In India, Standard Chartered Bank has launched its Standard Chartered mobile banking app previously known as ‘Breeze’. SC Mobile – the official Standard Chartered Bank Mobile Banking app provides a simple and quick way to control the finances. Account holders can access banking services like account summary, fund transfer, cheque book request, and much more on-the-go.

What are the services offered by Standard Chartered Mobile Banking Apps?

| Services offered by Standard Chartered Bank Mobile Banking Apps | ||

| Account Balance enquiry | Money transfer to any bank | Unlimited fund transfers without fees |

| Payment of credit card bills of any bank | Mobile recharge | DTH payment or recharge |

| Payment of mediclaim premiums | Viewing transaction history | Payment of utility bills |

| Money transfer without a beneficiary | BHIM and UPI services | Changing Debit or Credit Card PINs |

| Requesting cheque book | Blocking Debit or Credit Cards | Replacing Debit or Credit Cards |

| Downloading e-statements | Updating profile | Tracking of online requests |

What are different types of Standard Chartered Mobile Banking Apps?

| Mobile Banking Apps | Primary Features |

| Standard Chartered Mobile Banking App (Breeze) |

|

| SC Edge |

|

| SC Private Bank |

|

Standard Chartered Mobile Banking App (Breeze)

Gives users the power to transfer funds, pay bills and check account balance on-the-go.

| Standard Chartered Mobile Banking App (Breeze) | Features |

| Welcome screen features | Access balance across accounts/cards/loans without logging in |

| Fund Transfer | Transfer money to third-party accounts or to own accounts via IBFT (NEFT/RTGS/IMPS/UPI), VMT and One-time Transfer (OTT) |

| Online investments and savings | Invest in recurring deposits (RD) and Online Mutual Funds |

| Convenient payments | Make instant credit card and bill payments, recharge mobile and set standing instructions |

SC Edge

With SC Edge make travel bookings, pay bills, recharge, order food as well as check out the latest offers on StanChart cards.

| SC Edge | Features |

| Expense Manager | Keep a track of all spends with the Expense Manager feature |

| Services | Pay bills, recharge, order food etc. |

SC Private Bank

Earlier known as Portfolio View & Messaging, SC Private Bank App gives users the ease of navigation over their financial information.

| SC Private Bank | Features |

| Enquiry | View your portfolio and summary in interactive dashboard designs |

| Language | Access the application in English, Simplified Chinese or Traditional Chinese |

| eStatement | Avail eStatement on-the-go using SC Private Bank app |

How to register for Standard Chartered Mobile Banking App?

Following are the steps through which one can register for Standard Chartered Mobile Banking App –

Download and install the application from the Apple App Store or Google Play Store for iOS and Android devices respectively.

To Register through Temporary ID and Passcode

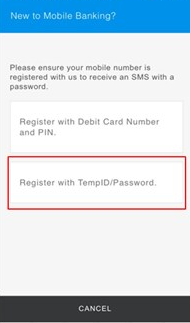

Step 1: Open the SC Mobile app – official Standard Chartered Mobile Banking app.

Step 2: Click on “Register” in login page of Mobile Banking app.

Step 3: Click on “Register with Temporary ID/Password”.

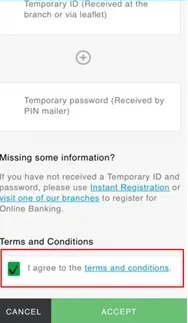

Step 4: Click on “Accept” option after checking “I agree to the Terms and Conditions”.

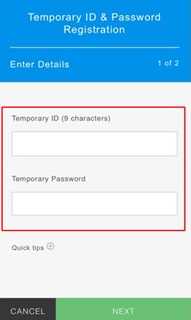

Step 5: Enter the customer relationship number (as temporary ID) and the password available in the welcome kit, click “Next” to confirm.

Step 6: Setup the username and password and then click “Next”.

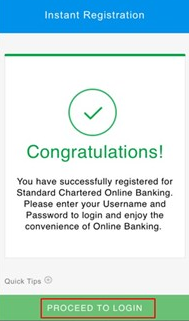

Step 7: Click “Proceed to Login” to enter Online Banking.

Immediate Registration

Step 1: Open the SC Mobile app.

Step 2: Click on “Register”.

Step 3: Click on “Register with Debit Card Number and PIN “.

Step 4: Enter the debit card details to proceed.

Step 5: Follow the steps to proceed further and the registration procedure will be completed.

How to use Standard Chartered Mobile Banking App?

Standard Chartered Mobile Banking App is very easy to use. Following are some of the options that are given in the app –

- On the welcome screen, click on “Login”.

- Enter the username and password to login Standard Chartered Bank Mobile Banking app.

- Click on the account mentioned on the next screen to check Standard Chartered Bank account balance.

- On the welcome screen, there are two widgets called balances and transactions.

- To make fund transfer, account holders can click on “Transfer” from the menu.

- Click on “Payments” to make Standard Chartered Bank Credit Card Bill Payment and other bill payments as well.

- To invest, account holders can click on “Investing” from the menu to invest in mutual funds, recurring deposits. Account holders can also check their investment profile within the SC Mobile app.

- Other than the above mentioned options, account holders can update their profile details and check credit card reviews as well.

What are the features of Standard Chartered Mobile Banking Apps?

Following are some of the main features of the Standard Chartered Bank Mobile App:

- Welcome screen

One will be able to check the account balance and transaction history of the past 30 days without having to log in.

- Easy transferring of funds

Transfer money to any account in any bank via NEFT, RTGS, UPI, IMPS, OTT (one-time transfer) and VMT in just a click. It allows one to check schedule transfers and history of the transfer.

- Login via fingerprint

Customers can login to their account by setting a fingerprint password to make their account safe.

- Flexible payments

Customers can pay their credit card bills and other utility bills and recharge their mobiles with only a few clicks. Customers can also set standing instructions. With Bharat QR, one can make merchant payments (by scanning QR code).

- Online savings and investments

Investing funds in recurring deposits (RD) and fixed deposits (FD) and mutual funds or SIPs is possible through the app. The app makes it easier and simpler to manage investment profiles.

- Other services

Customers can update their profile (Email ID, PAN card details, Aadhaar Card details, etc.) very easily, request for a new cheque book, change Debit and Credit Card PINs, block lost or stolen Debit or Credit Card, track card rewards without paying a visit to the branch.

Advantages of Standard Chartered Mobile Banking Apps

- Customers can get all the banking operations, details and transactions on their

- 24 hours operational so that one can operate it whenever and wherever needed

- Safe and convenient to use

- Accounts can be managed easily

- Saves time as customers don’t have to go to the branch

Frequently Asked Questions (FAQs)

Q. What is Breeze?

A. Standard Chartered Mobile Banking app – SC Mobile was previously known as ‘’Breeze’’. Currently, the official Standard Chartered Mobile Banking app is available on Google Play Store and Apple App Store by the name of SC Mobile.

Q. How to carry out fund transfer in Mobile banking?

A. Login Standard Chartered Mobile Banking app, click on “Transfers” and select One Time Transfer for a single transaction or first transaction to a payee. Alternatively, account holder can select “Transfer to my Payees” to make fund transfer to one of the payees already added to the list.

If account holder wants to add a new payee, he / she will be required to click on “Transfer” and then “Add a New Payee”.

Q. Are there any charges to use SC Mobile app?

A. No. There are no charges levied to use mobile banking of Standard Chartered Bank.

Q. Is it safe to use SC Mobile app?

A. Yes. All the mobile banking apps provided by Standard Chartered Bank are quite safe and secure.