Net banking or online banking enables one to manage money online using mobile devices, tablets or computers. South Indian Bank allows users to carry out net banking activities through ‘SIBerNet’ which is the South Indian Bank Internet Banking Service. An account holder has to go for South Indian Bank net banking login to avail this facility.

Features of SIBerNet

- SIBerNet is available for 24 hours a day and 365 days a year.

- Using the internet, it helps customers to access their account from any place in the world.

- SIBerNet can also be used to pay bills, insurances, mutual funds investments, etc.

- Full account details can be obtained through this facility.

South Indian Bank Net Banking Services

- Inquiries

- Funds Transfer

- Requests

- Message centre: One can send messages to the Relationship Manager and receive quick reply from him.

- Alerts

- For easy identification, the customer can customize their accounts.

- One can change the amount and date format according to choice.

- The customer can make investment/credit decisions on the basis of deposit/credit models.

- One can avail different security features through SIBerNet.

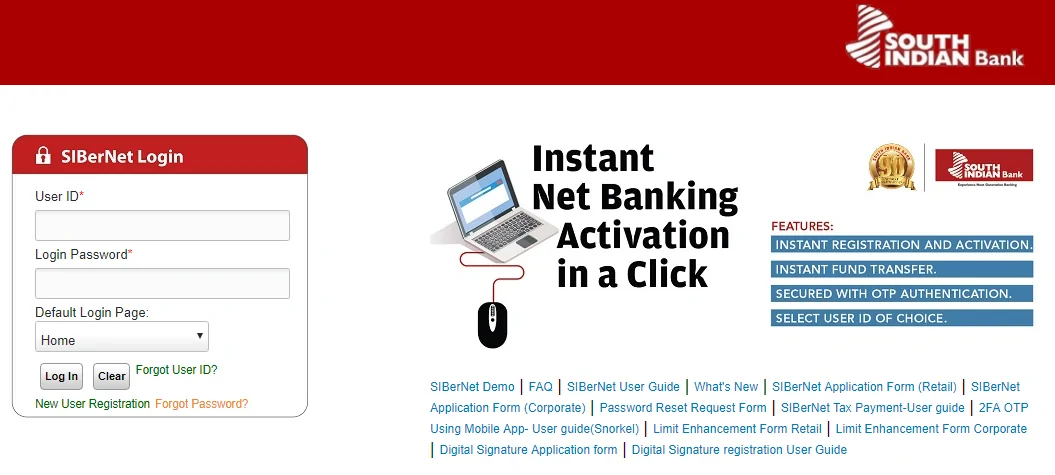

How to Login to South Indian Bank Net Banking

- Go to SIB Net Banking Login page at https://sibernet.southindianbank.com/corp/AuthenticationController?FORMSGROUP_ID__=AuthenticationFG&__START_TRAN_FLAG__=Y&FG_BUTTONS__=LOAD&ACTION.LOAD=Y&AuthenticationFG.LOGIN_FLAG=1&BANK_ID=059

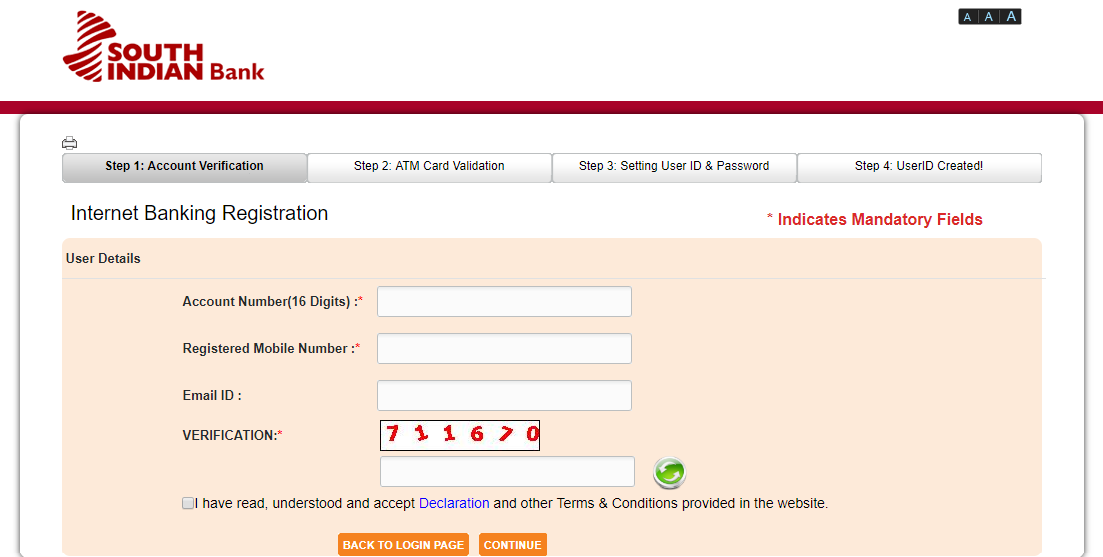

- Click on “New User Registration”

- Enter 16-digit account number, registered mobile number and email ID. Tick the declaration and click on the “Continue” button.

- Enter the OTP sent to the registered mobile number and click on Continue

- Enter ATM card details of the account and click on Continue

- Enter the User ID, login password and transaction password to complete instant net banking registration and activation process

- Then login to SIB Net Banking using your user ID and password

South Indian Bank Net Banking Login for Corporate Entities

Corporations can apply to various officials responsible for operating in bank accounts for the Internet Banking facility. Companies can also restrict account access to different users according to their requirements. Through internet banking, companies may also be issued on SIBerNet with a view only on request.

South Indian Bank Net Banking Transaction Limit

Corporate customers can increase their daily transfer limit on request. By default, customers in companies have the default transfer limit as follows:

| Transaction Type | Daily Default Limit-Corporate Customers |

| Self-Fund Transfer | Rs. 25 Lakhs |

| Third Party Fund Transfer | Rs. 15 Lakhs |

| External Fund Transfer | Rs. 15 Lakhs |

| IMPS Fund Transfer | Rs. 2 Lakhs in P2A |

Benefits of SIBerNet

- Online bill payment enables customers to securely pay for all goods/services in real time through Internet banking.

- GST payment facility in SIBerNet is available.

- All Internet Banking customers and corporate clients can make 24 x 7 transfers of other bank funds even on bank holidays through the IMPS offered through Internet Banking.

- South Indian Bank has established a direct link with IRCTC through Internet banking for railway ticket booking facilities.

- The South Indian Bank has a direct connection to KSEB (Kerala State Electricity Board) to pay electricity bills online via Net Banking. There is no additional fee (payment gateway charges) required to pay online KSEB bills.

2FA (Second Factor Authentication) for enhanced SIBerNet Security

- 2FA allows users to transact online as securely as possible.

- It is a security process where the system prompts the user to enter a one-time password OTP dynamically generated.

- This is a worldwide practice that guarantees maximum security for Internet Banking transactions.

- OTP is mandatory for financial transactions such as the transfer of third-party funds / NEFT and RTGS transfers above Rs. 2,000/-or if the transfer of third-party funds exceeds Rs. 10,000/- or if the transfer of external funds exceeds Rs. 5,000/- daily.

- All online bill payments / e-commerce transactions require OTP.

Immediate Payment Service IMPS Fund Transfer Facility

Immediate Payment Service (IMPS) is an electronic money transfer service provided by the Indian National Payments Corporation (NPCI) 24 x 7 instantly. All internet banking customers and corporate customers can make 24 x 7 bank transfers even on bank holidays through the IMPS facility offered by Internet Banking on South Indian Bank. As with the personalized transfer limit for NEFT/RTGS transactions, customers can reduce their IMPS transfer limit via internet banking by using the option customize transaction limit provided under other services.