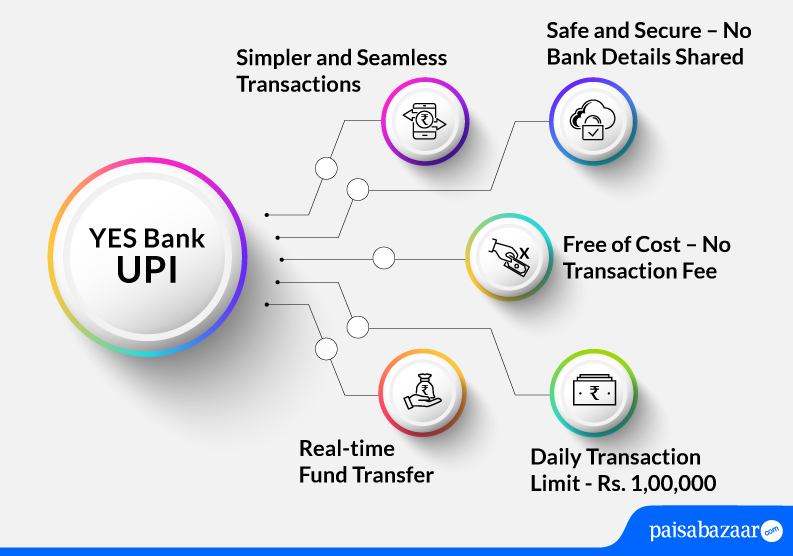

YES Bank offers UPI services to its account holders. The service enables accountholders to pay and receive instant money using the phone itself without any requirement of visiting the bank or filling forms. YES Bank UPI is free of cost and no fee is required to be paid for subscribing or during fund transfer. Unified Payment Interface, or UPI as it is commonly referred to, is developed by National Payments Corporation of India (NPCI) with an aim to create a digital platform for monetary transactions.

YES Bank UPI

UPI enables accountholders to transfer funds from one account to another account on a real-time basis without incurring any transaction charges. This fund transfer method is very reliable and can transfer funds without sharing the bank details ensuring the safety of bank details of the beneficiary. YES Bank also provides the facility to transfer funds through UPI online using the YES Bank UPI app.

Read more: UPI (Unified Payments Interface)

Features of YES Bank UPI App

YES Bank UPI provides its users with the below-mentioned features:

- Financial Services: You can avail various financial services with YES Bank through the UPI app such as payment of utility bills, rent, etc

- Transfer of Funds: You can easily transfer funds from one account to another without any hassle

- Receive Money: You can receive money from someone by simply providing your VPA to the sender

- Balance Enquiry: Since your account is tethered to the UPI application on your phone, you get all the real time details of your account on your phone itself

- Change MPIN: Just like changing of passwords and other IDs, you also get the facility to change your MPIN through the UPI application

- Reward Points: You may also earn reward points on select transactions that can be redeemed anytime

- Manage Credit Card: You can manage your YES Bank credit card. Pay bills and view statements

Get FREE Credit Report from Multiple Credit Bureaus Check Now

UPI Platform

UPI is built around four core elements. These elements are:

- Push and Pull Method of Payment

Authorization of payments for miscellaneous expenditures

In Push: It helps with online shopping, investments, payments of interests or payment to an individual.

By initiating collection request

In Pull: it helps in collecting bills, receiving premiums or interests, outstanding payments or splitting of bills.

- Safety and Security

UPI is by far one of the safest mediums of monetary transactions. Since it is sanctioned and regulated by RBI to enable digital money transfer, it uses strong and secure encryptions in the smartphones.

The credentials of the payer are recorded with the NPCI, making it easier to track them in case of any discrepancies.

- Seamless Transactions

The UPI has enabled transactions to be seamless. The transactions are instantaneous and in real time. There is no time bar on making transaction. They can be done any time of the day and seven days a week. This makes going to the banks an obsolete task.

Most importantly there is interoperability across various banks. It enables inter-bank money transfer through which people can make payments to an account in a different bank.

- Ease of Using

Most important feature of the UPI is the simplicity factor. You do not need to have any technical knowledge in order to efficiently operate UPI. All you need is a VPA. Every time you have to make a transaction you simply have to log in with your VPA

The UPI requires a One-Click 2-factor authentication. Once your authentication is duly made, you can use your UPI to make or receive payments.

Also Read: YES Bank Mobile Banking

How to Register for YES Bank UPI

To register for YES Bank UPI, customers can follow the below-mentioned steps:

Step 1: Log in to YES Bank’s mobile banking application

Step 2: You will see BHIM UPI option on the screen, click on it and allow YES Bank to send and view SMS messages, location and to make and manage phone calls

Step 3: In this step, verify your mobile number by clicking on ‘Send SMS’

Step 4: Once the message has been sent successfully and your registered mobile number has been verified, you will be directed to a page where you will be asked to create your UPI account

Step 5: Mention your name, create a UPI ID, and click on ‘Continue’

Step 6: Link your bank account upon clicking ‘Continue’

Step 7: Click on your bank account and proceed towards security question. Choose from the provided security questions and provide an answer accordingly. Click on ‘Submit’

Step 8: Your UPI ID will be created. It is to be noted that your YES Bank UPI PIN and MPIN are the same

Step 9: Now, go back on the main screen and click on BHIM UPI option again

Step 10: The account that you have linked, you will now have to create a UPI PIN of the same

Step 11: You will see option to set/reset UPI PIN, click on that option. You will be directed to the next page where you will have to input last 6-digits of your debit card and its validity. Click on ‘Verify’

Step 12: You will receive a 6-digit OTP on your registered mobile number, add that OTP

Step 13: Now, enter your 4-digit ATM PIN and then set your 6-digit UPI PIN which will be used at the time of making payments. Re-enter your set UPI PIN. At this step, you have successfully registered for YES Bank UPI.

Get FREE Credit Report from Multiple Credit Bureaus Check Now

How to Send Money through YES Bank UPI

To send money through YES Bank UPI, follow the below-mentioned steps:

Step 1: Open your YES Bank mobile banking app and click on BHIM UPI on the main screen

Step 2: Click on Pay Money option on your screen and choose from the options provided to pay

Step 3: You will have three options to pay namely: Pay through virtual address, Pay through account number or UPI Scan & Pay

Step 4: Choose the option that is convenient for you and proceed with making the payment

How to Raise Collect Request through YES Bank UPI App

Customers can refer to the below-mentioned steps to raise a collect request through YES Bank UPI App:

Step 1: Open YES Bank mobile banking app and click on BHIM UPI

Step 2: You will see many options for making UPI transactions, select ‘Collect Request’ out of all the options

Step 3: Enter the details of the payer such as VPA, amount to be collected and remarks

Step 4: Choose VPA that needs to be credited

Step 5: Choose to receive money and click on ‘Submit’

Step 6: Review the details that you have put in the next screen carefully and submit to process a collect payment through UPI

Step 7: Once the transaction has been authorised by the payer, money will be credited to your account

Suggested Read: YES Bank Savings Account

YES Bank UPI Transaction Limit

YES Bank customers can transfer a maximum of Rs. 1 Lakh on a daily basis. The UPI limit per transaction set by NPCI per transaction is also Rs. 1 Lakh.

YES Bank UPI Customer Care

For queries related to UPI, customers of YES Bank can call the bank on its toll-free number 1800 1200.

Read in Detail: YES Bank Customer Care

Get FREE Credit Report from Multiple Credit Bureaus Check Now

YES Bank UPI FAQs

Q. Is it possible to link one account with multiple VPAs?

Ans. Yes. You can link one account with multiple VPAs.

Q. I have forgotten my MPIN. Is it possible for me to reset my MPIN?

Ans. Yes. You can reset your MPIN using your debit card credentials in your YES Bank mobile banking app.

Q. Can I put a stop payment request after initiating a UPI request?

Ans. No. Once the UPI transaction is initiated, you cannot stop that transaction.

Q. While doing a UPI transaction from YES Bank mobile banking app, my transaction got failed but my account was debited? What do I do?

Ans. You need not worry in case of failed transactions. If your account has been debited, the amount will be refunded back to your account within an hour. However, if the amount is not refunded to your account, you can contact YES Bank customer support.

Q. Will I be able to use YES Bank UPI if I change my sim/mobile?

Ans. In such a case, you will have to re-register for UPI in YES Bank’s mobile banking application.

Q. How to activate YES Bank UPI?

Ans. You can activate YES Bank UPI through YES Bank’s mobile banking app.

Q. How to change YES Bank UPI PIN?

Ans. You can change your YES Bank UPI PIN through YES Bank mobile banking application.