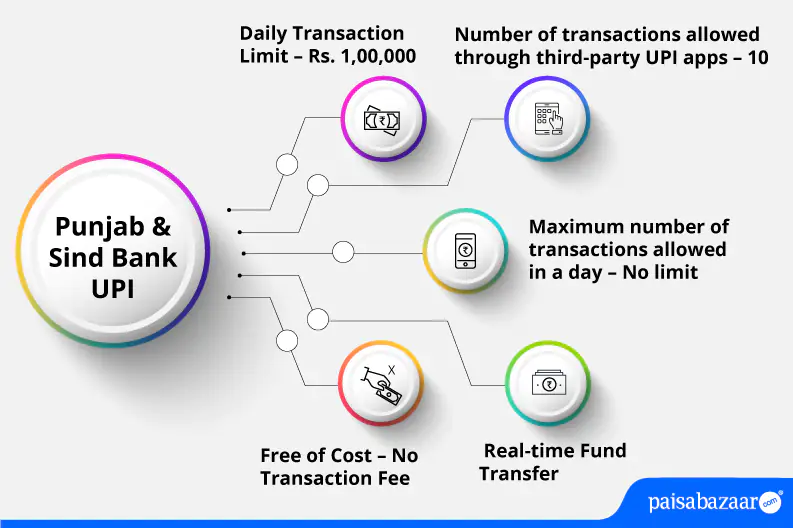

UPI (Unified Payments Interface) allows customers to transfer funds without facing any hassle. It is a quick way of sending and receiving money. Developed by NPCI, the facility is free of cost and allows customers to link their multiple bank accounts in one place or in one application. Punjab and Sind Bank UPI facility allows accountholders to use this facility using the bank’s app and other third-party apps. Customers of Punjab & Sind Bank can do UPI transactions through PSB UNIC BHIM app. Let us know more about this facility in detail.