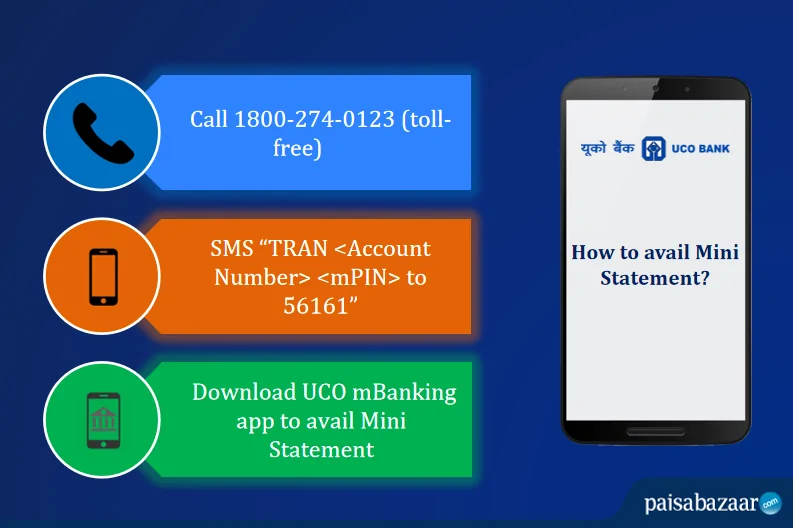

UCO Bank is one of the largest government-owned commercial banks in India. The bank has come up with advanced and simplified banking services to provide quick banking access to all its customers. To ensure that customers are able to view the transaction history of their account whenever they need to, UCO Bank has also provided several easy options to get the UCO Bank Mini Statement.