Axis ACE Credit Card and Flipkart Axis Credit Card are among the most popular cashback credit cards in India. While Axis ACE offers excellent value back across all categories, the Flipkart Credit Card is suited for getting maximum benefit on Flipkart, Myntra and other associated brands. The choice, however, depends on your spending preferences. Here’s a detailed comparison of the two cards to help you decide which one is more suited to your needs.

Key Highlights: Axis ACE Vs Flipkart Axis |

||

| Particular | Axis ACE | Flipkart Axis |

| Joining Fee | Rs. 499 (Reversed on spending Rs. 10,000 within 45 days) | Rs. 500 |

| Renewal Fee | Rs. 499 (Waived off on spending Rs. 2 lakh in a year) | Rs. 500 (Waived off on spending Rs. 2 lakh in a year) |

| Welcome Benefits | Nil |

|

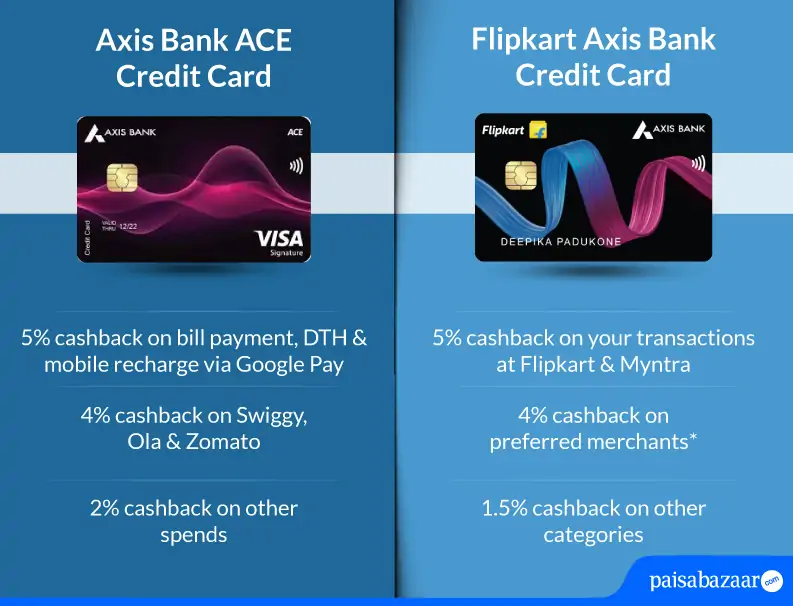

| Cashback Benefits |

|

|

| Lounge Access | 4 complimentary domestic lounge access in a year | 4 complimentary domestic lounge access in a year |

| Paisabazaar’s Rating | ★★★★ (4/5) | ★★★★ (4/5) |

Also read: Best Credit Cards in India

*(Uber, Swiggy, PVR, Curefit, Tata Sky, Cleartrip, Tata 1MG)

*(Uber, Swiggy, PVR, Curefit, Tata Sky, Cleartrip, Tata 1MG)

2 Comments

will i have to use flipcart axis credit card frequently or it is compulsion to use in future

If you have activated your card after issuance, it is suggested that you use it once every three months to keep it active. Not using your card for a long time may lead to card deactivation. Usually, issuers deactivate a card after six months of dormancy, but this may vary from card to card, and issuer to issuer. On the other hand, it is advisable to use your credit card, as and when required, as per your repayment ability.