One of the most important factors a CIBIL score depends on is the repayment history. Lenders analyse this section critically at the time of credit approval. They go through every credit product to check for a non-zero DPD in the credit report. Let us understand what a DPD is and how it can impact the credit score.

Know All About Days Past Due (DPD) in Your CIBIL Report

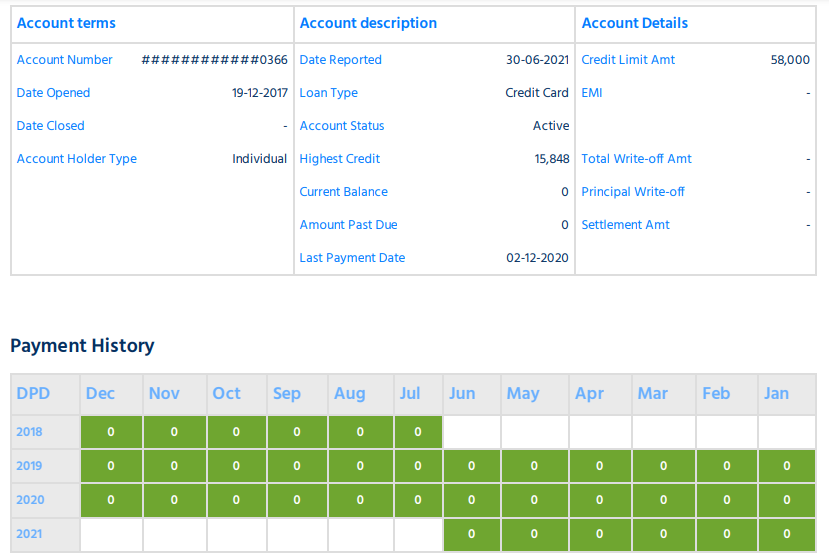

Days Past Due (DPD) indicates the number of days by which a borrower has missed an EMI or credit card payment. DPD is present in the ‘Payment History’ section of your CIBIL report.

The DPD in the CIBIL report is considered one of the determining factors for lenders while approving or rejecting your loan or credit card application.

Understanding the DPD Calculation Method

If you have made timely payments in the past, your DPD (Payment made within 90 days) will be mentioned as ‘000’. In case you have missed your payment by 40 days, your report will show ’40’ against the previous month.

There may be instances where “XXX” is mentioned in the DPD in CIBIL. It means that the lender has not provided the payment history details to the credit bureau. You should not worry, if you find it in your credit report, as it has no negative impact on your credit score or your chances of loan or card approval in the future.

Get your Credit Report and Verify your DPD Data Check Now

Significance of DPD Value

DPD shows how disciplined you have been in making EMI payments in the past. It contains your payment timeline for the past 36 months. While assessing your credit application, the lender checks whether you have missed any payments in the past. If your DPD is ‘000’ for all 36 months, it shows that you have prudently paid off all your credit dues on time and pose a lesser risk to the lender.

Occasionally missing the payment deadline also hurts your credit score and creditworthiness but few lenders might approve your credit application. However, frequent misses and non-payment of dues for long pose a higher risk for lenders and they may refrain from approving your loan or credit card applications.

2 Comments

One of my oldest education loan account was write-off/sattled in sept-2016, but bank closed the same account in sept-2023 and reported to cibil first time. The DPD history was updated since sept-2023 when loan was closed for 36 month as loss. I contacted bank and paid full amount and bank accordinly update to cibil to remove write-off amont.

In fresh cibil report cibil removed write off amount but same time cibil also marked negative rating by updating loss account since april-2024. pls suggest

You can request your lender to issue an NOC for loan closure and submit the same with CIBIL after raising a dispute against the loan account. Your DPD may not change but your account would be mentioned as “Closed” instead of “Written-off”. It would surely impact your credit score positively.