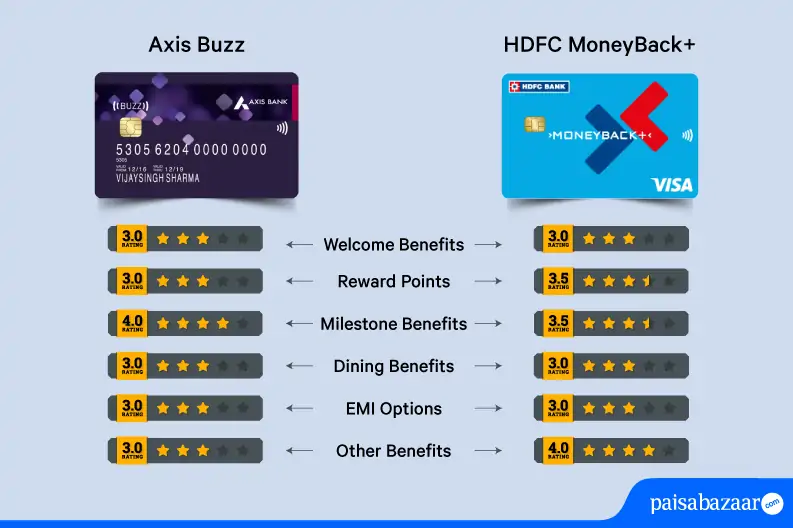

Axis Bank Buzz and HDFC MoneyBack+ Credit Card both are designed for people who frequently shop online. However, Axis Buzz is primarily suitable for you if you like to shop online through Flipkart. On the other hand, HDFC MoneyBack+ provides higher reward points on your purchases at select merchants. Both the cards come with relaxed eligibility criteria which makes them convenient for people who are new to credit. To know which of these is a better option for you, read this detailed comparison of Axis Buzz Vs. HDFC MoneyBack+:

Key Highlights: Axis Buzz Vs. HDFC MoneyBack+

|

||

| Particular | Axis Bank Buzz Credit Card | HDFC MoneyBack+ Credit Card |

| Joining Fee | Rs. 750 | Rs. 500 |

| Renewal Fee | Rs. 750 | Rs. 500 (Waived off on spending Rs. 50,000 in a year) |

| Welcome Benefits | Flipkart voucher worth Rs. 1,000 on making 3 purchases within 45 days | 500 CashPoints after the payment of joining fee |

| Reward Points | Up to 3X reward points on online spends | Up to 10X CashPoints on your purchases at select merchants |

| Discount | Up to 10% instant discount on Flipkart | Nil |

| Milestone Benefits | Flipkart vouchers worth Rs. 7,000 on achieving spending milestones | Gift voucher worth Rs. 500 on spending Rs. 50,000 every quarter |

| Dining Benefits | Min. 15% discount on dining at partner restaurants | Up to 15% off on dining at partner restaurants |

| Easy EMI Options | Convert purchases of Rs. 2,500 or above into EMIs | Convert big-ticket purchases into EMIs |

| Paisabazaar’s Rating | ★★★ (3/5) | ★★★ (3/5) |

Also read: Best Credit Cards in India

Welcome Benefits: Which One to Choose?

When it comes to welcome benefits, both the cards work on different schema. With Axis Buzz Credit Card, you get free vouchers for Flipkart, whereas, HDFC MoneyBack+ rewards you with CashPoints at the time of activation. Here are the details:

- Axis Bank Buzz Credit Card: Flipkart voucher worth Rs. 1,000 on making 3 purchases within 45 days*

- HDFC Bank MoneyBack+ Credit Card: 500 CashPoints after the payment of joining fee, which are redeemable at the value of 1 CashPoint = Re. 0.25

*The voucher will be sent to the registered mobile number within 30 days of the milestone achievement.

Which one is better?

Comparing the above-mentioned welcome benefits, it is difficult to say which one is better. If you look at the monetary value, then Axis Buzz is a better option as it offers welcome benefits worth more than the value of joining fee. However, you can avail the welcome benefit only after making three transactions with Buzz Credit Card. So, if you want a credit card which gives you the welcome benefit right after the payment of joining fee, then HDFC MoneyBack+ is a better option. The choice between these two totally depends on your preferences.

| If you want to avail welcome benefits, you can look for top credit cards with the best welcome benefits by clicking here. |

Discount & Rewards: Which One to Choose?

Both the credit cards let you earn reward points on your expenses. However, Axis Buzz has an upper hand as along with reward points, it also offers an instant discount on your purchases at Flipkart. Besides this, you can only earn reward points on your online and offline purchases via HDFC MoneyBack+ Credit Card. Here are the discount and rewards details you can avail with both credit cards:

| Axis Bank Buzz Credit Card Vs. HDFC MoneyBack+ Credit Card | |

|

|

*Excluding fuel, wallet loads/prepaid card loads & voucher purchases.

Note: With Axis Bank Buzz Credit Card, you can earn a maximum discount of Rs. 600.

Which one is better?

It is clearly visible that Axis Buzz Credit Card is a better option if you frequently shop online at Flipkart. The card not only lets you earn reward points but also gives an instant discount on your purchases at Flipkart. You can also earn higher reward points on your online spends with Buzz Credit Card. But you cannot neglect MoneyBack+ if your goal is to earn reward points on multiple categories along with EMI spends, which most cards do not offer. Overall, if you are not a loyal customer of Flipkart, then MoneyBack+ might seem a better option as it offers decent rewards on multiple brands, such as Amazon, BigBasket and more.

Suggested read: Top Credit Cards for Reward Points

Get Free Credit Report with monthly updates. Check Now

Milestone Benefits: Which One to Choose?

At an annual fee of Rs. 750, Axis Buzz offers multiple milestone privileges worth more than thrice the value of the fee. However, these benefits are restricted only to Flipkart as you will get a complimentary Flipkart voucher on achieving the respective spending milestone. Also, you will earn higher benefits on your spends at Flipkart. Below mentioned are the milestone privileges offered by Axis Bank Buzz Credit Card:

| Annual Spends on Flipkart | Flipkart Voucher Value |

| Rs. 25,000 | Rs. 500 |

| Rs. 50,000 | Rs. 1,000 |

| Rs. 1 lakh | Rs. 2,500 |

| Overall Annual Spend | Flipkart Voucher Value |

| Rs. 1 lakh | Rs. 1,000 |

| Rs. 2 lakh | Rs. 2,000 |

If we talk about HDFC MoneyBack+, it offers quarterly benefits worth Rs. 500 on achieving the spending milestone of Rs. 50,000. Thereby, you can earn an additional benefit of up to Rs. 2,000 in a year.

Which one is better?

Comparing the milestone benefits of both cards is quite difficult as both of them work on a different pattern. Axis Buzz rewards you with free vouchers on your annual spends, whereas HDFC MoneyBack+ gives you quarterly benefits. However, Axis Bank Buzz has an upper hand over HDFC MoneyBack+ because of its multiple spending milestones. You can achieve the milestone as per your spending pattern and avail respective benefits, but these benefits are limited to Flipkart only. Also, you must remember that it charges a higher annual fee as compared to HDFC MoneyBack+ and comes with no fee waiver condition.

| If you frequently shop through Flipkart, you can also look for Flipkart Axis Bank Credit Card. |

Similar Benefits

Apart from the above-stated ones, both the credit cards offer similar benefits that include discount on dining and EMI conversion of your purchases. Here are the details regarding the same:

| Particular | Axis Buzz Credit Card | HDFC MoneyBack+ Credit Card |

| Dining Benefits | Min. 15% discount on dining at partner restaurants | Up to 15% discount on dining at partner restaurants |

| EMI Conversion | Convert purchases of Rs. 2,500 or above into EMIs | Convert big-ticket purchases into EMIs |

Other Benefits of HDFC MoneyBack+ Credit Card

HDFC MoneyBack+ Credit Card lets you earn the below-mentioned additional benefits:

- 500 CashPoints after the payment of renewal fee

- Renewal fee waiver by spending Rs. 50,000 in a year

- 1% fuel surcharge waiver on transactions between Rs. 400 to Rs. 5,000. A maximum waiver of Rs. 250 can be availed per statement cycle.

Who is the Winner?

No doubt both the credit cards offer decent benefits on your purchases, but availing Axis Bank Buzz Credit Card makes more sense if you frequently shop online, especially from Flipkart. The card offers higher reward points on your online purchases and instant discount during specific time intervals while shopping at Flipkart. However, if you are looking for a card that lets you earn reward points on other brands as well, such as Amazon or BigBasket, then choosing HDFC Bank MoneyBack+ Credit Card would be a better option. Axis Buzz Credit Card is designed for people who frequently shop from Flipkart, whereas HDFC MoneyBack+ is an overall credit card that provides reward points on multiple categories.

You should apply for Axis Buzz Credit Card if:

- You frequently shop from Flipkart

- You want to avail instant cashback on your purchases at Flipkart

- You want to earn multiple milestone privileges

You should apply for HDFC MoneyBack+ Credit Card if:

- You frequently shop online from brands like Amazon, BigBasket, Swiggy and more

- You want to earn reward points on EMI spends also

- You want to avail renewal fee waiver

Lastly, Axis Buzz is a suitable option if your goal is to earn maximum benefits on your Flipkart purchases. But, MoneyBack+ would be a better choice if you want to earn decent rewards on your expenses. MoneyBack+ is not only an updated version of HDFC MoneyBack Credit Card but it also offers better rewards and benefits on your expenses. However, the ultimate choice will be yours and you should choose a credit card based on your spending pattern and requirements.