9 Mutual Fund Terms You Should Know

Mutual fund as an investment vehicle, is rapidly gaining popularity across India. The April–November period of 2015 saw an addition of 2.5 million new investors in mutual fund sector. However, most of these new investors and in fact, even the existing ones, do not have a clear understanding of important terms and concepts crucial for […]

What happens to my investments when I die

Your investments will be passed on to your heirs after you die. If you die leaving a will behind, your property will go to the heirs named in the will according to the shares you have specified. If you die without a will, these will the heirs mentioned by the personal law applicable to you….

5 Common Mutual Fund Investment Mistakes to avoid

The mutual fund industry in India manages assets worth an estimated Rs. 21.41 trillion as per AMFI data calculated till the 31st of October 2017. This might seem like a huge sum of money but in comparison to developed markets, mutual funds are still an emerging market. This becomes clear when you compare this to…

How To Choose Between Different Categories Of Equity Mutual Funds

Rahul, a 32-year old marketing professional, is thinking of investing in equities through mutual funds, given that he is looking at more than 5 years’ investment horizon. He is a do-it-yourself kind of person who wants to learn about investment products and manage his own investments. However, with over 460 equity-oriented mutual funds to choose […]

Pramerica Mutual Fund to acquire Deutsche Mutual Fund

Mergers and acquisitions have become common in mutual fund industry. Recently in the past, Kotak Mutual Fund acquired Pinebridge Mutual Fund, HDFC Mutual Fund acquired Morgan Stanley Mutual Fund, SBI Mutual Fund Bought Daiwa and Birla Sun Life acquired ING Mutual Fund. Now, Pramerica Mutual Fund is going to buy Deutsche Mutual Fund. Deutsche will […]

Best Tax Saving Investments

There are multiple investment options available in the market to save tax such as Mutual Funds (ELSS), 5-year Bank FDs, PPF, ULIPs, NSCs, and NPS. Investors may get confused while picking the right fit of tax saving investment for them. The article aims to present a comparative analysis of popular tax saving options available in India….

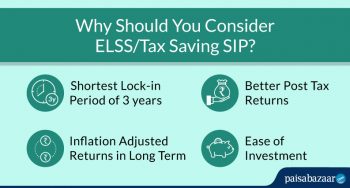

Best Tax Saving SIPs to Invest

Equity Linked Saving Schemes (ELSS) are a type of mutual funds that come with a statutory lock-in period of 3 years and are eligible for a tax deduction of up to Rs. 1,50,000 under section 80C of the Income Tax Act. You can invest in any mutual fund via two modes – either by making…

ICICI Prudential Mutual Fund Launches Retirement Fund NFO

Top 5 Best Money Market Funds to Invest

हिंदी में पढ़े Table of Contents : What are Money Market Funds? 5 Best Money Market Funds to Invest Advantages of Investing in Money Market Funds How to Invest in Money Market Funds? FAQs Money market funds are financial instruments having a short maturity period of up to 1 year. These funds are debt…