हिंदी में पढ़ें Scheduled Banks offering highest FD interest rates - 6.50% p.a. and above Amongst all bank categories, small finance banks are offering the best FD interest rates. Within the scheduled small finance bank category, North East Small Finance Bank offers the highest FD interest rate of 9.00% p.a. Among scheduled private sector banks,...

Monthly Interest for Rs 10 Lakh Fixed Deposit

The fixed deposit monthly income scheme is ideal for depositors who require fixed monthly income to meet their daily expenses. This monthly income plan is especially popular among retired individuals or those individuals having large surpluses from inheritance or other sources but do not have adequate income sources. Such individuals can deposit their surpluses in...

Monthly Interest for Rs 1 lakh Fixed Deposit

हिंदी में पढ़ें The monthly fixed deposit plan is ideal for depositors who need a fixed income monthly to meet their expenses. This plan is especially popular among retired individuals or those having large surpluses from inheritance or other sources but does not have adequate income sources. Such individuals can deposit their surpluses in FDs...

Monthly Interest for Rs 1 Crore Fixed Deposit

हिंदी में पढ़ें The monthly interest pay-out scheme is ideal for depositors who need a fixed income monthly to meet their daily expenses. This monthly plan is especially popular among retired individuals or those individuals having large surpluses from inheritance or other sources but does not have adequate income sources. Such individuals can deposit their...

Best FD Interest Rates in India

हिंदी में पढ़ें Currently, among all bank categories, North East Small finance Bank offers the best FD rates at 9% p.a., followed by Unity Small Finance Bank and Suryoday Small Finance Bank, which offer fixed deposits at 8.6% p.a., closely followed by Shivalik Small Finance Bank, which offers fixed deposits starting at 8.55% p.a. Utkarsh...

Tax Saving Fixed Deposit

Tax-saving fixed deposit schemes qualify for tax deduction under Section 80C of Income Tax Act. As tax saving FDs have fixed interest rate, which remains unchanged throughout its tenure, it offers greater income certainty for those with low risk appetite. Tax saving FDs have a lock-in period of 5 years and therefore, cannot be withdrawn...

Best NRE FD Rates : All You Need To Know

हिंदी में पढ़े

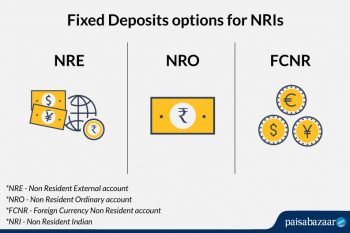

NRE, NRO & FCNR Fixed Deposits: Know the difference

Fixed deposit is considered a safe and fruitful investment option in India. People living in India enjoy decent returns on FD thus making FD a preferred choice for risk-averse investors. But the fixed deposit is not limited to residents of India only. NRIs or the Non-Resident Indians also have this option in the form of…

PPF vs FD: Which is Better?

Fixed Deposits and Public Provident Fund are two of the most secure investment options available to the Indian investors. Both instruments are ideal options for risk-averse investors. But how do we choose between the two? Here is a guide to understanding the differences and commonalities, both. Earn 6.5% p.a. on your FD & Get a...

COVID Crisis: Keep your cash handy – Later invest in FD

COVID-19 has knocked our doors, loud and strong and to fight it, all we need to do is stay put. But, what about our money? Does it need to stay put too? Or should it be locked safely in bank deposits? In such times, a mix & match is what will give the optimum results....