Citibank Personal Loan is an easy way to get cash in order to fulfill a wide range of financial requirements. You can avail loans up to Rs. 30 lakh with disbursals generally occurring within 48 hours with nil or minimal documentation. In case you run into any issues when applying for a personal loan or after disbursal, you can call the Citibank Customer Care Number: 1860-210-2484

Please note that local call charges will apply when calling this number and it is operational between 9 AM to 7 PM (Monday – Saturday) except on national holidays.

Citibank Personal Loan Customer Care Number for NRIs

Following is the Citibank Customer Care Number for those calling from outside India. Please note that international call charges are applicable. (+91)22-4955-2484

The Citi Customer Care Number for loan related queries is operational between 9 AM to 7 PM (Monday to Saturday) except on national holidays in India.

Know more about Citibank Personal Loan Click Here

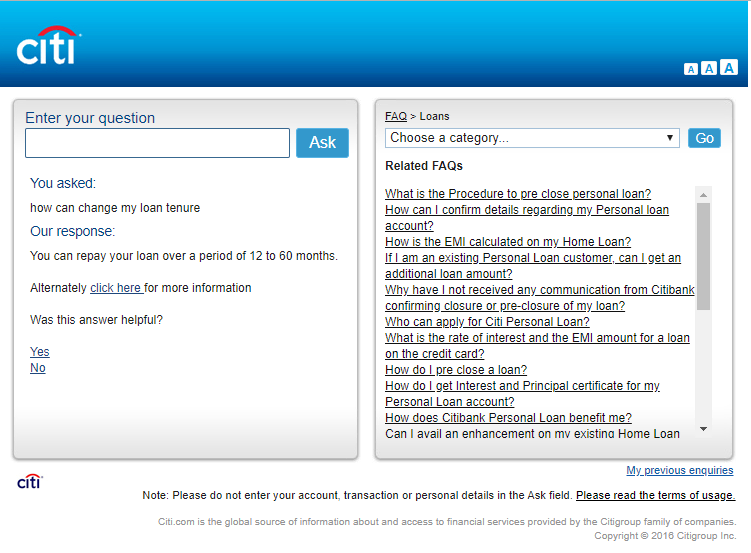

Citibank Personal Loan Virtual Assistant

Citibank Virtual Assistant is a completely online system that can help you get answers to all your Citibank-related queries. It has a collection of all the frequently asked questions. You just need to enter your question in the search box or select your query from the list as shown below and click “Ask” to get an instantaneous response. In case your query is not resolved this way, you can opt for a live chat with Citi Customer Care.

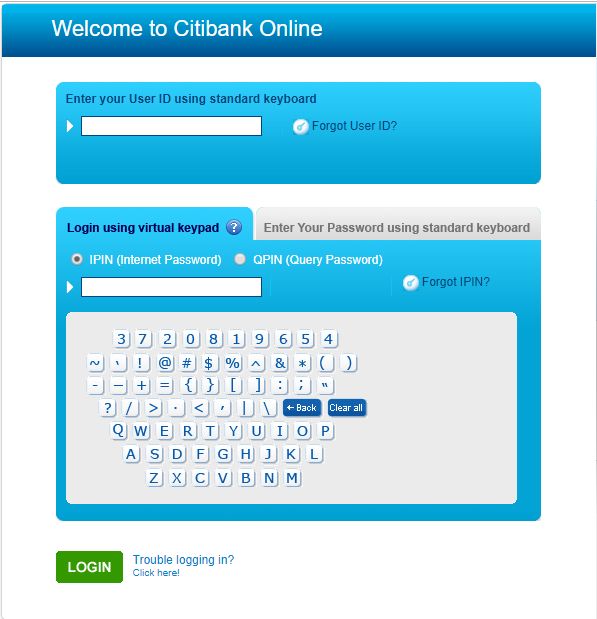

Citibank Personal Loan Customer Care for Personalized Response

You can get a personalized response to your query by logging into the Citibank Online Portal.

Citibank Head Customer Care and Principal Nodal Officer

You can write to Citibank Head Customer Care in case your query remains unresolved. The e-mail address is head.customercare@citi.com.

If you are not satisfied with the Head Customer Care, you can further escalate your concern to Principal Nodal Officer (PNO) using the following routes:

- Writing an e-mail stating your grievance to principal.nodal.officer@citi.com.

- Write a letter stating your grievance to the current PNO (Mr. M. Dhananjayan). Please note that you should mention your reference number and first point of contact with the bank in the application along with other key details and send it to the following address:

Citibank N.A., Mail Room,

ACROPOLIS, 9th Floor,

New Door No.148 (Old No.68),

Dr. Radhakrishnan Salai, Mylapore,

Chennai – 600004.

- By calling 1800-266-2400 (India Toll free) / 022-4955-2400 between 10:00 AM and 6:00 PM IST (Monday to Saturday) except on national holidays.

Transfer Your Personal Loan at Lower Interest Rates Apply Now

Citibank Personal Loan – Grievance Handling

The mechanism of Citibank Grievance Handling for personal loans as well as other products is divided into the following five levels:

Level 1: Regular Access Channels

You can register a complaint by calling the customer care number/using Citibank Live Chat/ through e-mail/ letter as mentioned in earlier sections

Level 2: Head Customer Care

If you are not satisfied with the level 1 response or have not received an appropriate response from Citi customer care within 2 working days, you can write to Head Customer Care. Contact details of Head Customer Care are mentioned in an earlier section.

Level 3: Citibank Grievance Redressal Officer (Principal Nodal Officer)

If you are not satisfied with the Level 2 response, you can contact the PNO (Principal Nodal Officer) via post by sending a letter to:

Citibank N.A., Mail Room,

ACROPOLIS, 9th Floor,

New Door No.148 (Old No.68),

Dr. Radhakrishnan Salai, Mylapore,

Chennai – 600004.

Alternatively, you can call 1800 266 2400 (All India Toll Free number) / 022-4955-2400 between 10:00 AM and 6:00 PM IST (Monday to Saturday) except on national holidays.

Level 4: Citibank Senior Management

If you continue to be dissatisfied with the resolutions provided by the previous levels, you can directly write to the Citibank Senior Management. Write to Citibank Head Personal Loans

Level 5: Reserve Bank of India – Banking Ombudsman Scheme

If you have not heard from Citibank for a month after your previous level complaint or are dissatisfied with the resolution provided via above levels, you can contact the Banking Ombudsman. The Banking Ombudsman is appointed by the RBI to ensure satisfactory settlement of complaints if the bank and the complainant are unable to come to an agreement.

Frequently Asked Questions (FAQs)

Q. What is the rate of interest on Citi Personal Loans?

Ans. The rate of interest applicable to Citi Personal Loan starts from 9.99%.

Q. What is the loan tenure for Citibank Personal Loan?

Ans. The loan tenure for Citibank Personal Loan varies from 12 to 60 months.

Q. What are the various documents required to apply for Citibank Personal Loan?

Ans. In general, a proof of identity, a proof of address and a proof of income are required to apply for Citibank Personal Loan. Know more about documents required for Citibank Personal Loan

Q. What is the loan booking fee for Citibank Personal Loan?

Ans. A loan booking fee (processing fee) of up to 2.75% of the approved loan amount is charged on Citibank Personal Loan.

Please Note: Citibank is not a Paisabazaar partner. Offers would be from partner Banks/NBFCs only.