What is car loan?

If you want to own a car and are short of cash you can avail a car loan to buy that dream car of yours. A car loan is the loan given by lender to fund the purchase of a car. You can repay the loan by paying back in easy installments.

Benefits of applying online

It is hassle free: – You can apply for a car loan sitting in your office or home. There is no need to rush to the nearest bank branch to avail a car loan. Applying online for the loan saves you both time and effort.

Easy comparison: – It is very easy to do the comparison of the various offers provided by different banks while if you want to do it offline, you will have to visit the branch of each bank to compare what they are offering. It will be very difficult and pain taking.

Round-the-clock service: – In the online mode you can apply for the loan any time you want to while you can visit your bank branch during office hours only.

How to apply online for car loan on Paisabazaar.com

Follow these easy steps to apply for a car loan on Paisabazzar.com

Step1 : Go to Paisabazaar.com

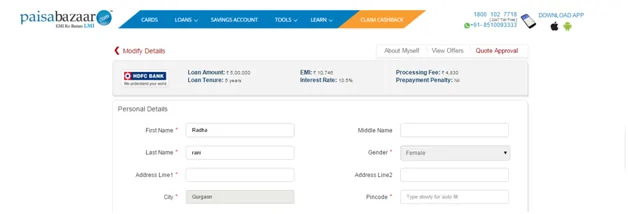

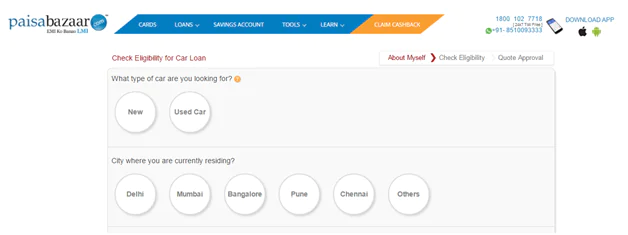

Step2: Click on Car loan under the loans section. Following page is displayed. You need to your personal details such as your name, address, contact details and other information like employer name, model of the car you want to buy monthly income, the amount of car.

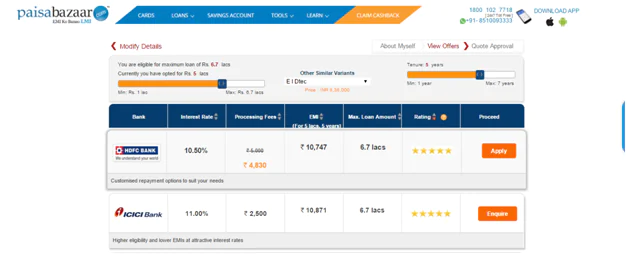

Step3: After you input your contact details you will be able to view the offers from different lender and will be able to check your eligibility in the next step. In this page you will get the complete detail about the offers that is the rating of the product, the maximum amount of loan you can avail, the equated monthly installment, the car loan interest rates, processing fees etc.

Step 4: After you choose the bank whose offer you want to take, you need to fill another form with the bank giving more details like your complete address, office address, PAN card number etc. Click on submit. The bank will then check your CIBIL score with Credit Information Bureau of India (CIBIL), before approving your loan.