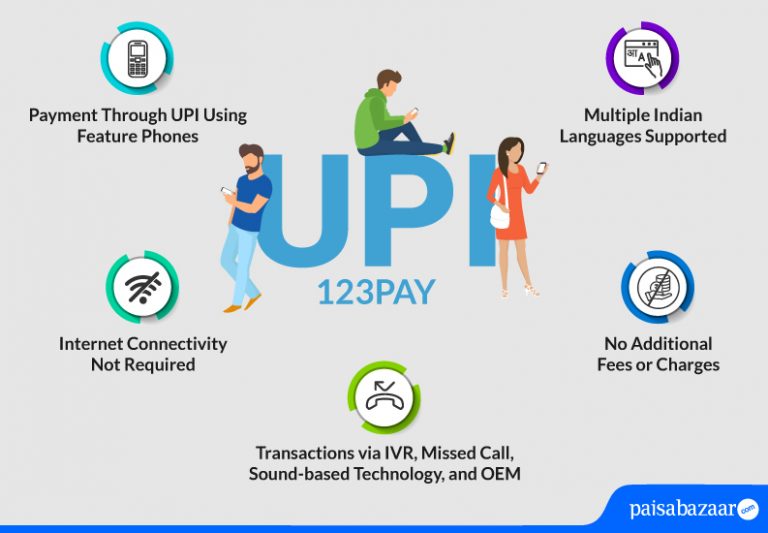

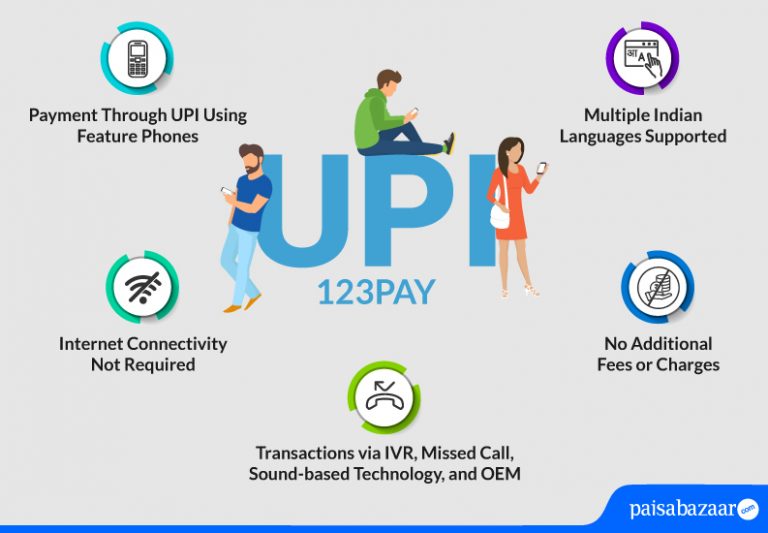

Unified Payment Interface is a single platform for accessing different bank accounts for making or requesting payments. It is an immediate money transfer service that lets users do transactions round the clock 24×7 and 365 days. This service was earlier limited to smartphones that needed internet connection. RBI in association with NPCI has launched the UPI 123Pay which will allow customers to do digital transactions without having an internet connection. It is especially launched for feature phone users. Let us know further about this service.

What is UPI 123Pay

UPI 123Pay is a newly launched instant payment system which will allow users to make UPI transactions without an internet connection. The feature is expected to benefit 40 crore feature phone users which will increase financial inclusion for rural areas of the country. With the world becoming digitalised, it is imperative to make the population of the country digital friendly. Post COVID era, there has been a jump in digital transaction. NPCI has given the slogan – Click karo, Pay karo.

The new 123Pay is different from the traditional UPI service. Earlier, one needed to have at least a smartphone and an active internet connection to carry out a UPI transaction. This limited the extent of UPI transactions to people who are proficient in using smartphones. It is noteworthy that still most of the people in India use feature phones and providing a payment service that will help adding these users in the ecosystem will be beneficial for all.

How to do UPI 123Pay

Transactions through UPI 123Pay can be done through IVR, missed call, sound-based and OEM-supported. Let us find out how we can do it step by step below:

UPI Payment through Pre-defined IVR Number

Under this payment, users are required to make a secured call from their feature phone on 080 4516 3666 & 080 4516 3581 & 6366 200 200 to start making financial transactions without internet connection. With the IVR providing multiple language options, customers can avail the service in their preferred language. IDFC First Bank, City Union Bank, & NSDL Payments Bank have gone live on IVR payments.

Below mentioned are the steps to know the process better:

Step 1: Dial IVR number from your feature phone

Step 2: As you proceed on the call, profile is created for the first-time user

Step 3: Mention the name of the bank for list account activity

Step 4: UPI ID will be assigned to you in the format mobile.voice@psp

Step 5: Set the UPI PIN by entering debit card details and OTP received

Step 6: Create a UPI number which will be used for sending/receiving payments

Step 7: The registration is successful, you can make transactions henceforth

UPI Payment through Missed Call

This method will allow users to do transactions and pay bills just by giving a missed call on the number displayed at the merchant’s place. Users will receive a call to authenticate the transaction by entering UPI PIN in order to complete the transaction once they give a missed call on the number displayed at the merchant’s place.

Below mentioned are the steps to set your UPI 123Pay account:

Step 1: Enter your postal pin code

Step 2: Select your preferred language

Step 3: Speak your preferred name which you want to listen

Step 4: Speak your bank name

Step 5: Enter your 6-digit debit card number

Step 6: Enter the debit card’s expiry month and year

Step 7: Enter the debit card’s PIN

Step 8: Enter bank OTP which you receive

Step 9: Enter new UPI PIN

Step 10: Confirm the new UPI PIN

Step 11: The registration is successful

UPI Payment through Functionality Implemented by OEM

In this type of method, an app will be installed on the feature phone which will allow customers to use various UPI functions except scan and pay feature. The interested partners will have to tie up with the feature phone mobile manufacturer to enable a native payment app.

Below mentioned are the steps to know the process better:

Step 1: Open the UPI app on your feature phone

Step 2: Enter the phone number

Step 3: Select your bank

Step 4: Select your account

Step 5: Enter the OTP that you have received

Step 6: Create UPI ID

Step 7: Set the UPI PIN

Step 8: UPI ID is created and the registration is successful

UPI Payment through Sound-based Technology

The feature will allow users to do transactions verbally. The solution has been created in collaboration with Tonetag and is supported by NSDL Payments Bank. The technology uses sound waves, to enable offline communication on any device and make transactions.

Below mentioned are the steps to know the process better:

Step 1: Dial IVR number from your feature phone

Step 2: As you proceed on the call, a profile is created for the first-time user

Step 3: Mention the name of the bank for list account activity

Step 4: UPI ID will be assigned to you in the format mobile.voice@psp

Step 5: Set the UPI PIN by entering debit card details and OTP received

Step 6: Create a UPI number which will be used for sending/receiving payments

Step 7: The registration is successful, you can make transactions henceforth.

Why is UPI 123Pay Introduced

UPI 123Pay has been introduced for users having feature phones to do transactions from their phone. It will ease out making digital transactions for rural areas majorly since you do not require a smartphone for the same. Digitalization has already revolutionised how we live our lives. Making transactions digitally is likely to become the norm. Hence, this facility will provide all feature phone users to do transactions digitally.

Important Points related to UPI 123Pay

- An instant pay facility for feature phones

- A feature launched for people who cannot afford a smartphone

- Doesn’t require internet connectivity

- Is a three-step process-call, choose and pay

- Users are required to link their bank accounts with their feature phone

- The service can be accessed in various Indian languages

- All the facilities of UPI are available except scan and pay feature

- Will give a boost to digital inclusion

FAQs

Q. Do I need a smartphone for a UPI payment?

Ans. NPCI has developed UPI 123Pay which will allow users to do payments on a feature or smartphone without having an internet connection.

Q. How can I transfer money without internet connection?

Ans. You can transfer money without having an internet connection via UPI 123Pay.

Q. How to authorize UPI 123Pay transaction with UPI PIN?

Ans. At the time of registration, you create a PIN of 4-6 digits. You will have to enter that UPI PIN to authorise all bank transactions. (Banks issued MPIN is different from UPI PIN, please don’t share your UPI PIN with anyone.)

Q. What will happen if I enter wrong UPI PIN for authorizing UPI 123 Pay?

Ans. If you enter the wrong PIN, the transaction will fail. If the wrong PIN is entered multiple times, the bank may temporarily block sending money using UPI option from account.

Q. Can I send money to any UPI user or I will be able to send money to users on feature phone?

Ans. Once you register yourself on UPI service, you will become a part of UPI system. You will be able to send money to anyone from your feature phone to another feature phone or a smartphone.

Q. Can I make payments from my bank account from someone else’s feature phone?

Ans. No, you can only make payments from your personal mobile number from your bank accounts. This will save your money from fraudulent activities.

Q. Where can disputes be raised for any fraudulent activities or problems for payments done via UPI 123Pay?

Ans. You can directly contact your bank in case of any issues faced or you can raise a complaint on same IVR number/feature phone.

Q. What is the per day transaction limit of UPI payment on UPI 123Pay?

Ans. You can transfer up to Rs. 1,00,000 from your feature phone.