RTGS or Real-time gross settlement is one of the most convenient forms of fund remittances offered by any bank in India. This kind of transaction can be initiated directly from your computer with the help of net-banking, or you could directly make use of the bank’s facilities to make an RTGS payment. The PNB RTGS form works just like any other kind of RTGS payment. Furthermore, it must be kept in mind that RBI manages all the RTGS payments in the country and keeps an eye out on each bank to implement an efficient working system.

Get Free Credit Report with monthly updates. Check Now

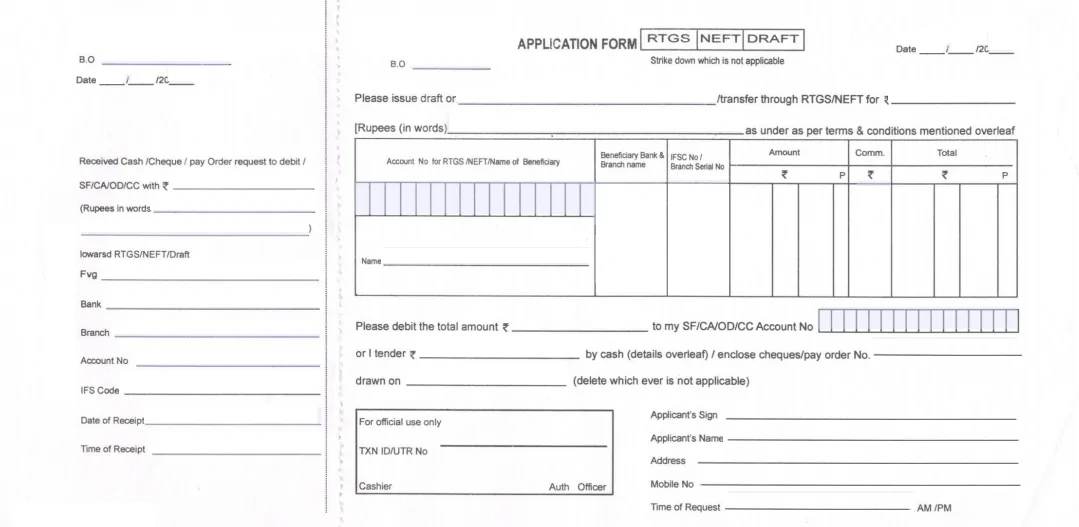

PNB RTGS Form

The RTGS form for every bank is pretty much similar and requires the same details to be filled out.

Here is how you can fill out an RTGS form at PNB:

Here is how you can fill out an RTGS form at PNB:

- You should have your account details and also of the beneficiary ready with you when filling the PNB RTGS Form

- You should have the IFSC and bank details of the beneficiary account as well

- You need to take a cheque leaf and fill out all the details on the back side of the cheque including beneficiary name, account details, IFSC, etc. On the front of the cheque you need to fill out “Oneself” for RTGS to xxxxx (name of beneficiary) and the amount.”

- Write the date of the transaction on the form

- Next, add the amount of the transaction, you will need to write this in numerical form as well as in words

- Add your account details and the details of your beneficiary’s account

- Once that is done, make sure that you have added the cheque details correctly or not. Also, mention the correct cheque date as well as cheque’s serial number

Things to Keep in Mind while Filling PNB RTGS Form

Since all the RTGS payments are final, you should make sure that:

- The details filled by you are correct

- You should cross-check the details on the form

- You should input the correct amount to be paid

- Keep in mind that your form has the correct signatures

- Also, write all the numbers in clear handwriting

Get Free Credit Report with monthly updates. Check Now

About RTGS

There are three aspects to an RTGS payment:

- The payments work on a real-time basis. This type of payment does not need the person to wait for the payment to be processed.

- Apart from this, the money is transferred on a one-on-one basis; the payment is not netted or bundled.

- The RTGS payment of any kind is final and irrevocable.

The RBI and the banks maintain all details of the RTGS payments. It must be remembered that RTGS payments cannot be initiated for payments below Rs 2,00,000. The service charges for PNB RTGS are as follows:

| Payment System | Revised Charges | |

|---|---|---|

| REAL-TIME GROSS SETTLEMENT SYSTEM (RTGS) | ||

| Inward Transactions | Free | |

| Outward Transactions | ||

| Transaction Value | From Branch | From IBS/ MBS |

| Rs. 2 lakh to 5 lakh | Rs.20.00 + GST | NIL |

| Above Rs. 5 lakh | Rs.40.00 + GST | |

Invest in FD & Get Lifetime FREE Step UP Credit Card

An Excellent Option to Build your Credit Score