How is Housing For All by 2022 mission boosting the Housing Sector?

How is Housing For All by 2022 mission boosting the Housing Sector? Check the benefits and Impact of housing for all scheme launched under Pradhan Mantri Awas Yojna (PMAY) and the mission to achieve Housing For All by 2022.

Ways to plan your Home Loan Down Payment

Whenever you borrow a home loan, lenders such as banks and Non-Banking Financial Companies (NBFCs) usually shell-out 80% of your property’s worth as a loan amount. The remaining 20% of the property value is to be paid by you. This 20% amount is called your Down Payment. For example, you are buying a property […]

Are you Eligible to get a Home Loan Subsidy?

Are you Eligible to get home loan subsidy? The announcement of the central government’s ‘Housing For All by 2022’ initiative came clubbed with the Pradhan Mantri Awas Yojna (PMAY) scheme focussed on the urban poor (Economically Weaker Sections (EWS), Lower Income Groups (LIG)) and later, also on the Middle Income Groups (MIG) of the society.

GST Regime: How will it impact property prices and home loan in India?

With the revolutionary ‘Goods & Services Tax’ or GST effective from July 1, 2017, most industries are waiting to see the impact it brings. One such industry is the real estate industry. While GST is expected to bring in more transparency in real estate, there is speculation whether it will ultimately lead to decrease in […]

5 Smart Ways to Pre-Pay Your Home Loan

Want to pre-pay your home loan? here is 5 Smart Ways to Pre-Pay Your Home Loan. Read more to know how to reduce home loan burden.

Buying a House Post Retirement? Here is How You Can Get a Home Loan

Home loan is a major financial commitment for homebuyers but, at the same time, it also entails huge risks for the bank. This is the reason why banks are very apprehensive about extending home loan to people who are close to retirement, regardless of their financial standing.

Why You Should Take A Home Loan Even If You Have Money To Pay Upfront?

A majority of homebuyers opt for home loans to fulfil their dream of owning a house. However, what if the buyer has enough funds to pay for the house in full? Should he still take a home loan? It is quite a debated topic among property experts. When you have extra funds to spare, why […]

5 Lesser Known Home Loan Charges to Remember

You might have seen quite a few advertisements recently that show that home loans are now available for interest rates as low as 8.5% per annum. These rates are indeed among the lowest in history and it is definitely a good time to invest in a property of your choice. However, before you get inspired […]

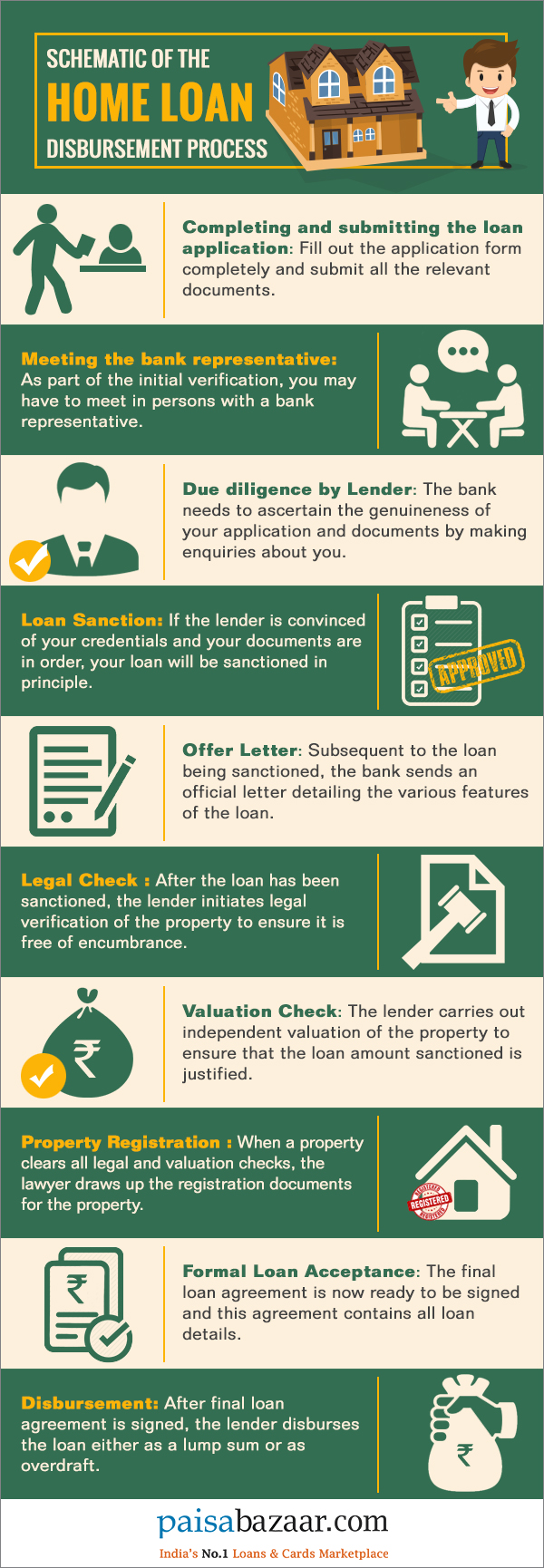

Schematic of the Home Loan Disbursement Process

In the following infographic, we have provided a step-by-step guide regarding the various steps that follow after you have submitted your home loan application with the financial institution.