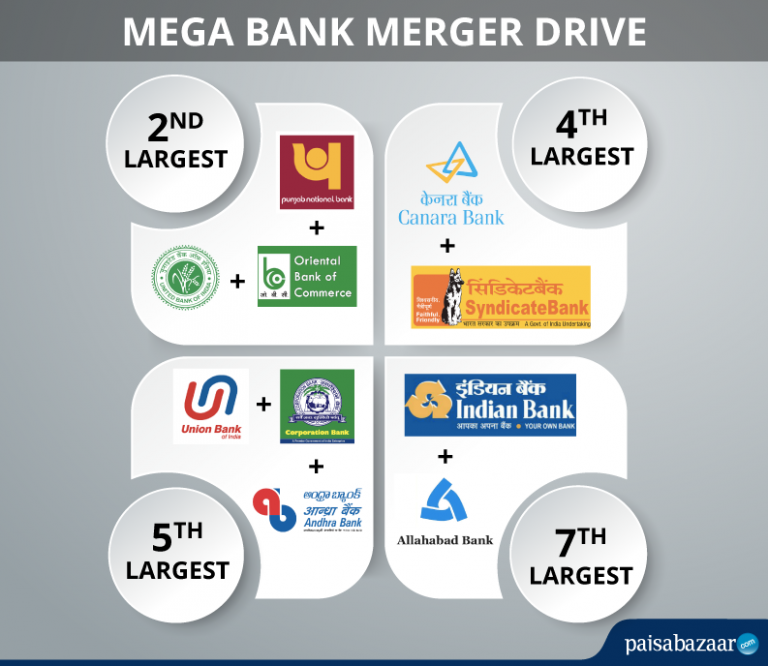

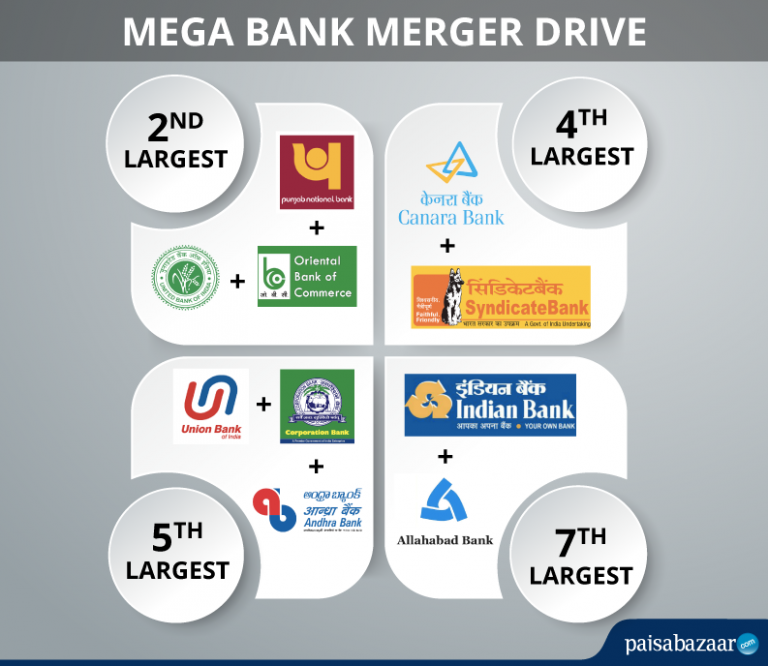

The Union Cabinet approved the merger of 10 public sector banks into 4 entities that have become effective from 1st April 2020. After this merger drive, the number of Public Sector Banks has reduced to 12 which was 27 before 2017.

“The amalgamation is being done so that customers are able to reap the benefit of larger banks being scaled up and more fund being available for credit,” finance minister Nirmala Sitharaman said.

Merger 1

As per the proposal, Punjab National Bank (PNB), Oriental Bank of Commerce (OBC), and United Bank of India are to be merged where PNB will be the anchor bank. This consolidation will make Punjab National Bank as India’s second-largest bank with a business of Rs. 7.95 trillion.

As per regulatory filings, shareholders of the United Bank of India and OBC will get 121 shares and 1,150 shares of PNB respectively for every 1,000 shares of PNB.

Merger 2

Canara Bank will take over Syndicate Bank and the shareholders of Syndicate Bank will get 158 shares for every 1,000 shares of Canara Bank.

Merger 3

Union Bank of India will be merged with Andhra Bank and Corporation Bank.

As per regulatory filings, shareholders of Andhra Bank and Corporation Bank will get 325 and 330 shares respectively for every 1,000 shares of Union Bank of India.

Merger 4

Also, Indian Bank is to be merged with Allahabad Bank. But the merger ratio of these banks has not been disclosed yet.

The merger of banks will provide the existing bank customers with increased access to banking services by about 3,000 branches or more. Moreover, the customers will benefit through investments in technology-enabled smart banking such as faster loan processing, paperless banking, home banking, etc.

Earlier in April 2019, Bank of Baroda (BOB) merged with Dena Bank and Vijaya Bank to become the country’s third-largest lender. Because of this merger, shareholders of Vijaya Bank and Dena Bank got 402 and 110 shares respectively for every 1,000 shares of BOB.

Find out more about Bank of Baroda Merger

In the year 2017, five associate banks and Bharatiya Mahila Bank collated with SBI. The 5 associate banks that merged with SBI are as under:

- State Bank of Bikaner and Jaipur

- State Bank of Patiala

- State Bank of Travancore

- State Bank of Hyderabad

- State Bank of Mysore

How will Banking Services be Impacted?

With the merger of the mega PSU banks, there will be access to a larger number of branches and ATMs across the country. Moreover, the amalgamated banks will offer a wide range of products, credit facilities and the best of banking services. Customers need not panic as most banking services will continue and the amalgamation will affect the customers in a positive way.

Will your Account Details like Account Number, IFSC, MICR, Debit Card, etc. will change?

After the merger of the various Mega Banks in India the present account number, IFSC, MICR code, debit card, etc. will remain the same until any further notification by the parent bank. Accountholders will be able to avail all the banking services on their bank account as before.

Later on, the parent bank is most likely to give its customers a new Account Number and Customer ID just like SBI did after its merger with 5 associate banks.

In the year 2017, SBI merged with 5 associate banks and changed the IFSC and branch names of almost 1300 branches across the country.

Read More: SBI changes IFSC codes, names of 1,295 branches

Should you Request for a New Cheque Book/Passbook?

There is no need to request a new Cheque Book/Passbook until any further notice by the parent bank. Customers can use the existing Cheque Book/Passbook after the merger as of now.

What will happen to the Loan Accounts?

Loan accounts will operate without any interference to the account holder. Moreover, there is no need to submit any kind of loan documents post-merger. Certain statutory documents would be needed if not submitted formerly.

After the merger, the terms and conditions along with rates of the banks merged may be linked with the terms and conditions of the parent bank and any changes taking place would be communicated to the customers accordingly.

Will your FD Rates change or remain the same?

Existing FD rates offered by a bank (merging bank/parent bank) will remain the same until its maturity. After the maturity of an FD, the renewal will be done on the basis of the new term deposit rates offered by the amalgamated bank.

What will happen to the Netbanking and Mobile Banking services of merged banks?

There will be no disturbance in the functioning of Netbanking and Mobile Banking services after the merger of the banks. The amalgamated bank will provide its customers with the best features of internet and mobile banking services.

Will your credit cards get closed or you will need new cards?

The credit card of the parent bank and the merged bank will be functional till the expiry date printed on the credit card. The credit card offered by the parent bank has to be renewed whereas customers having the credit card of merged bank will have to visit the parent bank to get a fresh credit card. The new credit card will be loaded with new offers and features.

Should you get new Demat Accounts opened?

There is no need to get a new Demat Account as the previous Demat Account will be functional until any further notice by the amalgamated bank.

Will there be any cash withdrawal or deposit restrictions?

No cash withdrawal or deposit restrictions will be imposed post amalgamation of banks. Any fee charged by the bank before the merger will continue to be levied post-merger as well.

What will happen to ATM transactions?

Customers of merged banks will be able to access the parent bank’s ATM and vice versa without any added charges. However, there is a limit of three financial transactions per day set on the merged banks. But these charges have been waived off till 30th June 2020 in view of the COVID-19 pandemic.

Will bank branches be closed or merged?

There will be no branch closure in any of the banks post-amalgamation. Bank branches of the merging banks located nearby may shift or merge on prior notice by the bank.

Bottom Line

Bank mergers in the past have showcased that accountholders need not panic as it is for the overall benefits of all stakeholders. If you have a bank account in any of the banks that are going to be merged with a larger bank, you need not worry as you will continue getting the facilities as before. However, there may be minor changes in the IFSC Codes and other codes. Any changes done with your account or the branch would also be duly communicated to you through emails, letters, and SMS.