Difference Between Secured and Unsecured Credit Card

Credit Card Bill Payment Queries

Credit Card Queries

HDFC MoneyBack+ Credit Card Vs. HDFC MoneyBack Credit Card

How New RBI Rules Are Making Credit Cards Safer?

Review: Standard Chartered Platinum Rewards Credit Card

Standard Chartered Platinum Rewards Credit Card is one amongst the top rewards credit card in India, that offers you up to 5X rewards on a low annual fee of Rs. 250. To understand, if this card is a good fit for you, read on to read a detailed review of this credit card.

IndianOil Axis Bank Credit Card Review

Axis Bank in collaboration with IndianOil has launched a fuel credit card i.e. IndianOil Axis Bank Credit Card. You can get up to 4% value back on your fuel purchases at IndianOil through this card. You can also avail 1% fuel surcharge waiver. Apart from fuel, you can avail exciting offers and benefits on other categories as well such as entertainment, dining, etc. Keep reading to know more about this credit card in detail.

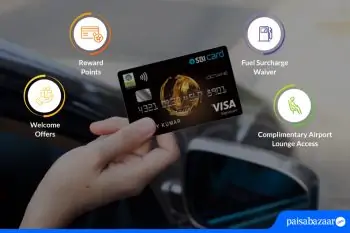

BPCL SBI Card Octane Review

BPCL SBI Card Octane is a fuel credit card offered in collaboration with Bharat Petroleum Corporation Ltd. (BPCL). This is a premium version of the previously launched, BPCL SBI Card. You can get a whopping 7.25% value back (including a 1% surcharge waiver) on your fuel purchases at BPCL via this card. This is an ideal option if you frequently visit BPCL outlets for fuel and are looking for an option to save money on your fuel expenses.