The transportation of goods through marine channel is a complex and risky process that depends on both man-made and natural situations. Hence, it is important to take appropriate marine insurance to cover the risks associated with the goods that get transported through this medium.

Table of Contents:

What is Marine Insurance?

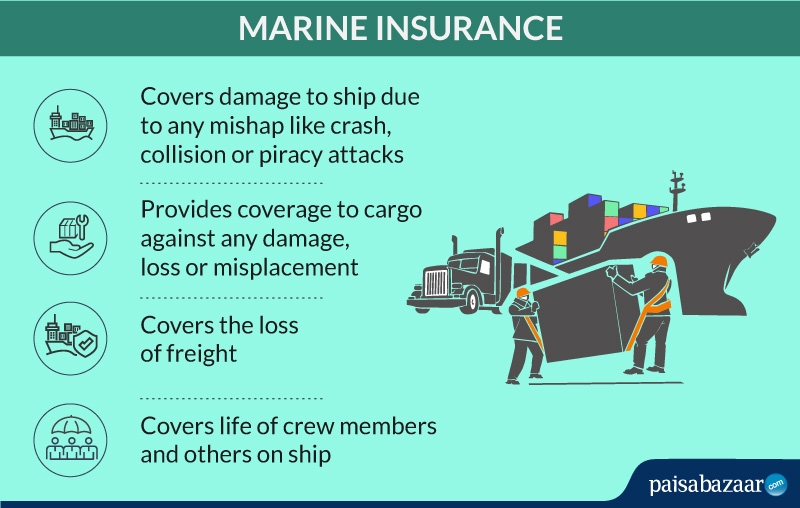

Marine insurance covers the risks faced by ship owners, cargo owners, terminal handlers and various intermediaries in the shipping business. Looking at various conditions that can affect your cargo, including weather conditions, pirates, navigation problem, it is recommended that you avail an appropriate insurance as per the nature of your business and the risks associated with business operations.

It also covers third parties if they happen to get affected directly or indirectly by the activity. There are various types of marine insurance one can choose from as per the need and requirement.

Types of Marine Insurance

Before going ahead with buying a marine insurance, you should be aware of the types of this insurance in order to be able to choose the most suitable one for your business. The types are:

Hull and Machinery Insurance: The hull is the main supporting body of the vessel without masts. Thus, hull insurance covers the applicant from any mishap to the ship. It is generally taken by ship owners. Along with hull insurance, one should also go for machinery insurance to cover the machinery of the ship. It insures the applicant against operational, mechanical and electrical damage to the ship machinery. Since both the sections cover the ship as a whole, it is jointly issued as Hull and Machinery Insurance by the insurance company.

Marine Cargo Insurance: Cargo owners are exposed to the risk of mishandling of the cargo at the terminal and during the voyage of the ship. It might get damaged, lost or misplaced. Hence, to protect the cargo owner from the financial losses arising out of such cases, marine cargo insurance is issued against appropriate premium payment. It comes with a third-party liability insurance which covers any damage done to the port, railway track, ship, other cargo or humans due to your cargo.

Liability Insurance: The ship may be exposed to crash, collision or piracy attack. Under such situations, the valuable cargo is exposed to a high risk. Moreover, the life of crew members and others on the ship is also in danger. The appropriate liability insurance indemnifies the ship owners out of any such liabilities due to events not under his control.

Freight Insurance: This section covers the loss of freight. In case the freight is lost or damaged or the ship is lost, the shipping company will not have to bear the loss. They can be compensated for the loss through this insurance.

What it all Covers?

The cargo movement is not uniform for every customer. The need for insurance is also different for different customers and at different point of time. Some of the common points covered under marine insurance are:

- Sinking, stranding, fire, explosion

- Loss in loading or unloading cargo

- Total loss coverage

- Earthquake or lightning

- Unforeseeable administrative expenses

- Jettison or washing overboard

- Collision, overturning, derailment, accident

- Natural calamities

- General average

It offers coverage under various sections. Let us understand them:

Voyage Policy: The validity of the insurance policy is limited to the specified voyage; hence, such policy is also known as voyage policy.

Time Policy: Many a times, customers want coverage for a particular period. Such a coverage is called time policy.

Mix Policy: When the marine insurance policy extends the insurance cover for a particular voyage and for the desired duration of time, it is called mix policy. It gives flexibility to customers to handle various uncertainties related to the movement of the ship and the cargo inside the ship.

Single Vessel Policy: For ship owners who own only one ship, this policy is ideal, considering the cost and coverage. For ship-owners having a fleet of ships, single vessel policy for each ship is not cost effective.

Fleet Policy: If the ship-owners have multiple ships (fleet of ships), the fleet policy is cost effective and easy to administer.

Floating Policy: The floating policy is issued to the shipping line on an ongoing basis. The only specified detail is the maximum sum insured in the policy. All other details are informed to the insurance company when the ship starts its voyage. For regular cargo owners, who need frequent transportation of goods through shipping line, this is the best policy, to save time and money.

Unvalued Policy: The value of the cargo is usually mentioned while taking the marine cargo policy. However, when the value of the goods and consignment is not defined before uploading the cargo, the unvalued policy is issued. It is also called open policy. The value is mentioned in case of claim after due verification and validation of the facts related to the consignment under the claim.

Valued Policy: When there is no ambiguity regarding the value of the consignment, it is mentioned during issuance of the cargo marine policy. In case of any claim, the amount of reimbursement is limited to value mentioned in the policy, subject to other terms and conditions of the policy.

Block Policy: The movement of the cargo includes rail, road, water and air mode before it reaches its destination. To cover the cargo for the complete journey, block policy is most suitable. In case of any loss at any point in the transit, the amount of insurance policy is payable to the applicant.

How this Insurance Functions?

The basic requirement of marine insurance is to provide you with peace of mind while conducting your business. Let us understand how it works:

- Evaluate and analyse your requirement regarding the risks involved and the loss that you would incur in case of any eventuality

- After preparing your list, check and compare the companies and policies to understand where you would get the best deal

- After zeroing in on the plan, get the documents in place for purchasing the policy

- In case of any untoward incident for which you would need a claim, immediately inform the insurance provider

- Submit the duly filled in claim form along with the required documents, proofs and certificates

- In case the claim is considered fit, you would get the claim, else it will be rejected

Eligibility Criteria

Let us look at the sections of people who are eligible for marine insurance. They include manufacturers, buying agents, buyers, import/export merchants, sellers, banks, contractors or any one who is into the business of movement of goods.

Claim Process

After purchasing the marine insurance, in case there arises a situation when you need to make a claim under the policy, you can follow the below mentioned steps:

- In case of loss or damage to the cargo or the ship, you need to immediately inform the insurance provider

- A surveyor will assess the damage or loss mentioned

- All the proofs and witnesses need to be submitted along with the duly filled in claim form

- For a missing package, the insured must lodge file a monetary claim with the insurance provider and get an acknowledgement for it

- If the provider finds the case fit, it would approve the claim, else it would reject it

- In case you are not satisfied with the case, you can approach the court of law

Documents Required for Claim Process

To make the claims under marine insurance and be able to reap the benefits, the correct documents should be submitted. In case of any lapse, there is a chance of the risk being rejected. Some of the documents are:

- Duly filled in claim form

- Original insurance certificate with the policy number

- Copy of Billing Lading

- Survey report or missing certificate

- Original invoice, packing list, shipping specification

- Copies of correspondence exchanged

Exclusions

Marine insurance has various kinds of coverage for the benefit of all. However, the policy does not cover certain situations, also called exclusions. Some of these cases are:

- Wilful, planned or intentional misconduct

- Strike, rioting, war

- Poor packaging quality of the cargo

- Delays

- General leakage or wear and tear of the cargo

- Financial distress or insolvency of the shipping line

- Removal of wreck

Companies Offering Marine Insurance in India

Looking at the fact that India is surrounded by water from three sides, shipping is an important sector. A big volume of cargo is managed at these ports, making this insurance an important requirement. Some of the companies providing marine insurance in India are:

- All major banks and financial institutions

- HDFC Ergo

- TATA AIG

- United India Insurance Company

- Royal Sundaram

- New India Assurance Company Limited

- Bharti AXA

Important Aspects

Before purchasing a marine policy, you should always check the companies and policies before finalising the one that suits you. Let us look at certain points to be kept in mind:

- As far as cargo insurance is concerned, the sum insured is calculated on the basis of cost, insurance and freight (CIF) value mentioned in the invoices. The insurance company generally agrees to the sum insured up to 10% to 15% higher value than total CIF value mentioned in the invoice.

- For insurance related to ship-owners, the sum insured is finalised after complex calculations. The factors like the route of the ship, the number of ships in the fleet, past claim history of the shipping line, safety and precautions arranged at various transit points, etc. are taken into consideration. Still, there are grey areas, which ship owners should carefully handle for comprehensive coverage of the ship, cargo and people inside the ship.

- The mode of transport for your cargo can be rail, road, water, air or a combination of more than two modes. Under such uncertainty, it is advisable to make sure that your marine policy assumes global coverage and you will get worldwide assistance for survey and settlement of your claim.

Advantages

While conducting business involving cargo and sea ways, it makes sense to opt for a marine insurance. Some of the advantages of purchasing this insurance are:

- The insurance provides financial stability to the business

- It helps manage the risks and conduct business without much worries

- It compensates for any financial loss that one faces during the transit of goods

Also Read : Business Insurance