalate the issue at the grievance cell of Reserve Bank of India.

(Image Source: Indian Overseas Bank)

(Image Source: Indian Overseas Bank)

RTGS is a modern form of electronic money transfer and is directly controlled by the Reserve Bank of India. for this reason, once the payment is successfully made, that is, the amount is deposited in the beneficiary bank account, it cannot be reversed; the settlement takes place right at the book of records of RBI.