UPI (Unified Payments Interface) has transformed the digital landscape. This is now one of the most popular modes of payment. As digital payments increase, there is a higher risk of falling prey to scammers and fraudsters. We must take necessary precautions to keep our UPI payments safe and secure.

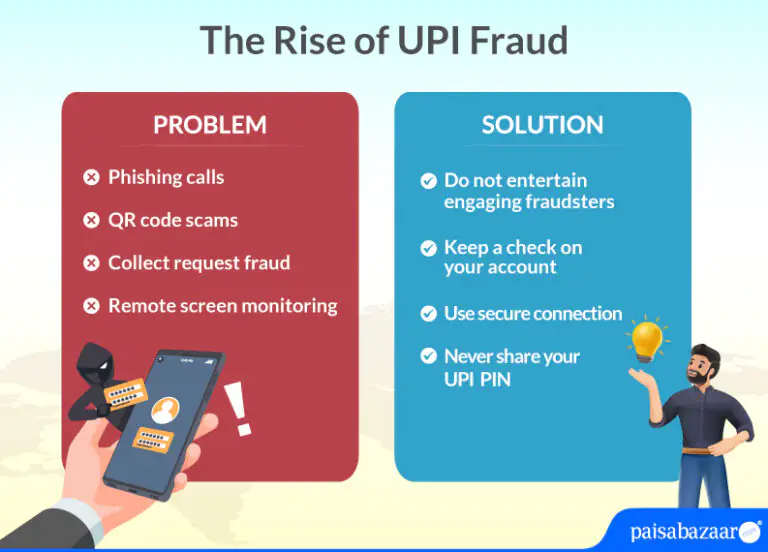

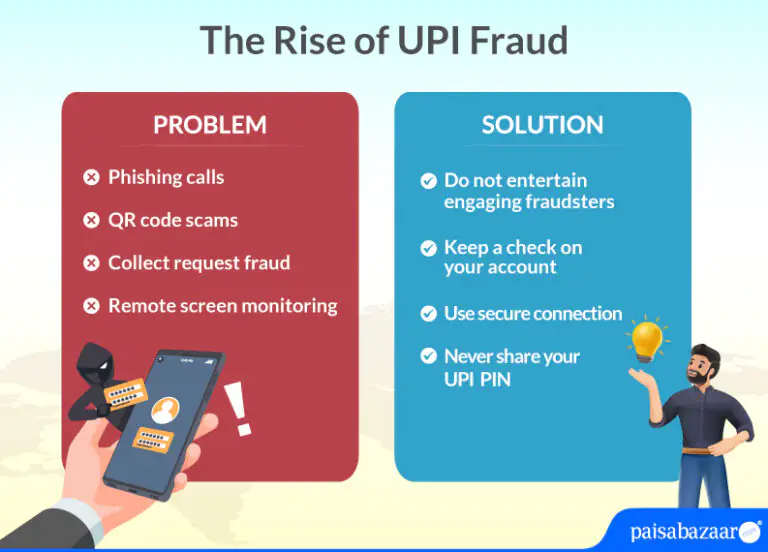

UPI fraud refers to the fraudulent activities that take place within the UPI’s ecosystem. Fraudsters use multiple tactics to deceive individuals into committing such frauds. Such scammers often trick people into revealing their UPI PIN or personal information enabling them to access the bank accounts of individuals or carry out fraudulent transactions. People who fall victim to these scams not only lose their money but their devices also get inflicted with viruses that can steal away all their personal information. Let us have a look at some of the common frauds and how to stay safe from them below.

Types of UPI Frauds

There are different types of UPI frauds that scammers commit to deceive individuals. Some of the common UPI frauds are phishing, sending fake emails, creating fake UPI IDs, SIM swapping, etc. Let us understand in detail.

Phishing

Phishing is one of the most common UPI frauds. Fraudsters send fake emails, texts, or messages impersonating banks or other trusted entities. They trick people into revealing their personal information while making them click on the malicious links sent by them to the person. In such a scenario, we tend to share our personal information or UPI PIN without knowing the authenticity of the message or the link sent to us.

Fraudsters impersonate bank officials and trusted entities gaining the trust of the people and extracting their personal information or UPI PIN. They try to spoof the information on a phone call by asking them about various details. The fraudster tends to obtain personal information regarding the credit card, bank account, UPI PIN, etc.

QR Code Scams

Fraudsters can produce counterfeit QR codes physically or in an online setup. Scanning these codes can lead to unauthorized transfer of funds into the scammer’s account. Hence, we must avoid scanning untrusted QR codes. It is worth mentioning that mere scanning someone’s QR code will not lead to the deduction of money from our accounts. Money is deducted from the account only after one enters the UPI PIN.

Collect Request Fraud

Collect request fraud is a common type of fraud in which fraudsters may send collect money request to your UPI ID. Approving their request will lead to a deduction of the specific amount from your account. These fraudsters pose as legitimate entities where they claim to be assisting you with a transaction issue. However, in reality, they deceive customers into providing sensitive information or initiate fraudulent transactions to their accounts.

Remote Screen Monitoring

This type of fraud is a security concern occurring when one installs apps from places other than trusted sources such as Apple App Store or Play Store. Those software might contain viruses that may allow the creator of the app to gain access to your data or give remote access of your smartphone to them. They can then not only monitor your smartphone but also cause you serious financial losses without your knowledge. They may get insights into your account details, PAN, Aadhaar, etc. that can be used for carrying out fraudulent activities.

Ways to save yourself from these scams

Everyone needs to know that before you click on any type of UPI link to make a payment or scan a QR code, you must know the authenticity of the link and ensure that it is genuine. Keeping the device’s software updated and installing antivirus protection is imperative to keep your devices safe and secure. Do not provide your personal information to anyone immediately on an unofficial link. Take due precautions while sharing your details to others. Verify all apps before installing them on your smartphone.

Do not entertain engaging fraudsters

Avoid engaging with fraudsters on a call. Your bank will never ask for your sensitive information because they already have the required information with them. Never share your UPI or card’s PIN on such calls. In case you receive any call impersonating a banking official asking you to share your information, that’s where you need to be aware.

Avoid UPI frauds by following security practices

To do so, make sure that you do not reveal your UPI PIN to anyone and protect your UPI applications with biometric recognition. In such a case, hackers may not be able to steal your information.

Also, you should not accept collect requests from anyone on the pretext of receiving funds in your account.

Keep a check on your account

Always keep a check on your account’s activity and track your transactions. You need to sift through your account’s activity and know if there is any fraud happening. Hence, it is advisable to check your account thoroughly regularly.

Basic Do’s and Don’t to follow to avoid UPI frauds

| Beware of impersonating banking officials. Verify the authenticity of the caller and avoid giving your information to them. | Never share your UPI PIN, password or OTP with anyone. Your bank’s representative will never ask you to share this information. |

| Use secure wi-fi connection while conducting UPI transactions. | Avoid using public networks because hackers can easily access them. |

| Update your UPI apps regularly because updates contain security enhancements. | Do not disable any notification regarding UPI transactions or account-related transactions. |

| Always keep a close eye on your UPI transactions. If you find any suspicious transaction, report it immediately to your bank. | Leaving your bank account unattended is a big no. |

Wallet Protect by Paisabazaar

Keeping such fraudulent activities in mind, Paisabazaar has come up with a Wallet Protect facility that provides users with an extra layer of security. This service provides a complimentary cover against cards, mobile wallets and UPI frauds that may take place due to skimming, phishing, PIN-based frauds, etc. It will protect you from spurious transactions making it safer to use your cards or the UPI facility.

| Click here to subscribe to the Wallet Protect service today! |

In conclusion, as we embrace the rise of UPI and move towards a cashless economy, we somewhere dismiss the thought that we are falling victim to scams because these UPI transactions come with an increased risk of fraud and scams. UPI frauds are a serious issue and we must take all the precautions to safeguard ourselves from such frauds. Taking preventive steps like verifying apps before downloading them for making payments, adding an additional layer of security to your device, making UPI payments on reliable sources, and keeping yourself aware of such fraudulent activities happening around. Hence, taking proper precautions is the most important thing, and taking preventive measures will only help you keep secure and safe.