RTGS or Real Time Gross Settlement is the most popular electronic money transfer mode in India when it comes to high volume money transfers. This system is directly controlled by the Reserve Bank of India (RBI). For this reason, once the payment gets settled in the book of records of the Reserve Bank, the same cannot be reversed. UCO bank offers its customers the option to perform RTGS transaction both online and at the bank branch. The remitter has to fill the UCO Bank RTGS form to avail this facility.

How to Fill UCO Bank RTGS Form

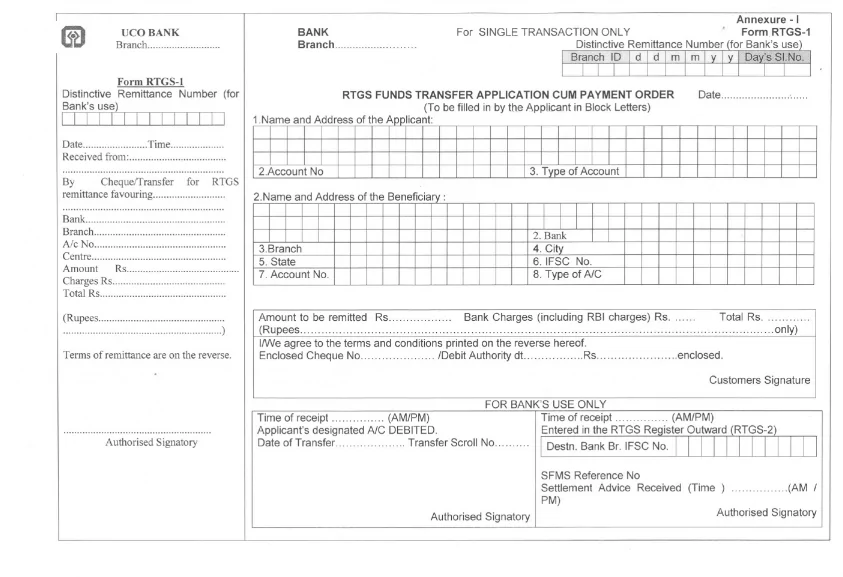

In order to initiate the RTGS transaction, the applicant has to provide the below-mentioned details in the UCO Bank RTGS form.

- Name and address of the remitter.

- Name and address of the beneficiary.

- Bank account number and type of account of the remitter.

- Bank account number, IFSC code, branch address and type of account of the beneficiary.

- Amount to be remitted, cheque number and bank charges (along with RBI charges).

The UCO Bank RTGS Form is a combined RTGS form and payment order. This makes it easy for the applicant to make payment through RTGS. The form is available in both English and Hindi. Applicants can download and print the form directly from the bank website. They can also fill the form online and make the RTGS payment through net banking or mobile banking.

Points to Remember while Filling UCO Bank RTGS Form

In order to carry out RTGS payment, the bank requires the applicants to keep the following points in mind:

- Until and unless the bank provides the customer with the counterfoil (acknowledgement slip) of the RTGS transaction, the bank is not bounded by the payment order.

- If the amount is successfully deposited in the payee’s bank account, the same cannot be revoked.

- The payer must ensure that the details mentioned in the form are correct. The bank will not be liable for the consequences which arise because of erroneous information in the form.

- If the RTGS amount is supposed to be debited from the payer’s bank account, then the payer must ensure that there is sufficient balance in it. If not, he/ she will be liable to pay the bank the amount which should have been debited along with the applicable charges.

- If system error or loss of connectivity leads to delay in the transaction, the bank cannot be held responsible for the same.

- If the RTGS transfer is made after the working hours, the same will be processed on the next working day.

The UCO Bank RTGS form is available both in English and Hindi. The bank permits RTGS above Rs 2 lakhs; there is no upper ceiling. As per RBI guidelines, in RTGS transaction, the money must be deposited in the beneficiary account within 30 minutes. If for some reason, the transaction cannot be processed, the money must be returned to the sender’s account within 2 hours.

UCO bank charges nominal fees for processing outward RTGS transactions. So in case account holders need to make any urgent payment of high volume, they just need to fill the UCO Bank RTGS form and deposit the cash.