Owning or driving a taxi can bring in various types of complications and issues, including accidents. An insurance is a must for any type and number of taxi you own – whether you own an entire fleet of taxi or just a single taxi. A taxi insurance usually falls under the commercial vehicle insurance policy.

Table of Contents:

What is Taxi Insurance?

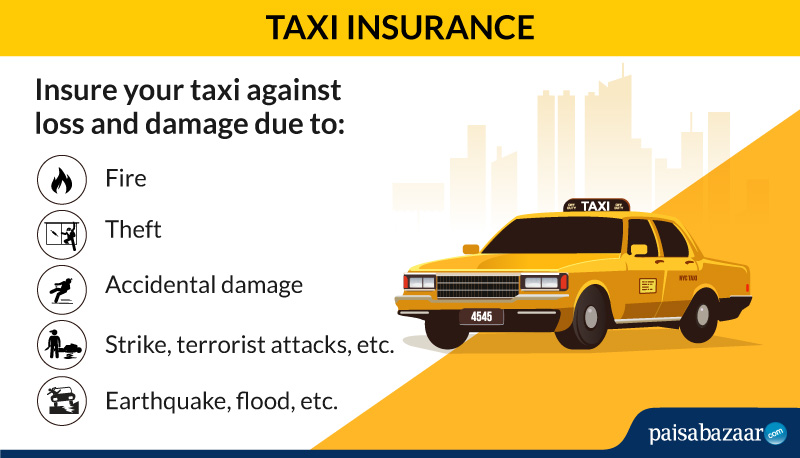

While carrying passengers in a taxi, the vehicle is exposed to various risks and complications which can add to your financial liability. Thus, to cover all such risks, you need a taxi insurance, which is a part of commercial vehicle insurance. The taxi insurance will ensure protection against accidents and any damage to the vehicle.

Types of Taxi Insurance

Let us see how a taxi insurance is classified and what all it covers:

Third Party Insurance Cover: According to the Motor Vehicles Act, 1988, this is the minimum coverage which every taxi owner must have. However, now this is a mandatory coverage which every vehicle insurance should include. Under this, the taxi owner needs to pay compensation to the third party, in case of any accident or damage. This insurance scheme covers

- Indemnity for third party property damage

- Personal accident cover for the policyholder

Comprehensive Insurance Cover: This provides higher level of benefits to both the car owner and the third party involved in the accident. This policy covers the following:

- Damage to your own car caused due to fire, explosions, burglary, riots, strikes and accidents

- Personal accidental cover for the car owner is mandatory provided by the insurance provider. The policyholder might also include passengers, paid driver and cleaner within the insurance

- Accidental damage, deaths and injuries to the third party car

Also Know About Car Insurance: Coverage, Claim & Renewal

What all Taxi Insurance Covers?

A taxi insurance offers coverage against mishaps occurring on Indian roads and third party liability. Let’s look at coverage offered:

- Personal damage: Loss, theft or damage to own car caused by natural calamities (storm, earthquakes, floods, etc.) or man-made perils (strikes, riots, terrorist attacks, etc.)

- Personal accident cover: Medical expenses due to accident or death of the car owner, riders, paid driver and cleaner

- Third party liability: Compensation for accidental deaths and injury to third party, including drivers or riders, will be provided by the insured company. It also covers damage to third party vehicles

The policy holder can pay some extra premium and increase the extent of the policy to include the following:

- Damage to electrical and non-electrical parts of the taxi

- Additional personal accident cover for driver

- Legal liabilities of the paid driver in connection to the insured taxi

- Additional cover for damage to headlights, bonnets and bumpers

- Legal liability regarding non-fare paying passengers

How Taxi Insurance Functions?

A taxi insurance is a type of commercial vehicle insurance in India that functions in the following manner:

- The policy seeker submits the application details along with the details of the taxi to be insured

- The insurance company calculates the premium based on the age of the vehicle, model and IDV

- The insurance policy is handed over within seven working days

- In case of any eventuality, the claimant informs the insurer about the same

- An investigator verifies the issue and approves the claim

- If the claim is not considered fit, the insurance company can reject the same

- If the claim applicant is not happy with the solution, he/she can raise the issue in the court of law

Eligibility Criteria

Availing a taxi insurance is a must once you buy the vehicle and plan to ferry passengers. A taxi insurance is a must for:

- Anyone who owns a taxi/vehicle in India

- Any taxi/vehicle owner who uses the vehicle for commercial purpose

Taxi Insurance Claim Process

In case of any eventuality, you will have to file a claim with the insurance company which is an easy and quick process. However, you should be aware of the steps so that you don’t waste time and manage the claim in a hassle-free manner. Let us look at the steps:

- The claimant informs the insurance company immediately about the issue

- The required documents are submitted to the insurer

- An investigator from the insurance company inspects the vehicle

- If the incident is covered in the insurance policy, the claim amount is paid in the bank account of the beneficiary

- If the claim is not as per the insurance policy taken by the claimant, it gets rejected

- If the claimant is not happy with the solution, he/she might raise a case in the court of law

Documents Required for Claim Process

You should be sure of the required documents to be submitted to settle any claims for a taxi insurance. The necessary documents:

- Duly filled in claim form

- Details of the damage

- Photocopy of the insurance policy

- Invoices of the repairs done on the vehicle

- Proof of the damage or accident

- Medical certificate in case of injury or death

Cases Where you Can’t Claim Taxi Insurance (Exclusions)

One should be careful while buying a taxi insurance or commercial car insurance and understand all the cases where coverage is not provided. Some of these exclusions are:

- Mechanical or electrical damage

- Depreciation of the vehicle with time

- Damage or accident as the driver was drunk or was under the influence of drugs

How Long Does it Take to Pay Out a Claim?

The taxi insurance is paid within 30 days of claim intimation. If the claimant is not satisfied with the resolution and the case is raised in the court of law, then it might take more time to settle the claim.

Companies Offering Taxi Insurance in India

Almost all general insurance companies in India offer taxi insurance under commercial insurance. Some of the insurance companies providing taxi insurance in India are:

- HDFC Ergo

- IFFCO TOKIO

- Royal Sundaram

- Bajaj Allianz

- ICICI Lombard

Important Aspects

Before purchasing a taxi insurance, you should understand all the aspects relating to the insurance in order to get the best deal. It is important to keep the following facts in mind while choosing a taxi insurance:

- Select a garage of your choice while listing it on the insurance policy for cashless repairs

- Policyholders are eligible for a no-claim bonus when they renew the taxi insurance policy. This bonus is accumulated every year if no claim is made

- It is better not to make claims for minor scratches or dents because then the policyholder misses on the no claim bonus

- The premium for taxi insurance is usually cheaper for drivers who have a clean record when it comes to accidents

- Before renewal of the taxi insurance policy, the insurer inspects the vehicle to calculate premium

Advantages of Buying Taxi Insurance

One should understand that a taxi insurance is a must for any vehicle used as a taxi. Some of the advantages of taxi insurance are:

- It helps the car owner to abide by the Motor Vehicles Act, 1988. This law requires every car plying on Indian roads to have an insurance.

- In this world of app-based commercial taxis, the use of vehicles have increased. This has also led to more number of unforeseen events associated with the commercial vehicles. A taxi insurance covers the business from losses due to compensation to be paid for accidents and damage. Thus, the cash flow is not hampered.

- Insurance saves from catastrophic losses. This prevents from closure of any business.

- Many vehicles have long-term car loans. The taxi insurance saves the car owners from these loans if the vehicles gets damaged or lost.

- Some insurance companies also provide expert advice. This helps the taxi owners to select the right policy.

FAQs

Q1. What is the minimum premium amount for taxi insurance?

The minimum premium amount is Rs. 50.

Q2. How is the value of the vehicle calculated under taxi insurance?

The value of the taxi/vehicle is calculated based on the basis of the manufacturer’s listed selling price and the depreciation value, which is deducted every year from the price.

Q3. What is IDV?

IDV is Insured Declared Value. This is the maximum amount an insurance company is liable to pay in case of any loss or theft of the vehicle.

Q4. How is the premium for taxi insurance calculated?

The premium for taxi insurance is calculated on the following factors:

- IDV

- Fuel type

- Vehicle age

- Place of registration

- Type and model of the vehicle

Q5. What are the clauses for cancellation of taxi insurance?

The policyholder can cancel the insurance plan if no claim has been made during the tenure of the policy.

Q6. Is it possible to transfer the ownership of taxi insurance?

Yes, the ownership of the insurance plan can be transferred.