Developed by NPCI, the Unified Payments Interface (UPI) facility lets users make real-time fund transfers and has eliminated the need to carry cash wherever you go. Making small transactions has also become feasible for individuals. The application is used on mobile devices and funds can be immediately transferred. One can avail this facility using the third-party UPI apps. Let us know more in detail below.

Ujjivan Small Finance Bank UPI

Customers of Ujjivan Small Finance Bank can transfer funds through UPI in real-time. They can link their savings account or current account with UPI and avail UPI services just by creating a VPA or Virtual Payment Address.

Also Read: Unified Payments Interface

Features of Ujjivan Small Finance Bank UPI

Ujjivan Small Finance Bank UPI offers the below-mentioned features:

- Funds can be availed immediately

- A single application for accessing different bank accounts through UPI

- Transactions done through UPI are safe and secure

- No charges levied to make UPI transactions

- Make payments to merchants instantly through the QR code

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Ujjivan Small Finance Bank UPI

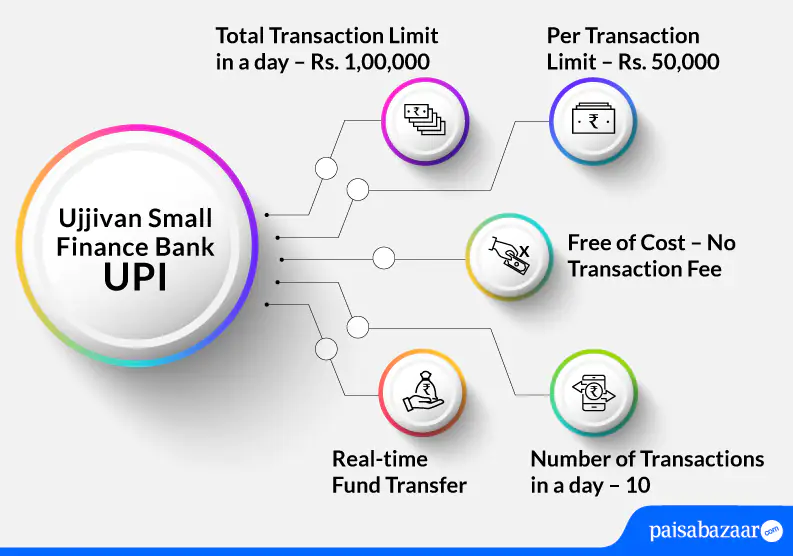

| Type of Transaction | Transaction Limit |

| Per transaction limit | Rs. 50,000 |

| Per day total transaction limit | Rs. 1,00,000 |

| Number of transactions allowed in a day per account | 10 |

| Maximum amount per transaction for a first-time user | Rs. 5,000 |

| Minimum amount per transaction | Rs. 1 |

| Note: It is to be noted that the limit of 10 transactions in a day is only applicable for fund transfers and does not include transactions for bill payments and merchant transactions.Users who change their mobile number, sim card, or device can transact up to Rs. 5,000 in a day for the first 24 hours. |

How to Register and Link your Account for Ujjivan Small Finance Bank UPI

Customers of Ujjivan Small Finance Bank can use BHIM app to avail UPI services. However, customers can also download and install BHIM to avail UPI services. The below-mentioned steps explain how customers can use BHIM to make UPI payments:

Step 1: Download and install BHIM UPI app from Google Play Store or Apple Store.

Step 2: Open the app and choose your preferred language.

Step 3: Tap on ‘Proceed’ on the next page.

Step 4: Verify your mobile number. Enter the passcode and confirm the passcode.

Step 5: Choose your bank account from the provided options. Select your account.

Step 6: Set your UPI PIN by providing last 6-digits of your ATM card and its validity.

Step 7: Enter the OTP received on your number. Enter the new UPI PIN and confirm the set UPI PIN.

Step 8: On the dashboard, tap on ‘Profile’ and make your new UPI ID.

Step 9: On the next page, enter your preferred UPI ID and tap on ‘Submit’.

Step 10: You can now send and receive money through BHIM UPI.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Send Money using BHIM UPI App

Ujjivan Small Finance Bank savings account holders can use the BHIM UPI app to send money through UPI. The below-mentioned steps explain how one can use BHIM UPI to send money:

Step 1: Open the app by entering your set passcode.

Step 2: Tap on ‘Send’ option on the home screen.

Step 3: On the next screen, enter the UPI ID or the number of the receiver and tap on verify.

Step 4: The details of the receiver will be fetched automatically. On the next page, verify the details and add the amount that needs to be transferred. Tap on ‘Confirm’.

Step 5: Verify the details and tap on ‘Send’.

Step 6: Money will be sent successfully.

How to Receive Money using BHIM UPI App

Individuals can refer to different ways of receiving money through BHIM UPI such as by using VPA, mobile number and QR code. The below-mentioned steps explain how customers can receive money through mobile number:

Step 1: Open BHIM UPI app and enter the passcode.

Step 2: On the home screen of the app, tap on ‘Receive Money’.

Step 3: Add the mobile number of the payer and tap on verify to check the name of the payer.

Step 4: Once the details of the payer are reflected on the screen, enter the amount and remarks.

Step 5: A confirmation of the request will be sent to you.

Step 6: Collect money request will be sent to the payer and you will receive a notification once the payer accepts your request.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

Ujjivan Small Finance Bank UPI Customer Care

If the customer has any issues regarding UPI services through mobile banking, he/she can call the bank at 1800 208 2121 or drop an email to the bank at customercare@ujjivan.com.

Also Read: Ujjivan Small Finance Bank Customer Care

Ujjivan Small Finance Bank UPI FAQs

Q. Can I have multiple VPAs for doing UPI transactions in Ujjivan Small Finance Bank?

Ans. Yes. You can have multiple VPAs for doing UPI transactions.

Q. While doing my UPI transaction, I entered the wrong PIN multiple times and my transaction got failed. Now, I am unable to do UPI transactions. What do I do?

Ans. If you enter the wrong UPI PIN while doing transactions, the bank will block your UPI transactions for a while and you will have to try doing the transaction after sometime.

Q. Is it possible to link more than one bank account to the same virtual address?

Ans. Yes. You can link more than one bank account to the same VPA.

Q. I changed my mobile carrier recently. Will I have to register again for UPI services?

Ans. There is no need to register again for UPI if you have changed your mobile carrier.

Q. While doing my UPI transaction, the transaction got failed and money was debited from my account. When will I get the money back?

Ans. In such a case, your money will be refunded to your bank account. However, in case of any failure, you may contact customer support of Ujjivan Small Finance Bank.