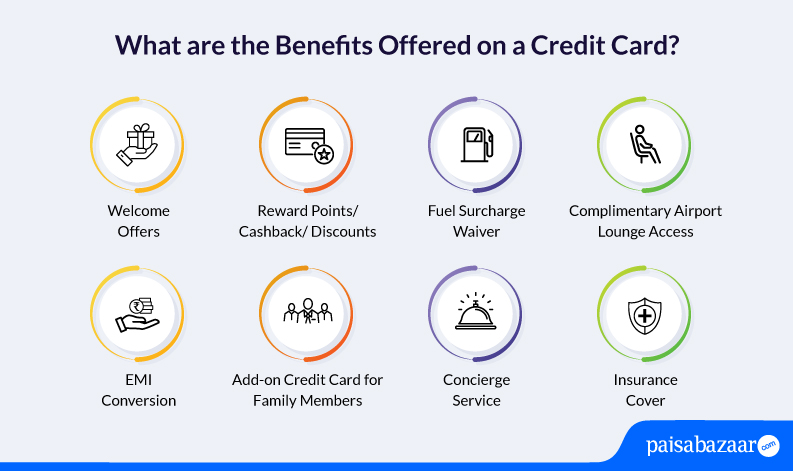

Credit cards offer benefits across multiple categories such as travel, shopping, fuel, etc, in the form of reward points, cashback, and discounts. However, you can maximize the benefits offered, only if you make an informed choice. Note, that the best credit card for you is the one that is chosen based on your lifestyle habits and spending patterns. To help you, we have covered important information about credit cards on this page. Read on to know more about credit cards in India.

| On this Page: |

10 Best Credit Cards in India for Dec 2022

| Credit Card | Best Suited For | Annual Fee |

| Axis Ace Credit Card | Cashback | Rs. 499 |

| SBI Card Elite | Rewards & Travel | Rs. 4,999 |

| HDFC Regalia | Shopping & Travel | Rs. 2,500 |

| Flipkart Axis Credit Card | Online Shopping | Rs. 500 |

| Amazon Pay ICICI Credit Card | Online Shopping | Nil |

| Citi PremierMiles | Travel | Rs. 3,000 |

| HDFC Millennia | Cashback | Rs. 1,000 |

| Standard Chartered Digismart | Travel & Online Shopping | Rs. 49 per month |

| HDFC Bank Diners Club Privilege | Travel &Lifestyle | Rs. 2,500 |

| HSBC Cashback | Cashback on Online Spends | Rs. 750 |

Please Note: In this article, we have chosen cards that offer the best benefits across categories for consumers from different income segments. This does not include Super-Premium Credit Cards, which are usually “invite-only” cards for consumers with high income. If you want to see the list of best super-premium cards in India, click here.