Mobile insurance has become as essential as having a mobile these days as mobile or a smartphone has already become an important part of our life today. We happen to depend on it for various purposes, including communication and business. In such a scenario, loss or damage to the smartphone can lead to big problems. Thus, to get financial support in case of theft or accidental damage to the phone, we can opt for it.

Table of Contents:

What is Mobile Insurance?

When a mobile is lost or damaged, there is a chance of the data in the device being lost or stolen, creating problems of different levels, including financial damage. Today, people spend a lot in purchasing smartphones and any issue with them can create a hole in the pocket. To overcome such issues, companies are now offering mobile insurance in India. These policies provide coverage against theft or accidental damage to all types of phones, including smartphones.

Need for Mobile Insurance

Mobile insurance is not compulsory; however, getting one for your mobile or smart phone will surely go a long way in saving you from financial losses related to its theft or damage. Let us understand the need for mobile insurance and how the coverage can come to your rescue in tackling various situations.

1. Theft protection: It is quite difficult to recover the phone if it gets stolen. And with the stolen phone, you also lose all your data. Financial loss is another setback associated with the theft. Thus, it makes sense to get mobile insurance to deal with such situations, as it covers the cost of a new phone.

2. Accidental breakage protection: Mobile phones are quite expensive today and repair of any kind of breakage can be an expensive affair. Getting mobile insurance can be a good decision, considering the fact that it provides coverage against breakage.

3. Water or liquid damage cover: Any accidental damage to the phone due to water or other liquid is covered under mobile insurance. A mobile phone can also get damaged due to moisture or humidity and this is usually covered by the insurance.

4. Covers high repair cost: Any damage to expensive phones like those from Apple, Samsung, OnePlus, etc. would lead to high repair cost. To avoid paying hefty amount on phone repair, it’s better to avail mobile insurance.

5. Protection for loss of phone: In case the mobile phone gets lost, you will not get any compensation under warranty. However, you do get compensation up to the sum insured amount under mobile insurance if you lose your phone.

Coverage

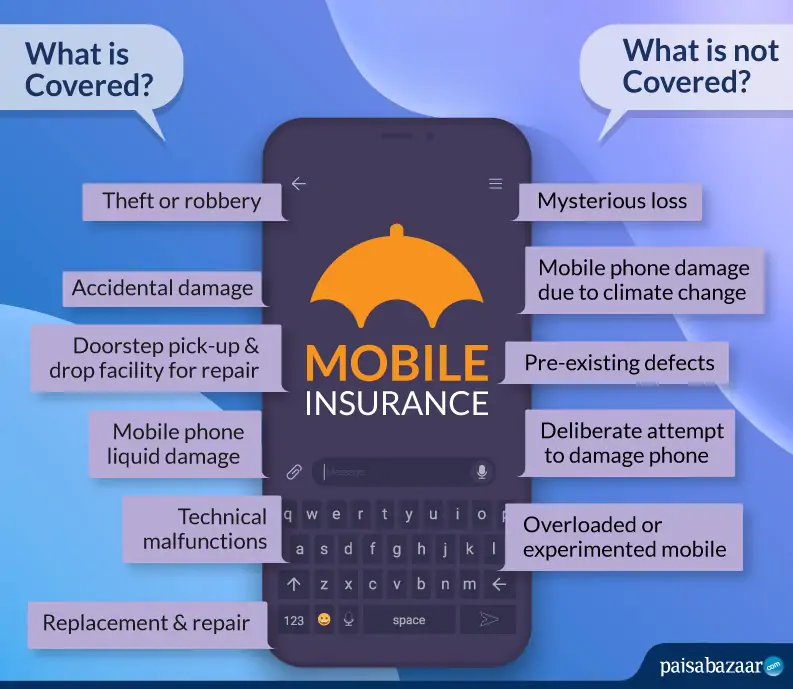

A mobile insurance offers coverage for various kinds of damage to the mobile. Let us look at the coverage below :

- In case of theft or robbery of the smartphone

- Replacing or repairing the lost or damaged phone within 48 hours of reporting the incident

- Protection against accidental damage

- Coverage against liquid damage of the mobile

- Doorstep pick-up and drop facility of the mobile phone for repairs

- Cashless process for the coverage

- Technical malfunctions like problems with ear jacks, charging ports and touch-screens are also covered by some companies

- Some insurance companies also offer No Claim Bonus to the policyholder at the time of policy renewal if no claims are reported during the previous policy term

Also Read: TV Insurance: Coverage, Claim & Exclusions

Claim Process for Mobile Insurance

Claim Process for Mobile Insurance

Below are some of the steps to be followed either by the policyholder of the mobile insurance policy or the insurance company that has provided the cover in the event of claims settlement. However, the process may vary from one company to another. The steps are:

- One must immediately report any loss or damage to the mobile phone to the insurance company offering the coverage either on a toll-free number or any other suggested customer support channels mentioned by the company

- Customers must also submit the Claim Form as requested by the insurance company. This can be done either online or by visiting the nearest branch office of the insurance company

- In case of theft or robbery, the customer must file an FIR with the nearest police station or submit the complaint and obtain a copy of it. In case of loss or damage to the mobile phone due to household fire, a report from the fire station is also required by some insurance companies

- Some insurance companies may require the photographs of the damaged mobile phone to be sent to the claims assessor

- Based on the policy document issued by the insurance company to the individual for his/her mobile insurance and internal investigation process of the insurance company, the claims would be settled in either way i.e. replacement or repair of the insured mobile phone

- Some private insurance companies settle the claim bills by directly making a payment to third-party mobile repair centers authorized by the insurance company for repairs

- Some insurance companies only allow one claim settlement per policy term whereas some offer more than one claims in the policy term year. However, one must always check the terms of the mobile insurance policy he/she has purchased

- The policyholders may contact the insurance company representatives during the claim process for any support either by visiting the branch office or contacting them via online channels provided by the insurance company

Documents Required

The customer needs to submit the required documents to the insurance company for initiating the claim process for the insured mobile phone.

Some of these documents may include an original invoice of the phone, along with the serial number of the phone and the insurance policy number. In case of a missing phone, you need to file an FIR and submit its copy while filing a claim.

Exclusions

Certain issues are not covered under mobile insurance. These come under exclusions. These exclusions usually vary from one insurance company to another. Let’s review some:

- Mysterious loss of the mobile phone that cannot be convincingly explained by the policyholder under insurance cover

- Any deliberate attempt to damage the phone or malicious intent, leading to a loss or damage to the mobile phone is also not included

- Any damage to the mobile phone due to change in climatic conditions

- If the mobile device is overloaded or experimented under abnormal conditions, leading to any damage

- Any pre-existing malfunctions or defects prior to the commencement of the policy

Advantages

Some of the benefits of mobile insurance offered by national and private insurance companies in India are:

- It helps mobile owners to protect themselves from huge repair costs in case of any damage to the mobile phone due to any mishap, such as dropping and collision

- One can be relaxed if the mobile is damaged due to spillage of any liquid like water, tea/coffee, or soft drinks, etc.

- Policyholders can enjoy a range of superior customer services

- Hassle-free and cashless claim saves time and energy

- Components like touch-screens, charging point, erroneous earphone jacks, and any damage to the internal and external components of the device are also covered

- Various rider options or additional benefits like transit insurance, worldwide coverage, etc. help enhance the coverage of the insurance

Extended Warranty vs Mobile Insurance

| Extended Warranty | Mobile Insurance |

| Theft and burglary is not covered | Theft and Burglary is covered |

| Liquid and accidental damage is not covered | Liquid and accidental damage is covered |

| It is provided by the manufacturer of the phone | It can be purchased through an insurance company |

| Included in purchase price of the mobile phone | It acts as an additional cover availed by customers from different insurance companies |

| Manufacturing defects and hardware malfunctions are covered | Damage from unforeseen incidents are covered |

FAQs

Q1. Can a mobile phone purchased outside India be covered under a mobile insurance policy in India?

Yes, some private insurance companies in India provide insurance cover to the mobile phones that are purchased outside India and thereby providing worldwide coverage.

Q2. Does any insurance provider help in retrieving the lost data from the mobile phone after it is damaged?

Some private mobile apps have partnered with private insurance companies in India that automatically backs up the phone data on cloud servers. Mobile Phone users should take regular data backups of their phones to avoid any such problems in the future.

Q3. Does mobile insurance cover damage to internal circuits of the phone?

Yes, some insurance companies provide insurance coverage to the motherboard or other internal circuitry of the mobile phone.

Q4. What information do I need to file a claim for my phone?

When filing a claim, you should know the make and model of your device available, as well as a method of payment for your deductible on hand along with the basic details required to fill in the claim form.

Q5. Is there any limit to the amount of claims I can make?

Yes. Most of the providers put a limit on the number of claims one can raise depending on the insurer company.

Q6. Can I check the status of my claim?

yes, You can check the status of your claim by going to your insurer’s website and under claim status, can fill the required details and check the status.

Q7. I have raised a claim earlier and want to raise a claim again, can I do that?

Yes, you can raise one more claim but the available coverage amount for second claim will be the balance amount left post your first claim.

Q8. How much time does it take to provide the claim amount?

If the procedure of filing a claim is followed properly, then the claim is settled between 15 to 30 days according to IRDA.

Q9. What is the cost of Mobile Insurance?

In India, generally the range starts from Rs.67 per month and goes to 6-7k depending on the insurer and the mobile price.