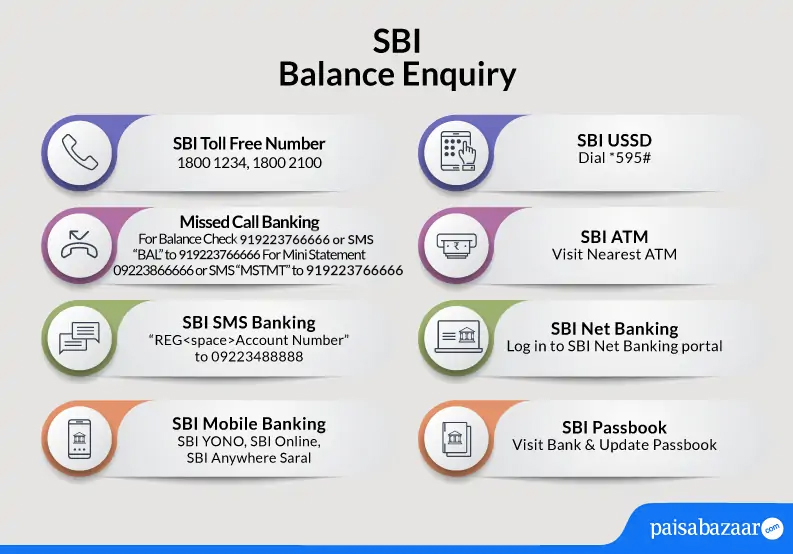

Savings account customers of State Bank of India (SBI) can check their account balance to stay updated with the money in their bank account. For this, they don’t have to visit the bank every time to get account balance details. SBI balance check can be performed using toll-free number, SMS, missed call, USSD, mobile banking, passbook or by visiting the ATM. Let us find out the respective SBI balance check number for every method.

59 Comments

Check tha statement for October and November month

You can download the account statement online through SBI YONO app or through SBI netbanking.

I forgot my account password

You can reset your password through the netbanking portal.

Me apne account number bhul gaya hu

Aapka account number bank passbook mein mentioned hota hai. Aap apna account number mobile banking ya SBI YONO app se bhi jaan sakte hain.

SBI balance check number

You can use the SBI balance check numbers mentioned in the article to get information about your account balance.

how to check sbi bank balance?

To know your SBI account balance, customers of SBI can call on the bank’s toll-free number 1800 1234 from their registered mobile number.