Important: As per RBI guidelines, the issuance of new credit cards on the Mastercard platform has been discontinued until further notice. Normal card services will continue for existing users.

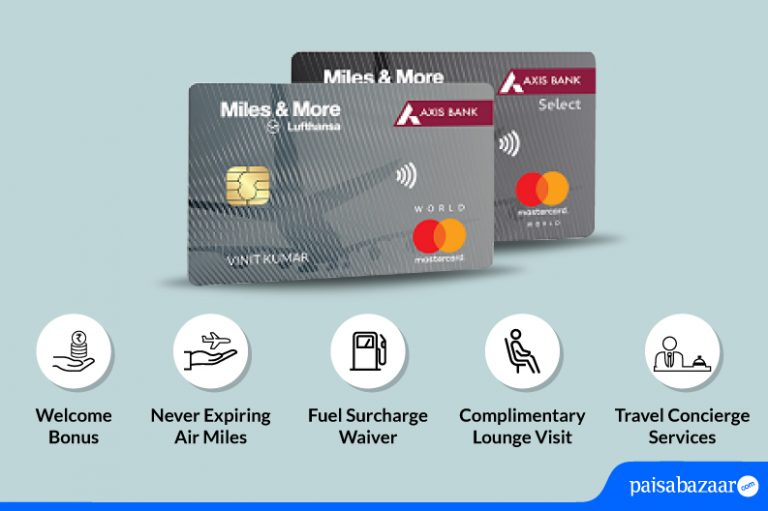

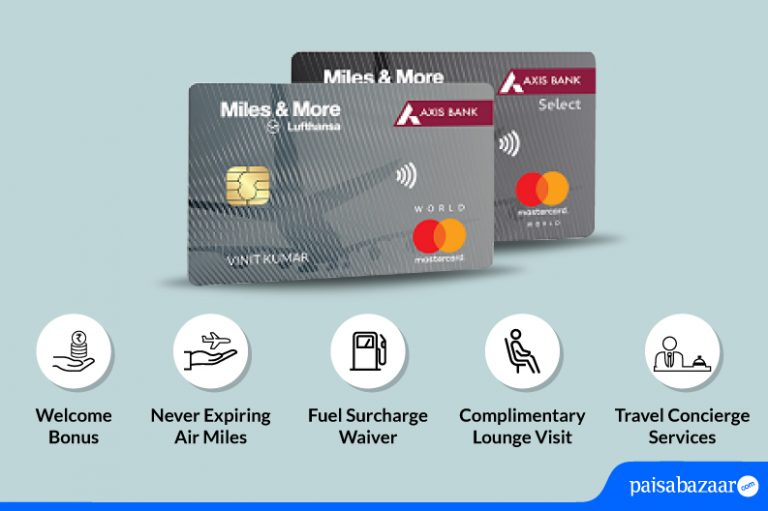

If you’re a frequent traveler, a travel credit card is a must to have. However, to fulfill the needs and requirements of travelers, Axis Bank in association with Lufthansa launched cards in two variants namely Miles & More Axis Bank World Card and Miles & More Axis Bank Select Card. If you apply for this card, you can avail card rewards on your purchases as air miles which will never expire. Here’s our detailed review of both credit cards to help you decide which variant is a perfect match for you.

Key Highlights of Axis Bank Miles and More Credit Card |

||

| Basis of Difference | Axis Bank Miles and More World Credit Card | Axis Bank Miles and More Select Credit Card |

| Joining Fee | Rs. 3,500+ G.S.T | Rs. 10,000+ G.S.T |

| Annual Fee (2nd Year Onwards) | Rs. 3,500+ G.S.T | Rs. 4,500+ G.S.T |

| Welcome Benefit | 5,000 miles | 15,000 miles |

| Award Bonus | 3,000 Award Miles | 4,000 Award Miles |

Avail Air Miles as Welcome Bonus

Air Miles are basically the points that you can redeem for flight tickets or other rewards. Axis Bank has an impressive way of awarding the customer with a welcome bonus of 15,000 award miles and 5,000 award miles for Axis Bank Miles and More Select Credit Card and Axis Bank Miles and More World Credit Card respectively.

However, at an annual fee of Rs. 3,500 and Rs. 4,500, the welcome benefits are more than satisfactory. You are getting air miles that can help you save the cost of flights and upgrades, hotels and shopping, and more. So, it will be a good deal for you to apply in any of the variants depending on your choice of card.

Never Expiring Award Miles

You can earn 6 award miles for every Rs. 200 spent on Axis Bank Miles and More World Credit Card whereas you can earn 4 award points for every 200 spent on Axis Bank Miles and More Select Credit Card and these award miles will never expire which is again a commendable benefit for the cardholders.

Note: There’s a condition on the eligible spends transactions as you spend excluding reversals, fraud transactions, fee payments, cash withdrawals, interest charges, EMI transactions.

Free Priority Pass Lounge Visits Across the World

With your first swipe, you can avail 4 airport visits to priority pass lounges in a year on your Axis Bank Miles and More World Select Credit Card whereas you can avail 2 complimentary airport visits to priority pass lounges in a year on your Axis Bank Miles and More World Credit Card. However, the complimentary visits are only available for the primary cardholders for both variants.

Enjoy Complimentary Lounge Visit

Another benefit that you can avail on your Axis Bank Miles and More Select Credit Card is 8 complimentary lounge visits applicable per quarter whereas on your Axis Bank Miles and More World Credit Card you can avail 4 complimentary lounge visits per quarter.

Travel Often? Save Money with Free Lounge Access

Exciting Annual Bonus

You can also earn an annual bonus of 4,000 Award Miles on your Axis Bank Miles and More Select Credit Card and 3,000 Award Miles on your Axis Bank Miles and More World Credit Card. Let’s find out the total miles that you can earn in a year.

Total Miles Earned in a Year |

||

| Basis of Difference | Axis Bank Miles and More Select Credit Card | Axis Bank Miles and More World Credit Card |

| Activation Welcome Miles | 15,000 | 5,000 |

| Annual Miles on Renewal | 4,000 | 3,000 |

| Spend Linked Miles (on a minimum spend Rs. 1,00,000) | 36,000 | 24,000 |

| Total Miles | 55,000 | 32,000 |

As you can see, you can earn 55,000 miles on your Axis Bank Miles and More World Credit Card and 32,000 on your Axis Bank Miles and More World Credit Card in a year which is a fairly good deal for saving on both the variants and also justified the annual/joining fee that you pay.

24×7 Dedicated Concierge Service

You can enjoy 24×7 dedicated concierge services such as assistance on flight bookings, table reservations, exclusive events/shows, etc. on both the card variants.

Other Benefits:

| Dining Delights-Avail a minimum 15% discount on partner restaurants in India with Axis Bank dining delight

Fuel Surcharge Waiver- 1% surcharge waiver on fuel transactions between Rs 400 and Rs. 4,000 at all fuel stations Convert Purchases to EMI- Convert your credit card purchase on any transaction over Rs. 2,500 into EMIs Pay Utility Bill Automatically- Avail this facility by initiating a simple standing instruction on the credit card in order to make utility bill payments through Axis Bank bill pay |

Which Variant Should You Choose?

Axis Bank Miles and More Select Credit Card

This is a viable option for those who tend to travel frequently and are willing to pay an annual fee of Rs. 10,000+ G.S.T.. The card comes with a set of benefits that can totally offset the annual fee. You can avail the welcome benefit of 15,000 award miles and 4,000 annual miles with this card. Moreover, you enjoy complimentary lounge visits, 24×7 concierge services, free priority pass lounge visits, and more.

Axis Bank Miles and More World Credit Card

In comparison to select credit card, the other variant can be availed at Rs. 3,500+ G.S.T. In case you are not willing to pay a high annual fee, this card could be good for you. The card also offers a wide range of travel benefits such as complimentary lounge visits, a welcome bonus of 5000 miles, 24×7 concierge services, and much more.

Overall as mentioned above, if you are a frequent traveler, both variants are good options for you as it offers lots of deals and discounts on travel along with multiple categories to its users. Moreover, the air miles earned do not expire and can be redeemed as per your choice.

Alternate Credit Cards You Can Apply For

| Travel Credit Card | Annual Fee* | Key Benefit |

| HDFC Bank Infinia Credit Card Metal Edition | Rs. 12,500 | Club Marriott Membership for First Year as a welcome offer |

| Etihad Guest SBI Premier Card | Rs. 4,999 | Complimentary Priority Pass Membership |

| RBL World Safari Credit Card | Rs. 3,000 | MakeMyTrip voucher worth Rs. 3000 as Welcome Gift |

| Axis Bank Magnus Credit Card | Rs. 10,000 | 2% Foreign Currency Conversion Fee |

Bottom Line

As said above, these cards are best suited for frequent travelers. These cards reward you with ‘miles’ which are achieved at different spending levels. You can also get access to various airport lounges and redeem your mile points so that you can book air tickets, hotel stays, and much more.