Everybody works hard to meet the basic needs of life. Apart from this, people also save money to purchase valuables like gold, watches, expensive pieces of art, electronics, etc. One of the valuables that an individual protects is the watch that can be either antique, expensive or being passed on as a family memento. Various international brands manufacture watches that use gold, silver, diamonds and platinum. The cost of such watches is exorbitantly high and hence, the need for watch insurance.

Table of Contents:

What is Watch Insurance?

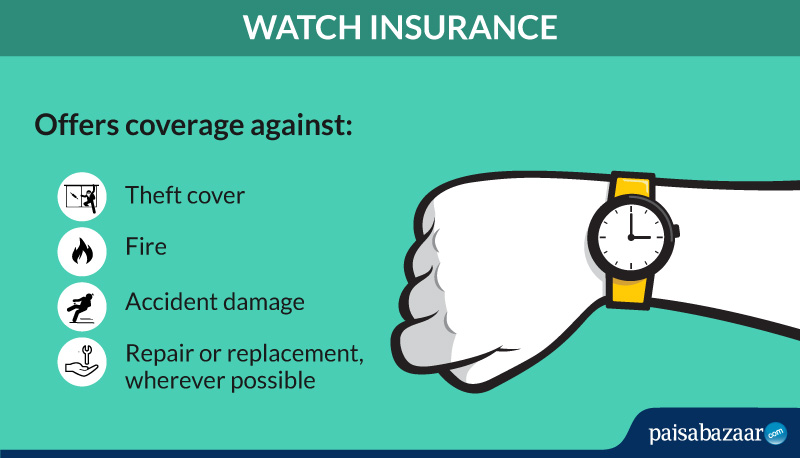

Watches with gold, silver and diamonds are sold across globe and are highly expensive items. Since these watches are very fragile, many private and national insurance companies in India offer watch insurance under Household Insurance Policy that protects valuables stored at home or any location within specified territorial limits from various perils like fire, theft, and burglary etc. under the all-risks policy.

Some private companies in India have started providing special or custom insurance solutions for watches in India.

What all Watch Insurance Covers?

Some of the watch retailers provide watch insurance immediately after the purchase of the watch. Insurance companies in India offer watch insurance under different policies, such as Fine Arts and Valuables Insurance Policy and All Risk Insurance Policy. Let us look at the coverage provided:

- Accidents, fire, riots, robbery, and fortuitous causes that may lead to loss or damage to the watch are covered under the all-risk insurance policy for households

- Rebates and discounts on premium amount are also offered by some insurance companies in case the cover is renewed without making a claim during the previous policy tenure

- Some general insurance policies offered by private insurance companies in India also cover watches if they are in transit or moved from one location to another under the specified territorial limits

How Watch Insurance Functions?

To understand watch insurance better, you should be aware as to how the insurance works so that you don’t miss any important aspect. Let us look at how it functions:

- Analyse the cost of your watch and the loss you would face in case of loss or damage to the watch

- Check and compare the insurance company and the insurance policy before finalising a plan

- Submit the duly filled in proposal form along with other required documents

- In case of any eventuality, inform the insurance company immediately for claims

- Submit the duly filled in claim form along with other documents and proofs

- After an assessment, the insurance company will either accept or reject the claim

- If you are not satisfied with the deal, you can approach the court of law

Eligibility Criteria

Watch insurance is for anybody who wishes to protect her/his fine timepieces and luxury watches from various risks and problems.

Watch Insurance Claim Process

Below are the general steps to be followed by the policyholder or the insurance company when a loss or damage to the insured watch or timepiece is reported to the insurance company:

- In the event of any loss or damage to the watch or time-piece insured under the insurance policy, the policyholder must immediately report the incident to the insurance company on the toll-free number or other customer channels provided for support by the insurance company

- The policyholder must also report to the nearest police station for any insured risks like theft or robbery and obtain a copy of FIR from the police station

- The policyholder must submit the claim form to the Policy Issuing Office or the nearest branch of the insurance company from where the policy has been purchased

- The company may appoint a surveyor to initiate the investigation process for claim settlement for the watch or timepiece lost or damaged. He/she may also facilitate a photograph session to click pictures of the damaged watch or the time-piece or the broken-glass, etc.

- The policyholder must also produce all relevant documents related to the watch or time-piece value that is covered under the insurance policy and fully cooperate with the insurance company for a fair investigation

- The policyholder must also submit an Indemnity Bond to the Insurance Executive if applicable along with the Final Investigation Report by the police in the event of theft or robbery of the watch etc.

- After all documents and facts are checked by the Surveyor, a final loss evaluation report or an assessment report is prepared by the insurance company for the watch or the timepiece insured

- Based on the risks covered and sum assured under the policy or any other compensation in the form of repair, reinstatement, or replacement is proposed by the Surveyor in the final report for the watch or the time-piece under claim

- The policyholder would have to submit ID proofs and banking details to the insurance company to receive the compensation for the loss or damage of the watch or the time-piece insured

- The sum assured is transferred to the policyholder’s bank account or the compensation against any repair or reinstatement of the watch or time-piece insured is made by the insurance company directly to the third-party depending on the terms of the insurance company

Documents Required for Claim Process

While filing a claim process, you should keep all the required documents in place so that the claim is not rejected. The documents are:

- Reason of the claim

- FIR lodged with the police

- Duly filled in claim form

- Policy certificate

- A detailed statement of events which led to the loss and damage of the watch

- Indemnity bond, wherever required

- If the insured watch, at the time of loss or damage, was with the care of the Railways, Hotels, Airlines or any other authority, the policyholder will also have to intimate them

How Long Does it Take to Pay Out a Claim?

Watch Insurance claim can be settled within 30 days of claim intimation. If any arbitration is involved, it might take more time to settle the claim.

Cases Where you Can’t Claim Watch Insurance (Exclusions)

Insurance companies always mention some exclusions under the watch insurance policies. These are cases not covered under the watch insurance. Some of them are:

- Loss or damage to the watch or a luxury timepiece due to acts of war, invasion, terrorism, or civil war

- Loss or damage to the watch due to any radioactive substance or other ionizing radiations

- Loss or damage to the watch by regular wear and tear or depreciation of the insured article

- Permanent or temporary disposition due to any lawful activity by the policyholder

- Mechanical derangement or over-winding of watches and timepieces

- Theft or robbery from unlocked cars or premises

Companies Offering Watch Insurance in India

Watch insurance can be offered as a stand alone insurance policy as well as a part of another insurance. In India, it is mostly provided as a part of another policy. Some of the insurance companies providing watch insurance in India are:

- Tata AIG – Under Fine Art and Valuables Insurance

- United India Insurance Company – Under All Risk Insurance Policy

- Liberty General Insurance – Under All Risk Insurance Policy

Important Aspects

Before finalising a watch insurance policy, it makes sense to understand all the points so that you get the best deal. Let us look at some of the aspects relating to watch insurance:

- The notice and communication made to the insurance company should be documented. Even if the beneficiary is calling up to intimate about the event, the revert or acknowledgement should be in writing

- Some insurance companies also offer a free-look period to customers as a trial period before they can decide to purchase the policy for a full-year coverage

Advantages of Buying Watch Insurance

In order to protect a valuable item like watch, you should consider buying a watch insurance. Let’s review some of the benefits offered under watch insurance in India:

- Insurance cover to watches for individuals include threats of loss or damage to the watch by perils like fire, theft, burglary, and other risks included in all-risk policy for households

- Some companies also provide cover to watches that are worn, kept or carried anywhere in India through transit options under insurance cover

- Some private insurance companies also provide Extended Warranty Cover to the watch to minimise the risks of cost arising due to loss or damage from risks covered under the policy

- Claims settlement processes by some companies are hassle-free and convenient for the policyholders who have purchased insurance covers to protect their watches or luxury timepieces

- Some companies also offer a free evaluation or assessment of the loss to the policyholder in case of any mishap with the watch insured

- A few private insurance companies in India also provide protection cover to watches by giving worldwide transit coverage wherein the claims would be settled in INR only

- Some insurance companies also provide claims settlements twice a year but maximum liability not exceeding the Sum Assured

FAQs

Q1. Does any insurance company also provide repair of the watch or time-piece from the store where it has been purchased?

Yes, some private companies make compensation for repair directly to the store from where the watch has been purchased, but the customer may have to pay some additional fees, if applicable.

Q2. Can a watch insurance policy be cancelled by an insurance company during the cover period or policy term?

Yes, the insurance company can cancel the policy by providing a notice period to the policyholder and process the refund of the premium amount based on a pro-rata basis or the rate applicable.

Q3. Does the insurance company provide cover to digital watches sold by technology companies like Apple, Casio, etc.?

Yes, insurance companies usually provide coverage to all the smart watches or digital watches provided by such brands in India. One must check with the insurance company about a particular model to be covered under the insurance cover.

Q4. Will the insured wristwatch have an insurance cover if one is travelling from Delhi to Mumbai by air?

Yes, some insurance companies provide transit insurance that covers the watch with the protection cover from various risks while travelling anywhere in India. Some additional rider benefits may include any loss or damage to the watch caused by the aircraft, other aerial devices and articles dropped there from.

Q5. Can an insurance company provide an immediate protection cover for a watch as soon as it is purchased from a reputed store?

Yes, some private insurance companies provide such a facility. Even retail stores also have business arrangements with some private insurance companies in India that provide an immediate insurance cover to the watch at the time of purchase from the store.