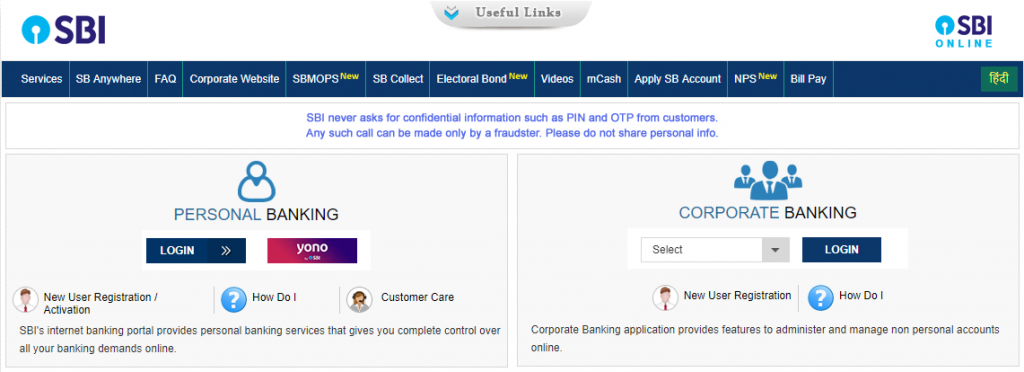

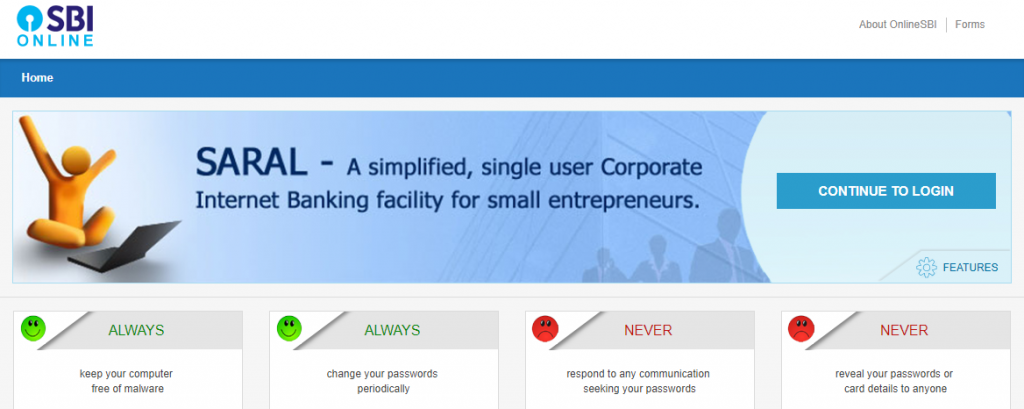

Corporate Banking, commonly referred to as business banking, is all about providing companies with a range of tailored banking services such as loans to help them run their daily operations. Corporate bankers often call themselves ‘Relationship Mangers’ (RMs) because they are tasked with growing client relationships over the long-term rather than focusing on a single deal.